Allstate 2013 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2013 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

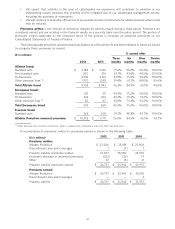

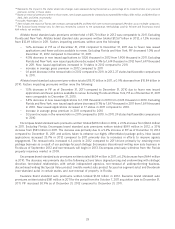

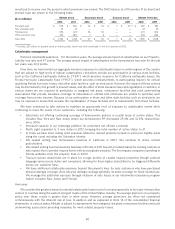

Underwriting results are shown in the following table.

($ in millions) 2012 2011 2010

Premiums written $ 27,026 $ 25,981 $ 25,906

Premiums earned $ 26,737 $ 25,942 $ 25,955

Claims and claims expense (18,433) (20,140) (18,923)

Amortization of DAC (3,483) (3,477) (3,517)

Other costs and expenses (3,534) (3,139) (2,957)

Restructuring and related charges (34) (43) (33)

Underwriting income (loss) $ 1,253 $ (857) $ 525

Catastrophe losses $ 2,345 $ 3,815 $ 2,207

Underwriting income (loss) by line of business

Standard auto $ 367 $ 561 $ 692

Non-standard auto 102 102 74

Homeowners 690 (1,331) (336)

Other personal lines 94 (189) 95

Underwriting income (loss) $ 1,253 $ (857) $ 525

Underwriting income (loss) by brand

Allstate brand $ 1,515 $ (667) $ 568

Encompass brand (70) (146) (43)

Esurance brand (192) (44) —

Underwriting income (loss) $ 1,253 $ (857) $ 525

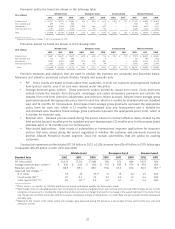

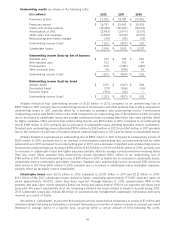

Allstate Protection had underwriting income of $1.25 billion in 2012 compared to an underwriting loss of

$857 million in 2011, primarily due to underwriting income in homeowners and other personal lines in 2012 compared to

underwriting losses in 2011, partially offset by a decrease in standard auto underwriting income. Homeowners

underwriting income was $690 million in the 2012 compared to an underwriting loss of $1.33 billion in 2011, primarily

due to decreases in catastrophe losses and average earned premiums increasing faster than loss costs, partially offset

by higher expenses. Other personal lines underwriting income was $94 million in 2012 compared to an underwriting

loss of $189 million in 2011, primarily due to decreases in catastrophe losses including favorable reserve reestimates.

Standard auto underwriting income decreased $194 million to $367 million in 2012 from $561 million in 2011 primarily

due to the inclusion of a full year of Esurance brand’s underwriting losses in 2012 and increases in catastrophe losses.

Allstate Protection experienced an underwriting loss of $857 million in 2011 compared to underwriting income of

$525 million in 2010, primarily due to an increase in homeowners underwriting loss, an underwriting loss for other

personal lines in 2011 compared to an underwriting gain in 2010, and a decrease in standard auto underwriting income.

Homeowners underwriting loss increased $995 million to $1.33 billion in 2011 from $336 million in 2010, primarily due

to increases in catastrophe losses and higher expenses partially offset by average earned premiums increasing faster

than loss costs. Other personal lines underwriting income decreased $284 million to an underwriting loss of

$189 million in 2011 from underwriting income of $95 million in 2010, primarily due to increases in catastrophe losses,

unfavorable reserve reestimates and higher expenses. Standard auto underwriting income decreased $131 million to

$561 million in 2011 from $692 million in 2010, primarily due to increases in catastrophe losses and higher expenses,

partially offset by favorable reserve reestimates.

Catastrophe losses were $2.35 billion in 2012 compared to $3.82 billion in 2011 and $2.21 billion in 2010.

$1.12 billion of the 2012 catastrophe losses related to Sandy, comprising approximately 179,000 expected claims of

which approximately 170,000 claims have been reported. Through February 4, 2013, approximately 98% of the

property and auto claim counts related to Sandy are closed and approximately 95% of our expected net losses have

been paid. We expect substantially all of our remaining estimated net losses related to Sandy to be paid during 2013.

2012 catastrophe losses also include $8 million of accelerated and reinstatement catastrophe reinsurance premiums

incurred as a result of Sandy.

We define a ‘‘catastrophe’’ as an event that produces pre-tax losses before reinsurance in excess of $1 million and

involves multiple first party policyholders, or an event that produces a number of claims in excess of a preset, per-event

threshold of average claims in a specific area, occurring within a certain amount of time following the event.

36