Allstate 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Allstate Corporation Notice of 2013

Annual Meeting, Proxy Statement and

2012 Annual Report

Vision. Strategy. Results.

Table of contents

-

Page 1

Vision. Strategy. Results. The Allstate Corporation Notice of 2013 Annual Meeting, Proxy Statement and 2012 Annual Report -

Page 2

... executing a consumer-focused strategy and excellence in governance and social responsibility. Shareholders beneï¬ted from this success with higher dividends, share repurchases and an increased share price. Overall, it was a very strong year for Allstate. FINANCIAL HIGHLIGHTS Revenues ($ billions... -

Page 3

... to grow insurance premiums. We exceeded this goal through the acquisition of Esurance; policy growth in Encompass, Allstate Canada and Emerging Businesses; and higher average auto and homeowners premiums in the Allstate brand. Overall items in force in the Allstate agency customer segment declined... -

Page 4

... ADVICE AND ASSISTANCE Encompass products are sold through independent agencies that serve brand-neutral customers who prefer personal service and support from an independent agent. Answer Financial, an independent personal lines insurance agency, serves self-directed, brand-neutral consumers who... -

Page 5

...The pay-for-use Good Hands® Roadside Assistance service has exceeded 850,000 members. · Our Claim Satisfaction GuaranteeTM promises a return of premium if an Allstate brand standard auto insurance customer is dissatisï¬ed with the claims experience. · Allstate House and Home® insurance provides... -

Page 6

... dreams through products and services designed to protect them from life's uncertainties and to prepare them for the future. STRATEGIC VISION • Put the customer at the center of all of our work and provide the products and services they need in ways they want them. • Take an enterprise view of... -

Page 7

... are limited to five public company boards, in addition to Allstate in each case. This is in line with current corporate governance best practices. Our full policy is stated in our Corporate Governance Guidelines. • Director experience. We reviewed concerns about service by Allstate directors on... -

Page 8

... tenure and experience as Allstate's CEO, and an independent compensation consultant's review of market and industry data, we increased Mr. Wilson's incentive compensation targets. The changes place Mr. Wilson's total target direct compensation opportunity at approximately the 50th percentile... -

Page 9

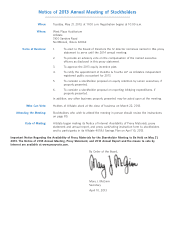

... CORPORATION 2775 Sanders Road Northbrook, Illinois 60062-6127 April 10, 2013 21MAR201300512470 Notice of 2013 Annual Meeting and Proxy Statement Dear Stockholder: Allstate's 2013 annual meeting of stockholders will be held on Tuesday, May 21, 2013, at 11:00 a.m. (CDT) at our offices in Northbrook... -

Page 10

-

Page 11

...2014 annual meeting. To provide an advisory vote on the compensation of the named executive officers as disclosed in this proxy statement. To approve the 2013 equity incentive plan. To ratify the appointment of Deloitte & Touche LLP as Allstate's independent registered public accountant for 2013. To... -

Page 12

...the annual meeting in person Proxy Solicitation ...75 78 79 79 80 80 Appendices Appendix A - Categorical Standards of Independence ...Appendix B - The Allstate Corporation 2013 Equity Incentive Plan ...Appendix C - Policy regarding Pre-Approval of Independent Registered Public Accountant's Services... -

Page 13

...certain legal requirements. A representative of American Election Services, LLC will act as the inspector of election and will count the votes. The representative is independent of Allstate and its directors, officers, and employees. If you write a comment on your proxy card, voting instruction form... -

Page 14

...of nominees bringing the full complement of director skills to serve Allstate. Executive compensation program designed to align pay with performance. Plan provides a reasonable approach to equity incentive compensation awards. Auditor remains independent and fees continue to be reasonable. Proposal... -

Page 15

...their perspectives. Annual report on corporate involvement with public policy. The report provides transparency on Allstate initiatives to promote sound public policy in areas such as teen safe driving and can be found at www.allstate.com/publicpolicyreport. Independent Board. Our Board is comprised... -

Page 16

... to the Board whether the audited financial statements should be included in Allstate's annual report on Form 10-K. • Reviews Allstate's accounting principles and practices affecting the financial statements. • Discusses risk assessment and risk management processes with management. • Oversees... -

Page 17

... or any business entity affiliated with that candidate. • Based on these results, the committee decides which candidates warrant further consideration. • Certain directors are designated to meet with each candidate. At the same time, both the search firm and management conduct additional... -

Page 18

... Allstate Board. In addition to this fundamental expertise, the Board and committee seek directors with corporate operating experience, relevant industry experience, financial expertise, and/or compensation and succession experience. The Board and committee also look for a balance of retired former... -

Page 19

...to the Office of the Secretary, The Allstate Corporation, 2775 Sanders Road, Suite A2W, Northbrook, Illinois 60062-6127. A stockholder also may directly nominate someone for election as a director at a stockholders' meeting. Under our bylaws, a stockholder may nominate a candidate at the 2014 annual... -

