Allstate 2013 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2013 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ALLSTATE FINANCIAL 2012 HIGHLIGHTS

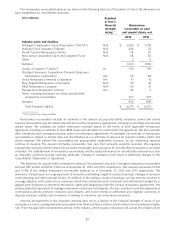

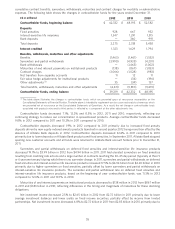

• Net income was $541 million in 2012 compared to $590 million in 2011.

• Premiums and contract charges on underwritten products, including traditional life, interest-sensitive life and

accident and health insurance, totaled $2.18 billion in 2012, an increase of 3.8% from $2.10 billion in 2011.

• Investments totaled $57.00 billion as of December 31, 2012, reflecting a decrease in carrying value of $374 million

from $57.37 billion as of December 31, 2011. Net investment income decreased 2.5% to $2.65 billion in 2012 from

$2.72 billion in 2011.

• Net realized capital losses totaled $13 million in 2012 compared to net realized capital gains of $388 million in 2011.

• Contractholder funds totaled $39.32 billion as of December 31, 2012, reflecting a decrease of $3.01 billion from

$42.33 billion as of December 31, 2011.

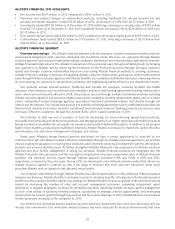

ALLSTATE FINANCIAL SEGMENT

Overview and strategy The Allstate Financial segment sells life insurance, voluntary employee benefits products,

and products designed to meet customer retirement and investment needs. We serve our customers through Allstate

exclusive agencies and exclusive financial specialists, workplace distribution and non-proprietary distribution channels.

Allstate Financial brings value to The Allstate Corporation in three principal ways: through profitable growth, by bringing

new customers to Allstate, and by improving the economics of the Protection business through increased customer

loyalty and stronger customer relationships based on cross selling Allstate Financial products to existing customers.

Allstate Financial’s strategy is focused on expanding Allstate customer relationships, growing our underwritten product

sales through Allstate exclusive agencies and Allstate Benefits (our workplace distribution business), improving returns

on and reducing our exposure to spread-based products, and emphasizing capital efficiency and shareholder returns.

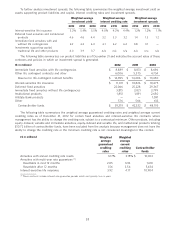

Our products include interest-sensitive, traditional and variable life insurance; voluntary accident and health

insurance; fixed annuities such as deferred and immediate annuities; and funding agreements backing medium-term

notes, which we most recently offered in 2008. Our products are sold through multiple distribution channels including

Allstate exclusive agencies and exclusive financial specialists, workplace enrolling independent agents and, to a lesser

extent, independent master brokerage agencies, specialized structured settlement brokers, and directly through call

centers and the internet. Our institutional product line consists of funding agreements sold to unaffiliated trusts that use

them to back medium-term notes issued to institutional and individual investors. Banking products and services were

previously offered to customers through the Allstate Bank, which ceased operations in 2011.

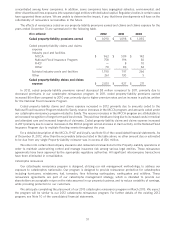

We continue to shift our mix of products in force by decreasing our lower returning spread-based products,

principally fixed annuities and institutional products, and through growth of our higher returning underwritten products

having mortality or morbidity risk, principally life insurance and accident and health products. In addition to focusing on

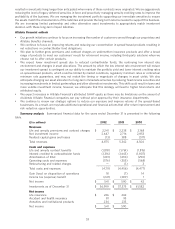

higher return markets, products and distribution channels, Allstate Financial continues to implement capital efficiency

and enterprise risk and return management strategies and actions.

Based upon Allstate’s strong financial position and brand, we have a unique opportunity to cross-sell to our

customer base. We will enhance trusted customer relationships through our Allstate exclusive agencies to serve those

who are looking for assistance in meeting their protection and retirement needs by providing them with the information,

products and services that they need. To further strengthen Allstate Financial’s value proposition to Allstate exclusive

agencies and drive further engagement in selling our products, Allstate Financial products are integrated into the

Allstate Protection sales processes and the new agent compensation structure incorporates sales of Allstate Financial

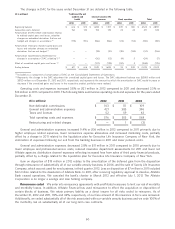

products. Life insurance policies issued through Allstate agencies increased 9.3% and 31.5% in 2012 and 2011,

respectively, compared to the prior years. During 2012, we introduced a new deferred annuity product that allows our

Allstate exclusive agents to continue to offer a full range of products that meet customer retirement needs while

providing Allstate with an attractive risk adjusted return profile.

Our employer relationships through Allstate Benefits also afford opportunities to offer additional Allstate products

and grow our business. Allstate Benefits is an industry leader in voluntary benefits, offering one of the broadest product

portfolios in the voluntary benefits market. Our strategy for Allstate Benefits focuses on growth in the national accounts

market by increasing the number of sales and account management personnel, expanding independent agent

distribution in targeted geographic locations for increased new sales, increasing Allstate exclusive agency engagement

to drive cross selling of voluntary benefits products, capitalizing on strategic alliance opportunities, and developing

opportunities for revenue growth through new product and fee income offerings. In 2012, Allstate Benefits new business

written premiums increased 6.5% compared to 2011.

Our deferred and immediate annuity business has been adversely impacted by the credit cycle and historically low

interest rate environment. Our immediate annuity business has been impacted by medical advancements that have

52