Allstate 2013 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2013 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Protection reporting unit and relatively less for the Allstate Financial reporting unit. The results of this analysis are

consistent with both the relative operating performance of the individual reporting units as well as their respective

industry sector’s performance. Specifically, spread-based products, which are a material component of the Allstate

Financial reporting unit, are experiencing the continued impacts of the historically low interest rate environment which

has depressed operating margins. In contrast, underwriting results from the Allstate Protection business have benefitted

by the general presence of stable to higher premium rates and stable loss costs.

Goodwill impairment evaluations indicated no impairment as of December 31, 2012 and no reporting unit was at

risk of having its carrying value including goodwill exceed its fair value.

CAPITAL RESOURCES AND LIQUIDITY 2012 HIGHLIGHTS

• Shareholders’ equity as of December 31, 2012 was $20.58 billion, an increase of 12.5% from $18.30 billion as of

December 31, 2011.

• On January 3, 2012, April 2, 2012, July 2, 2012, October 1, 2012 and December 31, 2012, we paid shareholder

dividends of $0.21, $0.22, $0.22, $0.22 and $0.22, respectively. On February 6, 2013, we declared a quarterly

shareholder dividend of $0.25 payable on April 1, 2013.

• In November 2012, we completed a $1.00 billion share repurchase program that commenced in November 2011. In

December 2012, we commenced a new $1.00 billion share repurchase program that is expected to be completed by

December 31, 2013, and as of December 31, 2012, had $984 million remaining. In February 2013, an additional

$1 billion share repurchase program was authorized and is expected to be completed by March 31, 2014. Our

repurchase programs may utilize an accelerated repurchase program. During 2012, we repurchased 26.7 million

common shares for $910 million.

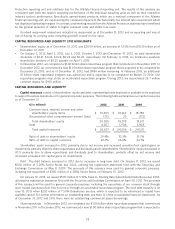

CAPITAL RESOURCES AND LIQUIDITY

Capital resources consist of shareholders’ equity and debt, representing funds deployed or available to be deployed

to support business operations or for general corporate purposes. The following table summarizes our capital resources

as of December 31.

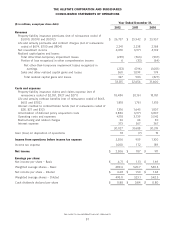

($ in millions) 2012 2011 2010

Common stock, retained income and other

shareholders’ equity items $ 19,405 $ 18,269 $ 18,789

Accumulated other comprehensive income (loss) 1,175 29 (172)

Total shareholders’ equity 20,580 18,298 18,617

Debt 6,057 5,908 5,908

Total capital resources $ 26,637 $ 24,206 $ 24,525

Ratio of debt to shareholders’ equity 29.4% 32.3% 31.7%

Ratio of debt to capital resources 22.7% 24.4% 24.1%

Shareholders’ equity increased in 2012, primarily due to net income and increased unrealized net capital gains on

investments, partially offset by share repurchases and dividends paid to shareholders. Shareholders’ equity decreased in

2011, primarily due to share repurchases and dividends paid to shareholders, partially offset by net income and

increased unrealized net capital gains on investments.

Debt The debt balance increased in 2012 due to increases in long-term debt. On January 11, 2012, we issued

$500 million of 5.20% Senior Notes due 2042, utilizing the registration statement filed with the Securities and

Exchange Commission on May 8, 2009. The proceeds of this issuance were used for general corporate purposes,

including the repayment of $350 million of 6.125% Senior Notes on February 15, 2012.

On January 10, 2013, we issued $500 million of 5.10% Fixed-to-Floating Rate Subordinated Debentures due 2053,

utilizing the registration statement filed with the Securities and Exchange Commission on April 30, 2012. The proceeds

of this issuance will be used for general corporate purposes, including the repurchase of our common stock through

open market purchases from time to time or through an accelerated repurchase program. The next debt maturity is on

June 15, 2013 when $250 million of 7.50% Debentures are due, which is expected to be refinanced or repaid from

available capital. For further information on outstanding debt, see Note 12 of the consolidated financial statements. As

of December 31, 2012 and 2011, there were no outstanding commercial paper borrowings.

Share repurchases In November 2012, we completed our $1.00 billion share repurchase program that commenced

in November 2011. In December 2012, we commenced a new $1.00 billion share repurchase program that is expected to

78