Page 20

...the Board effective March 1, 2013. The terms of all12JAN201218342287 The Board recommends that you vote FOR all directors expire at the annual meeting in May 2013. The director nominees listed in this proxy statement. Board expects all nominees named in this proxy statement The Allstate Corporation... -

Page 21

... Parcel Service, Inc. • Home Depot 2007-present 2007-present CORE CAPABILITIES ߜ Corporate governance - director and former chairman and CEO. ߜ Stockholder advocacy - experience managing risk. ߜ Leadership - expertise in leadership development and succession planning. ߜ Strategic oversight... -

Page 22

...e G´ en´ erale Asset Management, S.A. and The TCW Group, Inc. 21MAR201300454246 Age 53 Allstate Board Service • Director since 2006 • Audit committee member • Compensation and succession committee member QUALIFICATIONS Other Public Board Service: • The Kroger Company 1999-present CORE... -

Page 23

... platforms for long-term value creation. ߜ Leadership - senior leadership positions at a large public company operating in the highly competitive drugstore industry. ߜ Strategic oversight - experience leading a geographically distributed, consumer-focused service business. ADDITIONAL CAPABILITIES... -

Page 24

... and promotional services, since 2010. • Former Chairman and CEO of McDonald's Corporation. 21MAR201300473140 Age 70 Allstate Board Service • Director since 2002 • Audit committee member • Compensation and succession committee member QUALIFICATIONS Other Public Board Service: • Hasbro... -

Page 25

... board service. ߜ Stockholder advocacy - lead director at C.R. Bard. ߜ Leadership - former Chairman and CEO of a global public company. ߜ Strategic oversight - extensive experience in global business development. ADDITIONAL CAPABILITIES Corporate Operating Experience • CEO of a publicly traded... -

Page 26

... phone recycling company, since 2009. • Former Executive Chairman and CEO of Last Mile Connections, Inc., a telecommunications company. • Former President and Chief Operating Officer of Sprint Corporation. Allstate Board Service • Director since 1999 • Audit committee member • Compensation... -

Page 27

... 57 Allstate Board Service • Director since 2010 • Compensation and succession committee member • Nominating and governance committee member QUALIFICATIONS Other Public Board Service: • None CORE CAPABILITIES ߜ Corporate governance - executive recruitment and talent management expertise... -

Page 28

... large publicly traded company. • Lead director and chair of compensation committee of Baker Hughes Incorporated. Compensation and Succession Experience • Extensive experience in executive compensation, succession planning, and leadership development. • Former chair of Allstate's compensation... -

Page 29

... CEO of Exelon Corporation. • Former director of Sunoco, Inc. and Exelon Corporation. 21MAR201300502053 Age 67 Allstate Board Service • Director since 2012 • Compensation and succession committee member • Nominating and governance committee member QUALIFICATIONS Other Public Board Service... -

Page 30

...CEO. ߜ Strategic oversight - skills to drive innovation. ADDITIONAL CAPABILITIES Corporate Operating Experience • Leadership of a start-up company provides insight into Allstate's initiatives to drive change and innovation. • Managed several large consumer focused businesses with leading brands... -

Page 31

... Other Public Board Service: • Blue Nile, Inc. 1999-present CORE CAPABILITIES ߜ Corporate governance - director and former chairman and CEO. ߜ Stockholder advocacy - experience with long-term growth strategies. ߜ Leadership - former senior executive of major public companies. ߜ Strategic... -

Page 32

... strategy and operating priorities to achieve long-term stockholder value. • Creation and implementation of Allstate's risk and return optimization program, allowing Allstate to withstand the recent financial market crisis and adapt to increases in severe weather and hurricanes. • Industry... -

Page 33

... long-term value creation. In addition, the Board regularly reviews strategy; business plans; investment portfolios; liquidity and use of capital; and legal, regulatory, and legislative issues. Allstate's risk management objectives and processes are reviewed quarterly by the audit committee... -

Page 34

..., and PROXY STATEMENT interaction with committee members. The committee approved a new independent executive compensation consultant with services to begin in 2013. Management Participation in Committee Meetings Audit Committee. Our CEO, chief financial officer, chief risk officer, general counsel... -

Page 35

Corporate Governance Practices • Our chief financial officer discusses financial results relevant to incentive compensation, other financial measures, or accounting rules. The general counsel is available at meetings to provide input on the legal and regulatory environment. The secretary attends ... -

Page 36

... STATEMENT Proposal 2 Advisory Vote to Approve the Executive Compensation of the Named Executives We will conduct a say-on-pay vote every year at the annual meeting. A say-on-pay vote is required by section 14A of the Securities Exchange Act. Although the say-on-pay vote is non-binding, the Board... -

Page 37

...P. Greffin - Executive Vice President and Chief Investment Officer of Allstate Insurance Company • Suren K. Gupta - Executive Vice President - Technology & Operations of Allstate Insurance Company • Matthew E. Winter - President, Allstate Auto, Home, and Agencies Compensation Program Changes for... -

