Allstate 2013 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2013 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

be completed by December 31, 2013, and as of December 31, 2012, had $984 million remaining. This program is

expected to be funded by issuing a like amount of subordinated debentures (half of which were issued in January 2013).

In February 2013, an additional $1 billion share repurchase program was authorized and is expected to be completed by

March 31, 2014. Our repurchase programs may utilize an accelerated repurchase program. During 2012, we repurchased

26.7 million common shares for $910 million.

Since 1995, we have acquired 523 million shares of our common stock at a cost of $21.13 billion, primarily as part of

various stock repurchase programs. We have reissued 104 million shares since 1995, primarily associated with our

equity incentive plans, the 1999 acquisition of American Heritage Life Investment Corporation and the 2001 redemption

of certain mandatorily redeemable preferred securities. Since 1995, total shares outstanding has decreased by

417 million shares or 46.5%, primarily due to our repurchase programs.

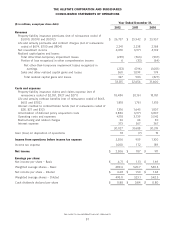

Financial ratings and strength The following table summarizes our senior long-term debt, commercial paper and

insurance financial strength ratings as of December 31, 2012.

Standard &

Moody’s Poor’s A.M. Best

The Allstate Corporation (senior long-term debt) A3 A- a-

The Allstate Corporation (commercial paper) P-2 A-2 AMB-1

Allstate Insurance Company (insurance financial strength) Aa3 AA- A+

Allstate Life Insurance Company (insurance financial strength) A1 A+ A+

Our ratings are influenced by many factors including our operating and financial performance, asset quality,

liquidity, asset/liability management, overall portfolio mix, financial leverage (i.e., debt), exposure to risks such as

catastrophes and the current level of operating leverage.

On January 31, 2013, A.M. Best affirmed The Allstate Corporation’s debt and commercial paper ratings of a- and

AMB-1, respectively, and our insurance entities financial strength ratings of A+ for AIC and Allstate Life Insurance

Company (‘‘ALIC’’). The outlook for AIC and ALIC remained stable. In April 2012, S&P affirmed The Allstate

Corporation’s debt and commercial paper ratings of A- and A-2, respectively, AIC’s financial strength ratings of AA- and

ALIC’s financial strength rating of A+. The outlook for all S&P ratings remained negative. There were no changes to our

debt, commercial paper and insurance financial strength ratings from Moody’s during 2012. The outlook for all of our

Moody’s ratings is negative. In the future, if our financial position is less than rating agency expectations including those

related to capitalization at the parent company, AIC or ALIC, we could be exposed to a downgrade in our ratings of one

notch or more which we do not view as being material to our business model or strategies.

We have distinct and separately capitalized groups of subsidiaries licensed to sell property and casualty insurance

in New Jersey and Florida that maintain separate group ratings. The ratings of these groups are influenced by the risks

that relate specifically to each group. Many mortgage companies require property owners to have insurance from an

insurance carrier with a secure financial strength rating from an accredited rating agency. In February 2013, A.M. Best

affirmed the Allstate New Jersey Insurance Company, which writes auto and homeowners insurance, rating of A-. The

outlook for this rating is stable. Allstate New Jersey Insurance Company also has a Financial Stability Rating姞 of A’’ from

Demotech, which was affirmed on November 28, 2012. On September 19, 2012, A.M. Best affirmed the Castle Key

Insurance Company, which underwrites personal lines property insurance in Florida, rating of B-. The outlook for the

rating is negative. Castle Key Insurance Company also has a Financial Stability Rating姞 of A’ from Demotech, which was

affirmed on November 28, 2012.

ALIC, AIC and The Allstate Corporation are party to the Amended and Restated Intercompany Liquidity Agreement

(‘‘Liquidity Agreement’’) which allows for short-term advances of funds to be made between parties for liquidity and

other general corporate purposes. The Liquidity Agreement does not establish a commitment to advance funds on the

part of any party. ALIC and AIC each serve as a lender and borrower and the Corporation serves only as a lender. AIC

also has a capital support agreement with ALIC. Under the capital support agreement, AIC is committed to provide

capital to ALIC to maintain an adequate capital level. The maximum amount of potential funding under each of these

agreements is $1.00 billion.

In addition to the Liquidity Agreement, the Corporation also has an intercompany loan agreement with certain of its

subsidiaries, which include, but are not limited to, AIC and ALIC. The amount of intercompany loans available to the

Corporation’s subsidiaries is at the discretion of the Corporation. The maximum amount of loans the Corporation will

have outstanding to all its eligible subsidiaries at any given point in time is limited to $1.00 billion. The Corporation may

use commercial paper borrowings, bank lines of credit and securities lending to fund intercompany borrowings.

79