Avon 2013 Annual Report Download - page 105

Download and view the complete annual report

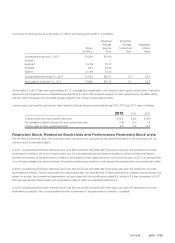

Please find page 105 of the 2013 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Defined Benefit Pension and Postretirement Plans

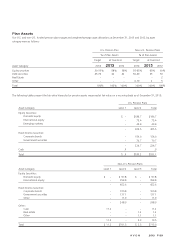

Avon and certain subsidiaries have contributory and noncontributory retirement plans for substantially all employees of those subsidiaries.

Benefits under these plans are generally based on an employee’s years of service and average compensation near retirement. Plans are

funded based on legal requirements and cash flow.

We provide health care benefits subject to certain limitations to the majority of retired employees in the U.S. and certain foreign countries. In

the U.S., the cost of such health care benefits is shared by us and our retirees for employees hired on or before January 1, 2005. Employees

hired after January 1, 2005, will pay the full cost of the health care benefits upon retirement. In August 2009, we announced changes to our

postretirement medical and life insurance benefits offered to U.S. retirees. The changes to the retiree medical benefits reduced the plan’s

obligations by $36.3. This amount is being amortized as a negative prior service cost over the average future service of active participants

which is approximately 12 years. The changes to the retiree life insurance benefits reduced the plan’s obligations by $27.7. This amount was

amortized as a negative prior service cost over 3.3 years, which was the remaining term of the plan.

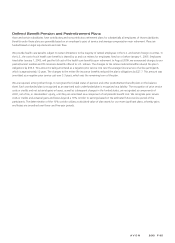

We are required, among other things, to recognize the funded status of pension and other postretirement benefit plans on the balance

sheet. Each overfunded plan is recognized as an asset and each underfunded plan is recognized as a liability. The recognition of prior service

costs or credits and net actuarial gains or losses, as well as subsequent changes in the funded status, are recognized as components of

AOCI, net of tax, in shareholders’ equity, until they are amortized as a component of net periodic benefit cost. We recognize prior service

costs or credits and actuarial gains and losses beyond a 10% corridor to earnings based on the estimated future service period of the

participants. The determination of the 10% corridor utilizes a calculated value of plan assets for our more significant plans, whereby gains

and losses are smoothed over three- and five-year periods.

A V O N 2013 F-35