Page 38

...'' employees with no employment agreements. ߜ ߜ Elements of 2012 Executive Compensation Program ߜ ߜ ߜ PROXY STATEMENT Policy on insider trading that prohibits hedging of Allstate securities. Moderate change-in-control benefits. Change-in-control severance benefits are three times target cash... -

Page 39

...and reward executives for performance on key strategic, operational, and financial measures during the year. Target based on job scope and market data. Actual awards based on company performance on three measures: • Adjusted operating income • Total premiums • Net investment income Individual... -

Page 40

...PROXY STATEMENT Our compensation program is designed to deliver compensation in accordance with corporate, business unit, and individual performance. A large percentage of each named executive's target total direct compensation is ''pay at risk'' through long-term equity awards and annual incentive... -

Page 41

... executives. The Committee benchmarked our executive compensation program design, executive pay, and performance against a group of peer insurance companies that are publicly traded and comparable to Allstate in product offerings, market segment, annual revenues, premiums, assets, and market value... -

Page 42

... target annual incentive award opportunity for each named executive was determined based on market data pay levels at peer insurance PROXY STATEMENT companies and our benchmark target for total direct compensation at the 50th percentile. Long-term Equity Incentive Awards We grant equity awards to... -

Page 43

... through Allstate agencies with a 9.3% increase in issued life insurance policies written in 2012. Allstate Benefits, Allstate Financial's voluntary employee benefits unit, had a successful annual enrollment season, achieving a 6.5% increase in new business written for the year. Allstate Investments... -

Page 44

... on annual incentive award decisions can be found in the Compensation Decisions for 2012 section below. We paid the cash incentive awards in March 2013. Performance Stock Awards Beginning in 2012, we granted one-half of our long-term equity incentive awards to senior executives in the form of... -

Page 45

...and other items that management cannot influence. • Measures performance in a way that is tracked and understood by investors. • Correlates to changes in long-term stockholder value. PROXY STATEMENT Performance is measured in three separate one-year periods. The actual number of PSAs earned for... -

Page 46

... competitive compensation data provided by its independent compensation consultant and company performance data. The Committee reviews the various elements of the CEO's compensation in the context of the total compensation package, including salary, annual cash incentive awards, and long-term... -

Page 47

... award opportunity. • Target Total Direct Compensation. The Committee continues to review Mr. Wilson's target total direct compensation against the benchmark guideline of the 50th percentile of our peers. Mr. Wilson's salary, annual cash incentive target of 300% of salary, and long-term equity... -

Page 48

...scope and responsibilities. Mr. Civgin's target equity incentive award opportunity of 300% of salary did not change. • Annual Incentive Award. Under Mr. Civgin's leadership, Allstate Financial continued its strategy to grow underwritten products sold through Allstate agencies and Allstate Benefits... -

Page 49

... recognition of increased job scope and responsibilities. Mr. Winter's target equity incentive award opportunity of 350% of salary did not change. • Annual Incentive Award. Under Mr. Winter's leadership, Allstate Auto, Home and Agencies continued to deliver on its strategy to offer unique products... -

Page 50

... changes in the terms or conditions of employment, including a material reduction in base compensation, a material change in authority, duties, or responsibilities, or a material change in job location) within two years following a change-in-control. In addition, long-term equity incentive awards... -

Page 51

... shares owned personally • Shares held in the Allstate 401(k) Savings Plan • Restricted stock units We also have a policy on insider trading that prohibits all officers, directors, and employees from engaging in transactions in securities issued by Allstate or any of its subsidiaries that might... -

Page 52

... and Chief Investment Officer) Suren K. Gupta (Executive Vice President-Technology & Operations) Matthew E. Winter (President, Allstate Auto, Home, and Agencies) Year 2012 2011 2010 Salary ($) 1,100,000 1,100,000 1,093,846 Bonus ($) - - - Stock Awards ($)(2) Option Awards ($)(3) Non-Equity... -

Page 53

... from $45,847 of annual pay credit and one year of interest with the remaining increase due to changes in the discount and interest rates. ALL OTHER COMPENSATION FOR 2012 - SUPPLEMENTAL TABLE (In dollars) The following table describes the incremental cost of other benefits provided in 2012 that are... -

Page 54

... to their accounts as employer matching contributions. (3) ''Other'' consists of premiums for group life insurance and personal benefits and perquisites consisting of mobile phones, tax preparation services, financial planning, ground transportation, supplemental long-term disability coverage, and... -

Page 55

... 3 to the Summary Compensation Table on page 40. Stock options Stock options represent an opportunity to buy shares of our stock at a fixed exercise price at a future date. We use them to align the interests of our executives with long-term stockholder value, as the stock price must appreciate from... -

Page 56

... the outstanding equity awards of the named executives as of December 31, 2012. OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2012 Option Awards(1) Stock Awards Equity Incentive Equity Plan Incentive Awards: Plan Number of Awards: Unearned Market or Shares, Payout Value Market Value Units, or... -

