Allstate 2013 Annual Report Download - page 257

Download and view the complete annual report

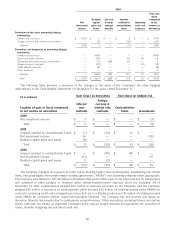

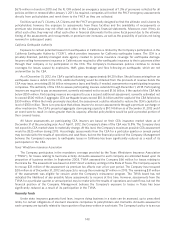

Please find page 257 of the 2013 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.incurred include $758 million, $196 million and $50 million in 2012, 2011 and 2010, respectively. Under the

arrangement, the Federal Government is obligated to pay all claims.

Ceded premiums earned under the Florida Hurricane Catastrophe Fund (‘‘FHCF’’) agreement were $18 million,

$27 million and $15 million in 2012, 2011 and 2010, respectively. There were no ceded losses incurred in 2012. Ceded

losses incurred were $8 million and $10 million in 2011 and 2010, respectively. The Company has access to

reimbursement provided by the FHCF for 90% of qualifying personal property losses that exceed its current retention of

$89 million for the 2 largest hurricanes and $30 million for other hurricanes, up to a maximum total of $236 million

effective from June 1, 2012 to May 31, 2013. There were no amounts recoverable from the FHCF as of December 31, 2012

or 2011.

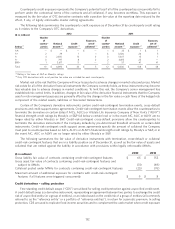

Catastrophe reinsurance

The Company has the following catastrophe reinsurance treaties in effect as of December 31, 2012:

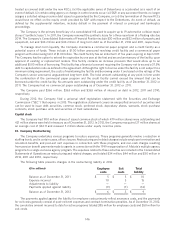

• Nationwide Per Occurrence Excess Catastrophe Reinsurance agreement comprises nine contracts, placed in

seven layers, incepting as of June 1, 2011 and with one, two and three year terms. This agreement reinsures

Allstate Protection personal lines auto and property business countrywide, in all states except Florida and New

Jersey, for excess catastrophe losses caused by multiple perils. The first five layers, which are 95% placed and

subject to reinstatement, comprise three contracts and cover $3.25 billion in per occurrence losses subject to a

$500 million retention and after $250 million in losses ‘‘otherwise recoverable.’’ Losses from multiple

qualifying occurrences can apply to this $250 million threshold which applies once to each contract year and

only to the agreement’s first layer. The sixth layer, which is 82.33% placed and not subject to reinstatement,

comprises five contracts: two existing contracts expiring May 31, 2013 and May 31, 2014, and three additional

contracts expiring May 31, 2013, May 31, 2014, and May 31, 2015. It covers $500 million in per occurrence

losses in excess of a $3.25 billion retention. The seventh layer, which is 83.12% placed and not subject to

reinstatement, consists of one contract expiring May 31, 2013, and covers $475 million in per occurrence losses

in excess of a $3.75 billion retention.

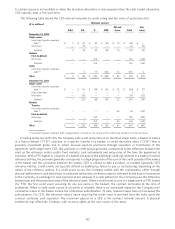

• Top and Drop Excess Catastrophe Reinsurance agreement comprising a three year term contract, incepting

June 1, 2011, and providing $250 million of reinsurance limits which may be used for Coverage A, Coverage B, or

a combination of both. Coverage A reinsures 12.67% of $500 million in limits excess of a $3.25 billion retention.

Coverage B provides 25.32% of $250 million in limits excess of a $750 million retention and after $500 million

in losses ‘‘otherwise recoverable’’ under the agreement. Losses from multiple qualifying occurrences can apply

to this $500 million threshold.

Losses recoverable under the Company’s New Jersey, Kentucky and Pennsylvania reinsurance agreements,

described below, are disregarded when determining coverage under the Nationwide Per Occurrence Excess Catastrophe

Reinsurance agreement and the Top and Drop Excess Catastrophe Reinsurance agreement.

• New Jersey Excess Catastrophe Reinsurance agreement, comprising three contracts, provides coverage for

Allstate Protection personal lines property excess catastrophe losses for multiple perils in New Jersey. Two

contracts, expiring May 31, 2014 and May 31, 2015, provide 31.66% of a $400 million limit excess of a

$139 million retention and 31.67% of a $400 million limit excess of a $150 million retention, respectively. Each

contract contains one reinstatement each year. A third contract, expiring May 31, 2013, is placed in two layers:

the first layer provides 32% of $300 million of limits in excess of a $171 million retention, and the second layer

provides 42% of $200 million of limits in excess of a $471 million retention. Each layer includes one

reinstatement per contract year. The reinsurance premium and retention applicable to the agreement are

subject to redetermination for exposure changes annually.

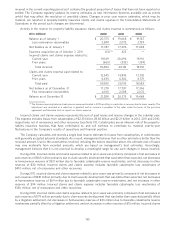

• Kentucky Excess Catastrophe Reinsurance agreement provides coverage for Allstate Protection personal lines

property excess catastrophe losses in the state for earthquakes and fires following earthquakes effective June 1,

2011 to May 31, 2014. The agreement provides three limits of $25 million excess of a $5 million retention

subject to two limits being available in any one contract year and is 95% placed.

• Pennsylvania Excess Catastrophe Reinsurance agreement provides coverage for Allstate Protection personal

lines property excess catastrophe losses in the state for multi-perils effective June 1, 2012 through May 31,

2015. The agreement provides three limits of $100 million excess of a $100 million retention subject to two

limits being available in any one contract year and is 95% placed.

• Five separate contracts for Castle Key Insurance Company and its subsidiary (‘‘Castle Key’’) provide coverage

for personal lines property excess catastrophe losses in Florida and coordinate coverage with Castle Key’s

141