Allstate 2013 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2013 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

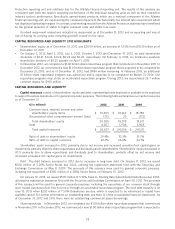

Contractual obligations and commitments Our contractual obligations as of December 31, 2012 and the

payments due by period are shown in the following table.

($ in millions) Less than Over

Total 1 year 1-3 years 4-5 years 5 years

Liabilities for collateral (1) $ 808 $ 808 $ — $ — $ —

Contractholder funds (2) 54,517 7,924 9,929 6,990 29,674

Reserve for life-contingent contract

benefits (2) 35,195 1,216 2,241 2,108 29,630

Long-term debt (3) 12,652 607 1,628 591 9,826

Capital lease obligations (3) 63 19 24 9 11

Operating leases (3) 580 166 229 115 70

Unconditional purchase obligations (3) 392 158 183 51 —

Defined benefit pension plans and other

postretirement benefit plans (3)(4) 3,276 622 280 286 2,088

Reserve for property-liability insurance

claims and claims expense (5) 21,288 9,258 6,513 2,392 3,125

Other liabilities and accrued expenses (6)(7) 3,722 3,529 98 69 26

Net unrecognized tax benefits (8) 25 25 — — —

Total contractual cash obligations $ 132,518 $ 24,332 $ 21,125 $ 12,611 $ 74,450

(1) Liabilities for collateral are typically fully secured with cash or short-term investments. We manage our short-term liquidity position to ensure the

availability of a sufficient amount of liquid assets to extinguish short-term liabilities as they come due in the normal course of business, including

utilizing potential sources of liquidity as disclosed previously.

(2) Contractholder funds represent interest-bearing liabilities arising from the sale of products such as interest-sensitive life, fixed annuities, including

immediate annuities without life contingencies and institutional products. The reserve for life-contingent contract benefits relates primarily to

traditional life insurance, immediate annuities with life contingencies and voluntary accident and health insurance. These amounts reflect the

present value of estimated cash payments to be made to contractholders and policyholders. Certain of these contracts, such as immediate

annuities without life contingencies and institutional products, involve payment obligations where the amount and timing of the payment is

essentially fixed and determinable. These amounts relate to (i) policies or contracts where we are currently making payments and will continue to

do so and (ii) contracts where the timing of a portion or all of the payments has been determined by the contract. Other contracts, such as interest-

sensitive life, fixed deferred annuities, traditional life insurance, immediate annuities with life contingencies and voluntary accident and health

insurance, involve payment obligations where a portion or all of the amount and timing of future payments is uncertain. For these contracts, we are

not currently making payments and will not make payments until (i) the occurrence of an insurable event such as death or illness or (ii) the

occurrence of a payment triggering event such as the surrender or partial withdrawal on a policy or deposit contract, which is outside of our control.

We have estimated the timing of payments related to these contracts based on historical experience and our expectation of future payment

patterns. Uncertainties relating to these liabilities include mortality, morbidity, expenses, customer lapse and withdrawal activity, estimated

additional deposits for interest-sensitive life contracts, and renewal premium for life policies, which may significantly impact both the timing and

amount of future payments. Such cash outflows reflect adjustments for the estimated timing of mortality, retirement, and other appropriate factors,

but are undiscounted with respect to interest. As a result, the sum of the cash outflows shown for all years in the table exceeds the corresponding

liabilities of $39.32 billion for contractholder funds and $14.90 billion for reserve for life-contingent contract benefits as included in the

Consolidated Statements of Financial Position as of December 31, 2012. The liability amount in the Consolidated Statements of Financial Position

reflects the discounting for interest as well as adjustments for the timing of other factors as described above.

(3) Our payment obligations relating to long-term debt, capital lease obligations, operating leases, unconditional purchase obligations and pension and

other post employment benefits (‘‘OPEB’’) contributions are managed within the structure of our intermediate to long-term liquidity management

program. Amount differs from the balance presented on the Consolidated Statements of Financial Position as of December 31, 2012 because the

long-term debt amount above includes interest.

(4) The pension plans’ obligations in the next 12 months represent our planned contributions, and the remaining years’ contributions are projected

based on the average remaining service period using the current underfunded status of the plans. The OPEB plans’ obligations are estimated based

on the expected benefits to be paid. These liabilities are discounted with respect to interest, and as a result the sum of the cash outflows shown for

all years in the table exceeds the corresponding liability amount of $2.14 billion included in other liabilities and accrued expenses on the

Consolidated Statements of Financial Position.

(5) Reserve for property-liability insurance claims and claims expense is an estimate of amounts necessary to settle all outstanding claims, including

claims that have been IBNR as of the balance sheet date. We have estimated the timing of these payments based on our historical experience and

our expectation of future payment patterns. However, the timing of these payments may vary significantly from the amounts shown above,

especially for IBNR claims. The ultimate cost of losses may vary materially from recorded amounts which are our best estimates. The reserve for

property-liability insurance claims and claims expense includes loss reserves related to asbestos and environmental claims as of December 31,

2012, of $1.52 billion and $241 million, respectively.

(6) Other liabilities primarily include accrued expenses and certain benefit obligations and claim payments and other checks outstanding. Certain of

these long-term liabilities are discounted with respect to interest, as a result the sum of the cash outflows shown for all years in the table exceeds

the corresponding liability amount of $3.65 billion.

(7) Balance sheet liabilities not included in the table above include unearned and advance premiums of $11.08 billion and gross deferred tax liabilities of

$2.89 billion. These items were excluded as they do not meet the definition of a contractual liability as we are not contractually obligated to pay

84