Page 57

Executive Compensation Tables Option Awards(1) PROXY STATEMENT Stock Awards Equity Incentive Equity Plan Incentive Awards: Plan Number of Awards: Unearned Market or Shares, Payout Value Market Value Units, or of Unearned of Shares or Other Shares, Units, Units of Stock Rights or Other That Have ... -

Page 58

... two different defined benefit pension plans. The following table summarizes the named executives' pension benefits, which are calculated in the same manner as the change in pension value reflected in the Summary Compensation Table. PENSION BENEFITS Number of Years Credited Service (#) 19.8 19.8 24... -

Page 59

...the Internal Revenue Code. (3) Mr. Wilson's prior employment with another former Sears, Roebuck and Co. subsidiary is counted in determining his 26.5 years of vesting service under the Allstate Retirement Plan, but is not included in the calculation of credited service used for benefit determination... -

Page 60

...would reach Social Security retirement age) multiplied by credited service after 1988 (limited to 28 years of credited service) For participants eligible to earn cash balance benefits, pay credits are added to the cash balance account on a Vesting Service Less than 1 year PROXY STATEMENT quarterly... -

Page 61

... annuity options. The lump sum under the final average pay benefit is calculated in accordance with the applicable interest rate and mortality as required under the Internal Revenue Code. The lump sum payment under the cash balance benefit is generally equal to a participant's cash balance account... -

Page 62

...Pre 409A balances, except the earliest distribution date is six months following separation from service. Upon proof of unforeseen emergency, a plan participant may be allowed to access certain funds in a deferred compensation account earlier than the dates specified above. The Allstate Corporation... -

Page 63

... long term disability plan (1) Named executives who receive an equity award under the 2009 Equity Incentive Plan or an annual cash incentive award under the Annual Executive Incentive Plan after May 19, 2009, are subject to a non-solicitation covenant while they are employed and for the one-year... -

Page 64

...work, or reduction in force. (6) Retirement for purposes of the Annual Executive Incentive Plan is defined as voluntary termination on or after the date the named executive attains age 55 with at least 20 years of service. (7) This description is the treatment of equity awards granted after February... -

Page 65

...management in a widely held company the size of Allstate. Effective upon a change-in-control, the named executives become subject to covenants prohibiting solicitation of employees, customers, and suppliers at any time until one year after termination of employment. If a named executive incurs legal... -

Page 66

.... (2) As of December 31, 2012, Messrs. Shebik and Wilson are the only named executives eligible to retire in accordance with Allstate's policy and the terms of its equity incentive compensation and benefit plans. (3) The values in this change-in-control row represent amounts paid if both the... -

Page 67

... during the period the named executive is eligible for continuation coverage under applicable law. The amount shown reflects Allstate's costs for these benefits or programs assuming an 18-month continuation period. The value of outplacement services is $40,000 for Mr. Wilson and $20,000 for each... -

Page 68

...which our executives have little influence or control, such as financial market conditions. The compensation and succession committee reviews and assesses the measures used each year to ensure alignment with incentive compensation objectives. PROXY STATEMENT Annual Cash Incentive Award Performance... -

Page 69

... annual report on Form 10-K. Allstate Financial premiums and contract charges is equal to life and annuity premiums and contract charges reported in the consolidated statement of operations adjusted to exclude premiums and contract charges related to structured settlement annuities. Net Investment... -

Page 70

...of Board service, or upon death or disability if earlier. Non-employee directors do not receive stock options as part of their compensation as a result of a policy change on June 1, 2009. The aggregate number of options outstanding as of December 31, 2012, under prior option awards for each director... -

Page 71

... ownership guidelines for our non-employee directors. Within five years of joining the Board, each director is expected to accumulate an ownership position in Allstate securities equal to five times the value of the annual cash retainer paid for board service. Every director has met the ownership... -

Page 72

... and by all executive officers and directors of Allstate as a group. Shares reported as beneficially owned include shares held indirectly through the Allstate 401(k) Savings Plan and other shares held indirectly, as well as shares subject to stock options exercisable on or before April 30, 2013, and... -

Page 73

...'s common stock to file reports of securities ownership and changes in such ownership with the SEC. Based solely upon a review of copies of such reports, or written representations that all such reports were timely filed, Allstate believes that each of its executive officers, directors, and greater... -

Page 74

... total compensation of our officers and other employees. The Plan supports this overall compensation strategy by providing a means for granting equity awards to attract and retain talent. The material change to the Plan approved by the Committee and the Board is an increase in the number of shares... -

Page 75

... number of equity awards granted under the Plan in the past two years. In 2011 and 2012, we used 6,942,708 and 8,183,435, respectively, of the shares authorized under the Plan to grant equity awards. Further, the Committee and the Board considered our three-year average burn rate of PROXY STATEMENT... -

Page 76

... under the Plan to determine eligibility and types and terms of awards and to interpret and administer the Plan. In 2008 the Board delegated to the equity award committee, consisting of the person who at any time holds the office of CEO provided such person is an Allstate director, the authority... -

