Allstate 2013 Annual Report Download - page 198

Download and view the complete annual report

Please find page 198 of the 2013 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

outstanding at any point in time under the combination of the commercial paper program and the credit facility

cannot exceed the amount that can be borrowed under the credit facility.

• A universal shelf registration statement was filed with the Securities and Exchange Commission on April 30, 2012.

We can use this shelf registration to issue an unspecified amount of debt securities, common stock (including

421 million shares of treasury stock as of December 31, 2012), preferred stock, depositary shares, warrants, stock

purchase contracts, stock purchase units and securities of trust subsidiaries. The specific terms of any securities we

issue under this registration statement will be provided in the applicable prospectus supplements.

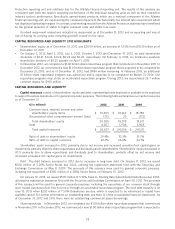

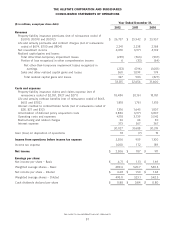

Liquidity exposure Contractholder funds were $39.32 billion as of December 31, 2012. The following table

summarizes contractholder funds by their contractual withdrawal provisions as of December 31, 2012.

($ in millions) Percent to

total

Not subject to discretionary withdrawal $ 6,012 15.3%

Subject to discretionary withdrawal with adjustments:

Specified surrender charges (1) 13,170 33.5

Market value adjustments (2) 5,382 13.7

Subject to discretionary withdrawal without adjustments (3) 14,755 37.5

Total contractholder funds (4) $ 39,319 100.0%

(1) Includes $6.81 billion of liabilities with a contractual surrender charge of less than 5% of the account balance.

(2) $4.45 billion of the contracts with market value adjusted surrenders have a 30-45 day period at the end of their initial

and subsequent interest rate guarantee periods (which are typically 5 or 6 years) during which there is no surrender

charge or market value adjustment.

(3) 76% of these contracts have a minimum interest crediting rate guarantee of 3% or higher.

(4) Includes $1.12 billion of contractholder funds on variable annuities reinsured to The Prudential Insurance Company of

America, a subsidiary of Prudential Financial Inc., in 2006.

While we are able to quantify remaining scheduled maturities for our institutional products, anticipating retail

product surrenders is less precise. Retail life and annuity products may be surrendered by customers for a variety of

reasons. Reasons unique to individual customers include a current or unexpected need for cash or a change in life

insurance coverage needs. Other key factors that may impact the likelihood of customer surrender include the level of

the contract surrender charge, the length of time the contract has been in force, distribution channel, market interest

rates, equity market conditions and potential tax implications. In addition, the propensity for retail life insurance policies

to lapse is lower than it is for fixed annuities because of the need for the insured to be re-underwritten upon policy

replacement. Surrenders and partial withdrawals for our retail annuities decreased 20.1% in 2012 compared to 2011. The

annualized surrender and partial withdrawal rate on deferred fixed annuities and interest-sensitive life insurance

products, based on the beginning of year contractholder funds, was 11.3% and 12.6% in 2012 and 2011, respectively.

Allstate Financial strives to promptly pay customers who request cash surrenders; however, statutory regulations

generally provide up to six months in most states to fulfill surrender requests.

Our institutional products are primarily funding agreements sold to unaffiliated trusts used to back medium-term

notes. As of December 31, 2012, total institutional products outstanding were $1.84 billion, with scheduled maturities of

$1.75 billion in April of 2013 and $85 million in 2016.

Our asset-liability management practices limit the differences between the cash flows generated by our investment

portfolio and the expected cash flow requirements of our life insurance, annuity and institutional product obligations.

Certain remote events and circumstances could constrain our liquidity. Those events and circumstances include, for

example, a catastrophe resulting in extraordinary losses, a downgrade in our senior long-term debt rating of A3, A- and

a- (from Moody’s, S&P and A.M. Best, respectively) to non-investment grade status of below Baa3/BBB-/bb, a

downgrade in AIC’s financial strength rating from Aa3, AA- and A+ (from Moody’s, S&P and A.M. Best, respectively) to

below Baa2/BBB/A-, or a downgrade in ALIC’s financial strength ratings from A1, A+ and A+ (from Moody’s, S&P

and A.M. Best, respectively) to below A3/A-/A-. The rating agencies also consider the interdependence of our

individually rated entities; therefore, a rating change in one entity could potentially affect the ratings of other related

entities.

82