Avon 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

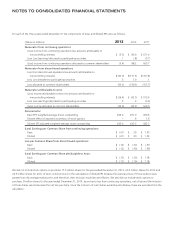

Notes payable included short-term borrowings of international subsidiaries at average annual interest rates of approximately 6.5% at

December 31, 2013 and 8.6% at December 31, 2012.

Other debt, payable through 2019, included obligations under capital leases of $11.6 at December 31, 2013 and $13.9 at December 31,

2012, which primarily relate to leases of automobiles and equipment. In addition, other debt, payable through 2019, at December 31, 2013

and 2012, included financing obligations of $56.3 and $61.6, respectively, of which $44.5 and $48.4, respectively, relates to the sale and

leaseback of equipment in one of our distribution facilities in North America entered into in 2009.

Adjustments for debt with fair value hedges include adjustments to reflect a net unrealized gain of $93.1 at December 31, 2012. We held

interest-rate swap contracts that effectively converted approximately 62% at December 31, 2012, of our long-term fixed-rate borrowings to

a variable interest rate based on LIBOR. As of December 31, 2013, all interest-rate swap agreements had been terminated either in

conjunction with the repayment of the associated debt or in the January 2013 and March 2012 swap termination transactions. See Note 8,

Financial Instruments and Risk Management.

Term Loan Agreement

On June 29, 2012, we entered into a $500.0 term loan agreement (the “term loan agreement”). Subsequently on August 2, 2012, we

borrowed an incremental $50.0 of principal from subscriptions by new lenders under the term loan agreement. Pursuant to the term loan

agreement, we are required to repay an amount equal to 25% of the aggregate remaining principal amount of the term loan on June 29,

2014, and the remaining outstanding principal amount of the term loan on June 29, 2015. Amounts repaid or prepaid under the term loan

agreement may not be reborrowed. Borrowings under the term loan agreement bear interest, at our option, at a rate per annum equal to

LIBOR plus an applicable margin or a floating base rate plus an applicable margin, in each case subject to adjustment based on our credit

ratings. The term loan agreement also provides for mandatory prepayments and voluntary prepayments. Subject to certain exceptions

(including the issuance of commercial paper and draw-downs on our revolving credit facility), we are required to prepay the term loan in an

amount equal to 50% of the net cash proceeds received from any incurrence of debt for borrowed money in excess of $500.

In March 2013, we entered into the first amendment to the term loan agreement. This amendment primarily related to (i) adding a provision

whereby the lenders may, at our discretion, decline receipt of prepayments, and (ii) adding a subsidiary debt covenant and conforming the

interest coverage ratio and leverage ratio covenants to those contained in the revolving credit facility (discussed below under “Debt

Covenants”). Later in March 2013, we repaid $380.0 of the outstanding principal amount of the term loan agreement with a portion of the

proceeds from the issuance of the Notes (as defined below under “Public Notes”), which repayment resulted in a loss in the first quarter of

2013 of $1.6 on extinguishment of debt associated with the write-off of debt issuance costs related to the term loan agreement. On July 25,

2013, we prepaid $117.5 of the outstanding principal balance under the term loan agreement, without prepayment penalties. At

December 31, 2013, there was $52.5 outstanding under the term loan agreement. Based on amounts outstanding at December 31, 2013,

$13.1 is required to be repaid on June 29, 2014 and was included within debt maturing within one year, and the remaining $39.4 is

required to be repaid on June 29, 2015 and was included within long-term debt, in the Consolidated Balance Sheets.

Private Notes

On November 23, 2010, we issued, in a private placement exempt from registration under the Securities Act of 1933, as amended, $142.0

principal amount of 2.60% Senior Notes, Series A, due November 23, 2015, $290.0 principal amount of 4.03% Senior Notes, Series B, due

November 23, 2020, and $103.0 principal amount of 4.18% Senior Notes, Series C, due November 23, 2022 (collectively, the “Private

Notes”). The proceeds from the sale of the Private Notes were used to repay existing debt and for general corporate purposes.

On March 29, 2013, we prepaid our Private Notes. The prepayment price was equal to 100% of the principal amount of $535.0, plus

accrued interest of $6.9 and a make-whole premium of $68.0. In connection with the prepayment of our Private Notes, we incurred a loss

on extinguishment of debt of $71.4 in the first quarter of 2013, which included the make-whole premium and the write-off of $3.4 of debt

issuance costs related to the Private Notes.

Public Notes

In April 2003, the call holder of $100.0 principal amount of 6.25% Notes due May 2018 (the “6.25% Notes”), embedded with put and call

option features, exercised the call option associated with these 6.25% Notes, and thus became the sole note holder of the 6.25% Notes.

Pursuant to an agreement with the sole note holder, we modified these 6.25% Notes into $125.0 aggregate principal amount of 4.625%

notes due May 15, 2013. The modified principal amount represented the original value of the putable/callable notes, plus the market value