Page 77

... the cancellation of options in exchange for options with a lower exercise price or for cash or other securities (other than in connection with certain corporate transactions involving Allstate or a change in control). PROXY STATEMENT Stock Appreciation Rights The Plan permits the Committee... -

Page 78

... under the Plan. Section 162(m); Performance Goals Internal Revenue Code section 162(m) generally limits income tax deductions of publicly-traded companies to the extent total compensation (including base salary, annual bonus, stock option exercises) for certain executive officers exceeds $1 million... -

Page 79

...-based compensation'' under Internal Revenue Code section 162(m), the Plan also contains the following per-participant limitations on awards granted under the Plan: • The total number of shares of stock with respect to which options or stock appreciation rights may be granted in any calendar year... -

Page 80

... in awards for accelerated vesting and other rights in the event of a change of control. Amendment, Modification, and Termination of the Plan The Board may amend, alter, suspend, or terminate the Plan at any time and in any respect, provided that no amendment will (1) increase the total number of... -

Page 81

... gain recognized by the employee. Use of Common Stock to Pay Option Exercise Price of Nonqualified Option If an employee delivers previously acquired common stock in payment of all or part of the option exercise price of a nonqualified stock option, there will be no recognition of taxable income or... -

Page 82

... the Plan, depending in part on the specific terms and conditions of such awards, may be considered ''non-qualified deferred compensation'' subject to the requirements of Internal Revenue Code section 409A, which regulates deferred compensation arrangements. If the terms of such awards do not meet... -

Page 83

... Plan Name and Position/Group Named Executive Officers Thomas J. Wilson (Chairman, President, and Chief Executive Officer) Steven E. Shebik (Executive Vice President and Chief Financial Officer) Don Civgin (President and Chief Executive Officer, Allstate Financial) PROXY STATEMENT Number of Options... -

Page 84

... the 2009 Equity Incentive Plan; and 210,147 shares that may be issued in the form of stock options, unrestricted stock, restricted stock, restricted stock units, and stock in lieu of cash compensation under the 2006 Equity Compensation Plan for Non-Employee Directors. The Allstate Corporation | 72 -

Page 85

... Esurance acquisition-related audit fees with the White Mountains Insurance Group. (2) Audit-related fees are for professional services, such as accounting consultations on new accounting standards, and audits and other attest services for non-consolidated entities (e.g., employee benefit plans... -

Page 86

...in its judgment, the committee recommended to the Board of Directors that the audited financial statements be included in Allstate's annual report on Form 10-K for the fiscal year ended December 31, 2012, for filing with the Securities and Exchange Commission, and furnished to stockholders with this... -

Page 87

... our Company's existing contractual obligations or the terms of any pay or benefit plan currently in effect. A Conference Board Task Force report on executive pay stated that hold-to-retirement requirements give executives ''an ever-growing incentive to focus on long-term stock price performance... -

Page 88

...take approximately 11 years for an executive to reach the same level of stock holdings PROXY STATEMENT through equity awards granted by Allstate, assuming that the performance stock awards payout at target levels. • Existing vesting schedules promote executives' focus on long-term performance. In... -

Page 89

...in the use of staff time and corporate funds to influence legislation and regulation, both directly and indirectly. We believe such disclosure is in shareholders' best interests. Absent a system of accountability, company assets could be used for objectives contrary to Allstate's long-term interests... -

Page 90

..., customers, and employees, as well as Allstate agency owners. • Allstate understands that transparency and accountability about corporate lobbying is important to you. That's why we provide figures related to trade association membership and lobbying expenditures in our report. • Publicly... -

Page 91

... to your plan account by voting in person at the meeting. You must instruct The Northern Trust Company, as trustee for the plan, how to vote your shares. Proxy Statement and Annual Report Delivery Allstate has adopted the ''householding'' procedure approved by the Securities and Exchange Commission... -

Page 92

..., Jersey City, NJ 07310 has been retained to assist in the solicitation of proxies for a fee not to exceed $16,500 plus expenses. Allstate will pay the cost of all proxy solicitation. By order of the Board, 16MAR200612392402 Mary J. McGinn Secretary Dated: April 10, 2013 The Allstate Corporation... -

Page 93

...form insurance policy or other financial product offered by the Allstate Group in the ordinary course of business. An Allstate director's relationship with another company that participates in a transaction with the Allstate Group (i) where the rates or charges involved are determined by competitive... -

Page 94

(This page has been left blank intentionally.) -

Page 95

... 21, 2012. On February 18, 2013, the Plan was amended, restated, and renamed The Allstate Corporation 2013 Equity Incentive Plan effective upon approval by stockholders at the Company's 2013 annual stockholders meeting, and shall thereafter remain in effect as provided in Section 1.3 herein. If the... -

Page 96

... STATEMENT Code means the Internal Revenue Code of 1986, as amended from time to time, or any successor code Committee means the committee, as specified in Article 3, appointed by the Board to administer the Plan. 2.9 Company has the meaning provided in Section 1.1 herein. 2.10 Covered Employee... -

