Allstate 2013 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2013 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company receives cash collateral for securities loaned in an amount generally equal to 102% and 105% of the

fair value of domestic and foreign securities, respectively, and records the related obligations to return the collateral in

other liabilities and accrued expenses. The carrying value of these obligations approximates fair value because of their

relatively short-term nature. The Company monitors the market value of securities loaned on a daily basis and obtains

additional collateral as necessary under the terms of the agreements to mitigate counterparty credit risk. The Company

maintains the right and ability to repossess the securities loaned on short notice.

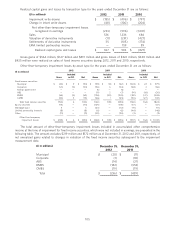

Recognition of premium revenues and contract charges, and related benefits and interest credited

Property-liability premiums are deferred and earned on a pro-rata basis over the terms of the policies, typically

periods of six or twelve months. The portion of premiums written applicable to the unexpired terms of the policies is

recorded as unearned premiums. Premium installment receivables, net, represent premiums written and not yet

collected, net of an allowance for uncollectible premiums. The Company regularly evaluates premium installment

receivables and adjusts its valuation allowance as appropriate. The valuation allowance for uncollectible premium

installment receivables was $70 million as of both December 31, 2012 and 2011.

Traditional life insurance products consist principally of products with fixed and guaranteed premiums and benefits,

primarily term and whole life insurance products. Voluntary accident and health insurance products are expected to

remain in force for an extended period. Premiums from these products are recognized as revenue when due from

policyholders. Benefits are reflected in life and annuity contract benefits and recognized in relation to premiums, so that

profits are recognized over the life of the policy.

Immediate annuities with life contingencies, including certain structured settlement annuities, provide insurance

protection over a period that extends beyond the period during which premiums are collected. Premiums from these

products are recognized as revenue when received at the inception of the contract. Benefits and expenses are

recognized in relation to premiums. Profits from these policies come from investment income, which is recognized over

the life of the contract.

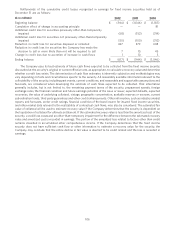

Interest-sensitive life contracts, such as universal life and single premium life, are insurance contracts whose terms

are not fixed and guaranteed. The terms that may be changed include premiums paid by the contractholder, interest

credited to the contractholder account balance and contract charges assessed against the contractholder account

balance. Premiums from these contracts are reported as contractholder fund deposits. Contract charges consist of fees

assessed against the contractholder account balance for the cost of insurance (mortality risk), contract administration

and surrender of the contract prior to contractually specified dates. These contract charges are recognized as revenue

when assessed against the contractholder account balance. Life and annuity contract benefits include life-contingent

benefit payments in excess of the contractholder account balance.

Contracts that do not subject the Company to significant risk arising from mortality or morbidity are referred to as

investment contracts. Fixed annuities, including market value adjusted annuities, equity-indexed annuities and

immediate annuities without life contingencies, and funding agreements (primarily backing medium-term notes) are

considered investment contracts. Consideration received for such contracts is reported as contractholder fund deposits.

Contract charges for investment contracts consist of fees assessed against the contractholder account balance for

maintenance, administration and surrender of the contract prior to contractually specified dates, and are recognized

when assessed against the contractholder account balance.

Interest credited to contractholder funds represents interest accrued or paid on interest-sensitive life and

investment contracts. Crediting rates for certain fixed annuities and interest-sensitive life contracts are adjusted

periodically by the Company to reflect current market conditions subject to contractually guaranteed minimum rates.

Crediting rates for indexed life and annuities and indexed funding agreements are generally based on a specified interest

rate index or an equity index, such as the Standard & Poor’s (‘‘S&P’’) 500 Index. Interest credited also includes

amortization of DSI expenses. DSI is amortized into interest credited using the same method used to amortize DAC.

Contract charges for variable life and variable annuity products consist of fees assessed against the contractholder

account balances for contract maintenance, administration, mortality, expense and surrender of the contract prior to

contractually specified dates. Contract benefits incurred for variable annuity products include guaranteed minimum

death, income, withdrawal and accumulation benefits. Substantially all of the Company’s variable annuity business is

ceded through reinsurance agreements and the contract charges and contract benefits related thereto are reported net

of reinsurance ceded.

96