Avon 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

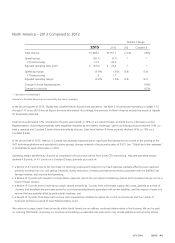

Operating margin was negatively impacted by .3 points as compared to the prior-year period from higher CTI restructuring. Adjusted

operating margin declined 3.0 points, or 2.6 points on a Constant $ basis, primarily as a result of:

• a decline of 2.5 points due to lower gross margin caused primarily by .9 points from higher supply chain costs not offset by pricing. Gross

margin was also negatively impacted by .9 points from foreign exchange and .7 points from the unfavorable net impact of pricing and

mix;

• a decline of .8 points from increased overhead, primarily due to wage inflation outpacing revenue growth;

• a benefit of .4 points from lower bad debt expense; and

• a benefit of .3 points from lower advertising costs.

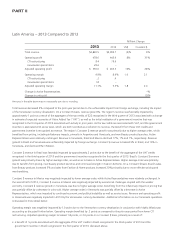

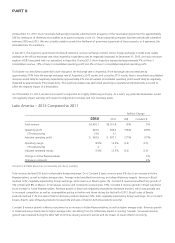

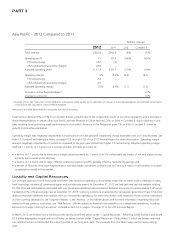

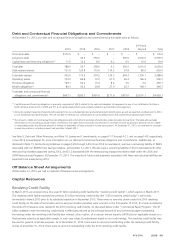

Europe, Middle East & Africa – 2013 Compared to 2012

%/Point Change

2013 2012 US$ Constant $

Total revenue $2,898.4 $2,914.2 (1)% 2%

Operating profit 406.7 312.8 30% 34%

CTI restructuring 17.7 11.8

Adjusted operating profit $ 424.4 $ 324.6 31% 35%

Operating margin 14.0% 10.7% 3.3 3.4

CTI restructuring .6 .4

Adjusted operating margin 14.6% 11.1% 3.5 3.6

Change in Active Representatives 1%

Change in units sold –%

Amounts in the table above may not necessarily sum due to rounding.

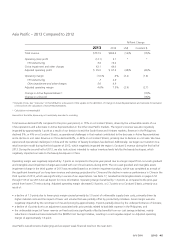

Total revenue decreased 1% compared to the prior-year period due to the unfavorable impact from foreign exchange. On a Constant $

basis, revenue grew 2% primarily due to an increase in Active Representatives and higher average order. The region’s Constant $ revenue

benefited from growth in South Africa, Russia and Turkey. This growth was partially offset by a decline in the United Kingdom.

In Russia, revenue declined 1%, or grew 2% on a Constant $ basis, primarily due to an increase in Active Representatives, which was

partially offset by lower average order. During the second half of 2013, average order in Russia was negatively impacted by product portfolio

mix and merchandising execution coupled with the weaker economy. In the United Kingdom, revenue declined 6%, or 5% on a Constant $

basis, negatively impacted by a decrease in Active Representatives, which was partially offset by higher average order. In Turkey, revenue

declined 5%, unfavorably impacted by foreign exchange. On a Constant $ basis, Turkey’s revenue grew 2%, as higher average order was

partially offset by a decrease in Active Representatives. In South Africa, revenue declined 8%, unfavorably impacted by foreign exchange. On

a Constant $ basis, South Africa’s revenue grew 9%, primarily due to higher average order from successful marketing strategies and

Representative mix.

Operating margin was negatively impacted by .2 points as compared to the prior-year period from higher CTI restructuring. Adjusted

operating margin increased 3.5 points, or 3.6 points on a Constant $ basis, primarily as a result of:

• a benefit of 1.9 points due to higher gross margin caused primarily by lower supply chain costs, largely due to lower material and

overhead costs together with the benefits from productivity initiatives, including facility rationalization. These items were partially offset by

the unfavorable net impact of mix and pricing of .5 points as a result of discounts and the unfavorable impact of foreign exchange;

• a benefit of .9 points from lower bad debt expense partially due to a higher provision in the first quarter of 2012 to increase reserves for

bad debts in South Africa as a result of growth in new territories, of which .5 points was an adjustment associated with prior periods. Bad

debt expense was also favorably impacted by the change in estimate of the collection of our receivables which increased bad debt in the

prior-year period that did not recur in 2013; and

• a benefit of .5 points from lower net brochure costs, partially impacted by initiatives to reduce the cost of our brochures in various

European markets.

A V O N 2013 41