Page 97

..., cash flow, return on equity, return on capital, return on assets, values of assets, market share, net earnings, earnings before interest, operating ratios, stock price, customer satisfaction, customer retention, customer loyalty, strategic business criteria based on meeting specified revenue goals... -

Page 98

... or payment of cash shall be made upon a Termination of Employment with respect to any Award that constitutes deferred compensation for purposes of Section 409A unless the Termination of Employment constitutes a ''separation from service'' as that term is used in Section 409A(a)(2)(A)(i) of the Code... -

Page 99

... would comply with all applicable laws (including, without limitation, the Code, the Securities Act, and the Exchange Act) and applicable requirements of any securities exchange or similar entity; provided, however, that if the Company cannot deliver any Stock or benefits under the Plan due to such... -

Page 100

... incentive stock option for purposes of Section 422 of the Code. Notwithstanding any provision of the Plan to the contrary, except in connection with a corporate transaction involving the Company (including, without limitation, a Change in Control as defined in the applicable Award Agreement or the... -

Page 101

... a change of control. The Option Award Agreement shall also specify whether the Option is intended to be an ISO or NQSO. The Option Exercise Price shall not be less than 100% of the Fair Market Value of the Stock on the date of grant. No Dividend Equivalents shall be provided with respect to Options... -

Page 102

... using broker-assisted cashless exercise on the business day immediately preceding the expiration date if: (i) (ii) the Fair Market Value of a share of Stock exceeds the Option Exercise Price in the applicable Option Award Agreement on that business day, and the exercise would result in the payment... -

Page 103

... determine, including but not limited to special provisions relating to a change of control. No Dividend Equivalents shall be provided with respect to SARs. 7.3 Exercise and Payment of SARs. Tandem SARs may be exercised for all or part of the Stock subject to the related Option upon the surrender of... -

Page 104

... behalf of the Participant on the business day immediately preceding the expiration date if: (i) (ii) the Fair Market Value of a share of Stock exceeds the Base Value in the applicable Award Agreement on that business day, and the exercise would result in the payment to Participant of at least $.01... -

Page 105

... the number of Performance Units and/or shares of Performance Stock granted, the initial value (if applicable), the Performance Period, the Performance Goals, and such other provisions as the Committee shall determine, including but not limited to special provisions relating to a change of control... -

Page 106

... a future Award. 12.3 Limitation of Implied Rights. Neither a Participant nor any other Person shall, by reason of the Plan, acquire any right in or title to any assets, funds or property of the Company or any Subsidiary whatsoever, including, without limitation, any specific funds, assets or other... -

Page 107

... such terms of the Foreign Equity Incentive Plans shall control. Article 15. Amendment, Modification, and Termination The Board may, at any time and from time to time, alter, amend, suspend, or terminate the Plan in whole or in part, provided that no amendment shall be made which shall increase the... -

Page 108

... multiplied by the excess of the Fair Market Value per share of Stock at the time of such sale or disposition over the Option Exercise Price or Base Value, as applicable. The return of Proceeds is in addition to and separate from any other relief available to the Company or any other actions as may... -

Page 109

..., own or control an interest in, or act as principal, director, officer, or employee of, or consultant to, any firm or company that is a Competitive Business. ''Competitive Business'' is defined as a business that designs, develops, markets, or sells a product, product line, or service that competes... -

Page 110

... of any Award under the Plan may not be made at the time contemplated by the terms of the Plan or the applicable Award Agreement, as the case may be, without causing the Participant holding such Award to be subject to taxation under Section 409A, the Company will make such payment on the first... -

Page 111

... sets forth guidelines and procedures to be followed by this Committee when approving services to be provided by the Independent Registered Public Accountant. Policy Statement Audit Services, Audit-Related Services, Tax Services, Other Services, and Prohibited Services are described in the attached... -

Page 112

... relating to accounting standards, financial reporting, and disclosure issues Due diligence assistance pertaining to potential acquisitions, dispositions, mergers, and securities offerings Financial statement audits and attest services for non-consolidated entities including employee benefit... -

Page 113

... Wilson also is a director of The Allstate Corporation. President Emerging Businesses. President and Chief Executive Officer Allstate Financial. Executive Vice President and Chief Administrative Officer of AIC (Human Resources). Executive Vice President and Chief Investment Officer of AIC. Executive... -

Page 114

... believe that the measure provides investors with a valuable measure of the company's ongoing performance because it reveals trends in our insurance and financial services business that may be obscured by the net effect of realized capital gains and losses, valuation changes on embedded derivatives... -

Page 115

... assets primarily relate to the acquisition purchase price and are not indicative of our underlying insurance business results or trends. We believe it is useful for investors to evaluate these components separately and in the aggregate when reviewing our underwriting performance. We also provide... -

