Allstate 2013 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2013 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296

|

|

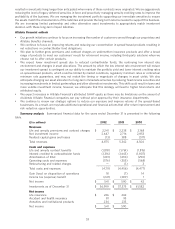

resulted in annuitants living longer than anticipated when many of these contracts were originated. We are aggressively

reducing the level of legacy deferred annuities in force and proactively managing annuity crediting rates to improve the

profitability of the business. We are managing the investment portfolio supporting our immediate annuities to ensure

the assets match the characteristics of the liabilities and provide the long-term returns needed to support this business.

We are increasing limited partnership and other alternative asset investments to appropriately match investment

duration with these long-term illiquid liabilities.

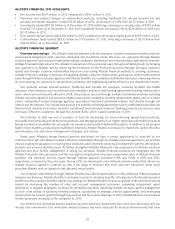

Allstate Financial outlook

• Our growth initiatives continue to focus on increasing the number of customers served through our proprietary and

Allstate Benefits channels.

• We continue to focus on improving returns and reducing our concentration in spread-based products resulting in

net reductions in contractholder fund obligations.

• We plan to further grow premiums and contract charges on underwritten insurance products and offer a broad

range of products to meet our customers’ needs for retirement income, including third-party solutions when we

choose not to offer certain products.

• We expect lower investment spread due to reduced contractholder funds, the continuing low interest rate

environment and changes in asset allocations. The amount by which the low interest rate environment will reduce

our investment spread is contingent on our ability to maintain the portfolio yield and lower interest crediting rates

on spread-based products, which could be limited by market conditions, regulatory minimum rates or contractual

minimum rate guarantees, and may not match the timing or magnitude of changes in asset yields. We also

anticipate changing our asset allocation for long-term immediate annuities by reducing fixed income securities and

increasing investments in limited partnerships and other alternative investments. This shift could result in lower and

more volatile investment income; however, we anticipate that this strategy will lead to higher total returns and

attributed equity.

• We expect increases in Allstate Financial’s attributed GAAP equity as there may be limitations on the amount of

dividends Allstate Financial companies can pay without prior approval by their insurance departments.

• We continue to review our strategic options to reduce our exposure and improve returns of the spread-based

businesses. As a result, we may take additional operational and financial actions that offer return improvement and

risk reduction opportunities.

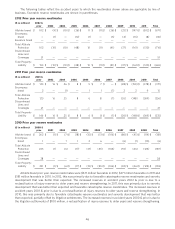

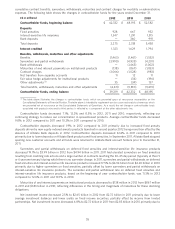

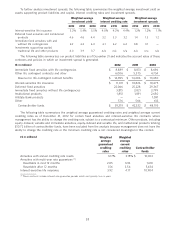

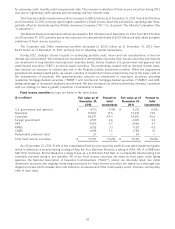

Summary analysis Summarized financial data for the years ended December 31 is presented in the following

table.

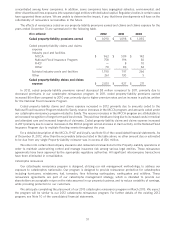

($ in millions) 2012 2011 2010

Revenues

Life and annuity premiums and contract charges $ 2,241 $ 2,238 $ 2,168

Net investment income 2,647 2,716 2,853

Realized capital gains and losses (13) 388 (517)

Total revenues 4,875 5,342 4,504

Costs and expenses

Life and annuity contract benefits (1,818) (1,761) (1,815)

Interest credited to contractholder funds (1,316) (1,645) (1,807)

Amortization of DAC (401) (494) (290)

Operating costs and expenses (576) (555) (568)

Restructuring and related charges — (1) 3

Total costs and expenses (4,111) (4,456) (4,477)

Gain (loss) on disposition of operations 18 (7) 14

Income tax (expense) benefit (241) (289) 1

Net income $ 541 $ 590 $ 42

Investments as of December 31 $ 56,999 $ 57,373 $ 61,582

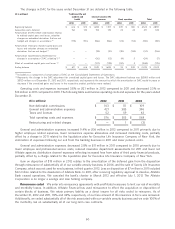

Net income

Life insurance $ 226 $ 262

Accident and health insurance 81 95

Annuities and institutional products 234 233

Net income $ 541 $ 590

53