Avon 2013 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2013 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

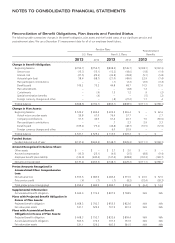

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

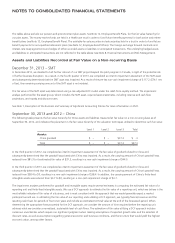

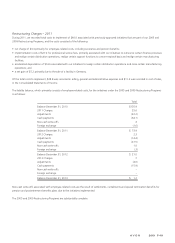

The following tables present the fair value hierarchy for pension assets measured at fair value on a recurring basis as of December 31, 2012:

U.S. Pension Plans

Asset Category Level 1 Level 2 Total

Equity Securities:

Domestic equity $ – $186.4 $186.4

International equity – 71.0 71.0

Emerging markets – 50.5 50.5

– 307.9 307.9

Fixed Income Securities:

Corporate bonds – 148.0 148.0

Government securities – 72.2 72.2

– 220.2 220.2

Cash 1.1 – 1.1

Total $ 1.1 $528.1 $529.2

Non-U.S. Pension Plans

Asset Category Level 1 Level 2 Level 3 Total

Equity Securities:

Domestic equity $ – $ 71.3 $ – $ 71.3

International equity – 297.4 – 297.4

– 368.7 – 368.7

Fixed Income Securities:

Corporate bonds – 85.9 – 85.9

Government securities – 113.3 – 113.3

Other – 11.5 – 11.5

– 210.7 – 210.7

Other:

Cash 16.4 – – 16.4

Real estate – – 13.1 13.1

Other – – .4 .4

16.4 – 13.5 29.9

Total $ 16.4 $579.4 $ 13.5 $609.3

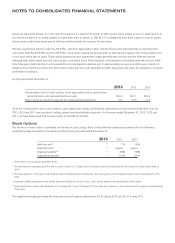

A reconciliation of the beginning and ending balances for our Level 3 investments is provided in the table below:

Amount

Balance as of January 1, 2012 $ 15.9

Actual return on plan assets held (2.6)

Foreign currency changes .2

Balance as of December 31, 2012 13.5

Purchases and sales, net (10.4)

Actual return on plan assets held (.5)

Foreign currency changes (.3)

Balance as of December 31, 2013 $ 2.3

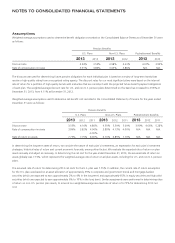

Investments in equity securities classified as Level 1 in the fair value hierarchy are valued at quoted market prices. Investments in equity

securities classified as Level 2 in the fair value hierarchy include collective funds that are valued at quoted market prices for non-active

securities. Fixed income securities are based on broker quotes for non-active securities. Mutual funds are valued at quoted market prices.

Real estate is valued by reference to investment and leasing transactions at similar types of property, supplemented by third party appraisals.