Page 116

... Financial Data ...Management's Discussion and Analysis Overview ...2012 Highlights ...Consolidated Net Income ...Application of Critical Accounting Estimates ...Property-Liability 2012 Highlights ...Property-Liability Operations ...Allstate Protection Segment ...Discontinued Lines and Coverages... -

Page 117

... earthquakes and also utilize detailed information about our in-force business. While we use this information in connection with our pricing and risk management activities, there are limitations with respect to its usefulness in predicting losses in any reporting period as actual catastrophic events... -

Page 118

... for cross-selling opportunities that cannot be fully replaced by our brokering arrangement to allow our agents to write property products with other carriers, new business growth in our auto lines could be lower than expected. A regulatory environment that limits rate increases and requires... -

Page 119

...nature and life of the product and is subject to variability as actual results may differ from pricing assumptions. Additionally, many of our products have fixed or guaranteed terms that limit our ability to increase revenues or reduce benefits, including credited interest, once the product has been... -

Page 120

... on many contracts and may not match the timing or magnitude of changes in investment yields. Decreases in the interest crediting rates offered on products in the Allstate Financial segment could make those products less attractive, leading to lower sales and/or changes in the level of policy loans... -

Page 121

as a result of market conditions or otherwise, this could require us to increase prices, reduce our sales of term or universal life products, and/or result in a return on equity below priced levels. Risks Relating to Investments We are subject to market risk and declines in credit quality which may ... -

Page 122

... in shareholders' equity. Changing market conditions could materially affect the determination of the fair value of securities and unrealized net capital gains and losses could vary significantly. Risks Relating to the Insurance Industry Our future growth and profitability are dependent in part on... -

Page 123

... and other securities from financial institutions, investing directly in banks, thrifts and bank and savings and loan holding companies and increasing federal spending to stimulate the economy. There can be no assurance as to the long term impact such actions will have on the financial markets or on... -

Page 124

... and prices, which may limit our ability to write new business Our personal lines catastrophe reinsurance program was designed, utilizing our risk management methodology, to address our exposure to catastrophes nationwide. Market conditions beyond our control impact the availability and cost of... -

Page 125

...; an increase in the perceived risk of our investment portfolio; a reduced confidence in management or our business strategy, as well as a number of other considerations that may or may not be under our control. The insurance financial strength ratings of Allstate Insurance Company and Allstate Life... -

Page 126

... availability of homeowners insurance, and the results for our Allstate Protection segment. Loss of key vendor relationships or failure of a vendor to protect personal information of our customers, claimants or employees could affect our operations We rely on services and products provided by many... -

Page 127

...- diluted Cash dividends declared per share Consolidated Financial Position Investments Total assets Reserves for claims and claims expense, life-contingent contract benefits and contractholder funds Long-term debt Shareholders' equity Shareholders' equity per diluted share Equity Property-Liability... -

Page 128

... to determine the allocation of resources. Allstate is focused on the following priorities in 2013 grow insurance premiums; maintain auto profitability; raise returns in homeowners and annuity businesses; proactively manage investments; and reduce our cost structure. The most important factors we... -

Page 129

... and losses Total revenues Costs and expenses Property-liability insurance claims and claims expense Life and annuity contract benefits Interest credited to contractholder funds Amortization of deferred policy acquisition costs Operating costs and expenses Restructuring and related charges Interest... -

Page 130

...and other information, as applicable. Credit and liquidity spreads are typically implied from completed transactions and transactions of comparable securities. Valuation service providers also use proprietary discounted cash flow models that are widely accepted in the financial services industry and... -

Page 131

...various inputs used in internal models to market observable data. When fair value determinations are expected to be more variable, we validate them through reviews by members of management who have relevant expertise and who are independent of those charged with executing investment transactions. We... -

Page 132

...as industry analyst reports and forecasts, sector credit ratings, financial condition of the bond insurer for insured fixed income securities, and other market data relevant to the realizability of contractual cash flows, may also be considered. The estimated fair value of collateral will be used to... -

Page 133

... with acquiring insurance policies and investment contracts. In accordance with GAAP, costs that are related directly to the successful acquisition of new or renewal insurance policies and investment contracts are deferred and recorded as an asset on the Consolidated Statements of Financial Position... -

Page 134

... related to changes in the investment margin component of EGP primarily related to equity-indexed annuities and was due to an increase in projected investment margins. The deceleration related to benefit margin was primarily due to increased projected persistency on interest-sensitive life insurance... -

Page 135

...cost to settle claims, less losses that have been paid. The significant lines of business are auto, homeowners, and other lines for Allstate Protection, and asbestos, environmental, and other discontinued lines for Discontinued Lines and Coverages. Allstate Protection's claims are typically reported... -

Page 136

... the year for data elements such as claim counts reported and settled, paid losses, and paid losses combined with case reserves. The calculation of development factors from changes in these data elements also impacts claim severity trends, which is a common industry reference used to explain changes... -

Page 137

... coverages, we monitor our rate of increase in average cost per claim against a weighted average of the Maintenance and Repair price index and the Parts and Equipment price index. We believe our claim settlement initiatives, such as improvements to the claim review and settlement process, the use... -

