Allstate 2013 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2013 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

concentrated among fewer companies. In addition, some companies have segregated asbestos, environmental, and

other discontinued lines exposures into separate legal entities with dedicated capital. Regulatory bodies in certain cases

have supported these actions. We are unable to determine the impact, if any, that these developments will have on the

collectability of reinsurance recoverables in the future.

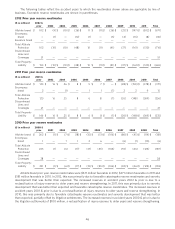

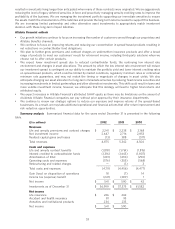

The effects of reinsurance ceded on our property-liability premiums earned and claims and claims expense for the

years ended December 31 are summarized in the following table.

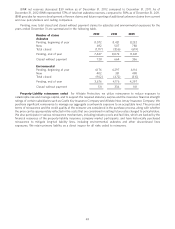

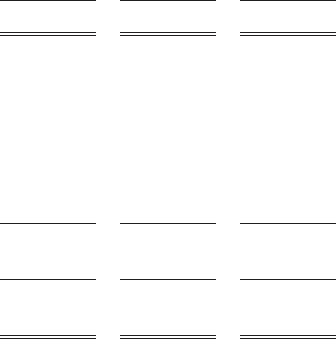

($ in millions) 2012 2011 2010

Ceded property-liability premiums earned $ 1,090 $ 1,098 $ 1,092

Ceded property-liability claims and claims

expense

Industry pool and facilities

MCCA $ 962 $ 509 $ 142

National Flood Insurance Program 758 196 50

FHCF — 8 10

Other 70 84 64

Subtotal industry pools and facilities 1,790 797 266

Other 261 130 5

Ceded property-liability claims and claims

expense $ 2,051 $ 927 $ 271

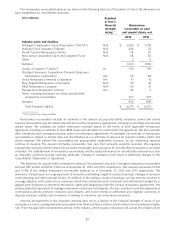

In 2012, ceded property-liability premiums earned decreased $8 million compared to 2011, primarily due to

decreased premiums in our catastrophe reinsurance program. In 2011, ceded property-liability premiums earned

increased $6 million compared to 2010 year, primarily due to higher premium rates and an increase in policies written

for the National Flood Insurance Program.

Ceded property-liability claims and claims expense increased in 2012 primarily due to amounts ceded to the

National Flood Insurance Program related to Sandy, reserve increases in the MCCA program, and amounts ceded under

our catastrophe reinsurance program related to Sandy. The reserve increases in the MCCA program are attributable to

an increased recognition of longer term paid loss trends. The paid loss trends are rising due to increased costs in medical

and attendant care and increased longevity of claimants. Ceded property-liability claims and claims expense increased

in 2011 primarily due to reserve increases in the MCCA program and an increase in claim activity on the National Flood

Insurance Program due to multiple flooding events throughout the year.

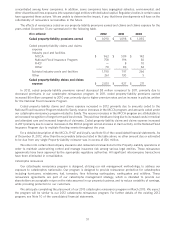

For a detailed description of the MCCA, FHCF and Lloyd’s, see Note 10 of the consolidated financial statements. As

of December 31, 2012, other than the recoverable balances listed in the table above, no other amount due or estimated

to be due from any single Property-Liability reinsurer was in excess of $26 million.

We enter into certain intercompany insurance and reinsurance transactions for the Property-Liability operations in

order to maintain underwriting control and manage insurance risk among various legal entities. These reinsurance

agreements have been approved by the appropriate regulatory authorities. All significant intercompany transactions

have been eliminated in consolidation.

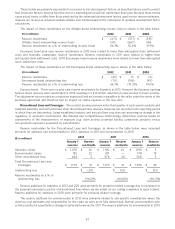

Catastrophe reinsurance

Our catastrophe reinsurance program is designed, utilizing our risk management methodology, to address our

exposure to catastrophes nationwide. Our program is designed to provide reinsurance protection for catastrophes

including hurricanes, windstorms, hail, tornados, fires following earthquakes, earthquakes and wildfires. These

reinsurance agreements are part of our catastrophe management strategy, which is intended to provide our

shareholders an acceptable return on the risks assumed in our property business, and to reduce variability of earnings,

while providing protection to our customers.

We anticipate completing the placement of our 2013 catastrophe reinsurance program in March 2013. We expect

the program will be similar to our 2012 catastrophe reinsurance program. For further details of the existing 2012

program, see Note 10 of the consolidated financial statements.

51