Allstate 2013 Annual Report Download - page 247

Download and view the complete annual report

Please find page 247 of the 2013 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296

|

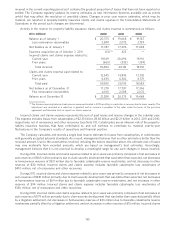

|

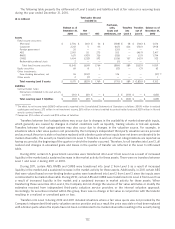

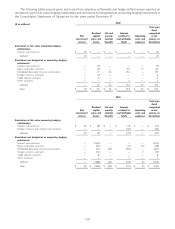

2010

Total gain

(loss)

Realized Life and Interest recognized

Net capital annuity credited to Operating in net

investment gains and contract contractholder costs and income on

income losses benefits funds expenses derivatives

Derivatives in fair value accounting hedging

relationships

Interest rate contracts $ (139) $ 9 $ — $ 11 $ — $ (119)

Foreign currency and interest rate contracts — (2) — (18) — (20)

Subtotal (139) 7 — (7) — (139)

Derivatives not designated as accounting hedging

instruments

Interest rate contracts — (496) — — — (496)

Equity and index contracts — (91) — 113 18 40

Embedded derivative financial instruments — (3) (28) 34 — 3

Foreign currency contracts — (10) — — (3) (13)

Credit default contracts — (8) — — — (8)

Other contracts — — — 3 — 3

Subtotal — (608) (28) 150 15 (471)

Total $ (139) $ (601) $ (28) $ 143 $ 15 $ (610)

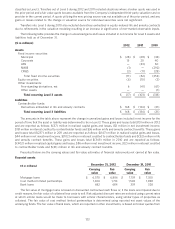

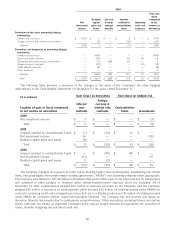

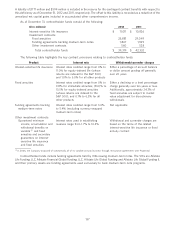

The following table provides a summary of the changes in fair value of the Company’s fair value hedging

relationships in the Consolidated Statements of Operations for the years ended December 31.

Gain (loss) on derivatives Gain (loss) on hedged risk

($ in millions)

Foreign

Interest currency &

Location of gain or (loss) recognized rate interest rate Contractholder

in net income on derivatives contracts contracts funds Investments

2012

Net investment income $ 3 $ — $ — $ (3)

Total $ 3 $ — $ — $ (3)

2011

Interest credited to contractholder funds $ (7) $ (34) $ 41 $ —

Net investment income 26 — — (26)

Realized capital gains and losses (8) — — —

Total $ 11 $ (34) $ 41 $ (26)

2010

Interest credited to contractholder funds $ — $ (48) $ 48 $ —

Net investment income (33) — — 33

Realized capital gains and losses 9 (2) — —

Total $ (24) $ (50) $ 48 $ 33

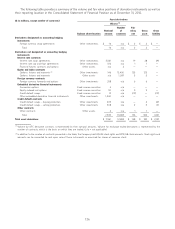

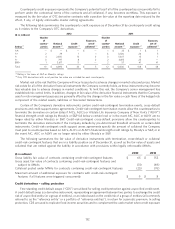

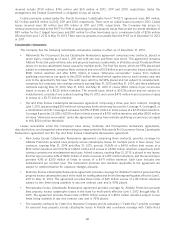

The Company manages its exposure to credit risk by utilizing highly rated counterparties, establishing risk control

limits, executing legally enforceable master netting agreements (‘‘MNAs’’) and obtaining collateral where appropriate.

The Company uses MNAs for OTC derivative transactions that permit either party to net payments due for transactions

and collateral is either pledged or obtained when certain predetermined exposure limits are exceeded. As of

December 31, 2012, counterparties pledged $29 million in cash and securities to the Company, and the Company

pledged $26 million in securities to counterparties which includes $25 million of collateral posted under MNAs for

contracts containing credit-risk-contingent provisions that are in a liability position and $1 million of collateral posted

under MNAs for contracts without credit-risk-contingent liabilities. The Company has not incurred any losses on

derivative financial instruments due to counterparty nonperformance. Other derivatives, including futures and certain

option contracts, are traded on organized exchanges which require margin deposits and guarantee the execution of

trades, thereby mitigating any potential credit risk.

131