Page 138

... that we pay for an accident year typically relate to claims that are more difficult to settle, such as those involving serious injuries or litigation. Private passenger auto insurance provides a good illustration of the uncertainty of future loss estimates: our typical annual percentage payout... -

Page 139

... variability. Based on our products and coverages, historical experience, the statistical credibility of our extensive data and stochastic modeling of actuarial chain ladder methodologies used to develop reserve estimates, we estimate that the potential variability of our Allstate Protection... -

Page 140

... retention on primary insurance plans. Our exposure is further limited by the significant reinsurance that we had purchased on our direct excess business. Our assumed reinsurance business involved writing generally small participations in other insurers' reinsurance programs. The reinsured losses... -

Page 141

...for life-contingent contract benefits estimation Due to the long term nature of traditional life insurance, life-contingent immediate annuities and voluntary accident and health insurance products, benefits are payable over many years; accordingly, the reserves are calculated as the present value of... -

Page 142

...: Allstate Protection and Discontinued Lines and Coverages. Allstate Protection comprises three brands: Allstate, Encompass and Esurance. Allstate Protection is principally engaged in the sale of personal property and casualty insurance, primarily private passenger auto and homeowners insurance... -

Page 143

... ratio - the ratio of claims and claims expense and operating costs and expenses in the Discontinued Lines and Coverages segment to Property-Liability premiums earned. The sum of the effect of Discontinued Lines and Coverages on the combined ratio and the Allstate Protection combined ratio is equal... -

Page 144

... the Encompass brand. We also sell auto insurance direct to consumers online, through call centers and through select agents, including Answer Financial, under the Esurance brand. Our strategy is to position our products and distribution systems to meet the changing needs of the customer in managing... -

Page 145

... and service channels by increasing the productivity of the Allstate brand's exclusive agencies. Since Allstate brand customers prefer personal advice and assistance, beginning in 2013 all Allstate brand customers who purchased their policies directly through call centers and the internet will... -

Page 146

... address rate adequacy and improve underwriting and claim effectiveness. We also consider various strategic options to improve our homeowners insurance business returns. Allstate brand also includes Emerging Businesses which comprises Consumer Household (specialty auto products including motorcycle... -

Page 147

... Allstate brand Encompass brand: Standard auto Homeowners Other personal lines (1) Total Encompass brand Esurance brand Standard auto Allstate Protection unearned premiums (1) $ 4,188 200 3,396 1,370 9,154 321 222 50 593 265 $ 10,012 Other personal lines include commercial, renters, condominium... -

Page 148

... brand standard auto) or 12 months prior for homeowners. New issued applications: Item counts of automobiles or homeowners insurance applications for insurance policies that were issued during the period, regardless of whether the customer was previously insured by another Allstate Protection market... -

Page 149

...: aligned pricing and underwriting with strategic direction, terminated relationships with certain independent agencies, non-renewal of underperforming business, discontinued writing the Special Value product (middle market auto product focused on segment auto) and Deerbrook (non-standard auto) in... -

Page 150

...the MD&A and Note 10 of the consolidated financial statements. Allstate brand Homeowners PIF (thousands) Average premium-gross written (12 months) Renewal ratio (%) (12 months) Approved rate changes (2): # of states Countrywide (%) State specific (%) (3) (1) Encompass brand 2010 6,690 $ 943 88.4 32... -

Page 151

... overall homeowners strategy to profitably grow and serve our customers. Our Allstate House and Home product provides options of coverage for roof damage including graduated coverage and pricing based on roof type and age and uses a number of factors to determine the pricing, some of which relate to... -

Page 152

... and related charges Underwriting income (loss) Catastrophe losses Underwriting income (loss) by line of business Standard auto Non-standard auto Homeowners Other personal lines Underwriting income (loss) Underwriting income (loss) by brand Allstate brand Encompass brand Esurance brand Underwriting... -

Page 153

..., such as certain types of terrorism or industrial accidents. The nature and level of catastrophes in any period cannot be reliably predicted. Catastrophe losses by the size of event are shown in the following table. ($ in millions) 2012 Number of events Claims and claims expense 1.2% $ 5.9 4.8 88... -

Page 154

.... Bodily injury and property damage coverage paid claim severities increased 4.1% and 3.0%, respectively, in 2012 compared to 2011. In 2012, severity increased in line with historical Consumer Price Index (''CPI'') trends. Standard auto loss ratio for the Allstate brand decreased 0.1 points in 2011... -

Page 155

...distribution channels when considering the cumulative earned premiums of policies sold. DAC We establish a DAC asset for costs that are related directly to the successful acquisition of new or renewal insurance policies, principally agents' remuneration and premium taxes. For the Allstate Protection... -

Page 156

... writing new homeowners business in California in 2007. We continue to renew current policyholders. We ceased writing new homeowners business in Florida in 2011 beyond a modest stance for existing customers who replace their currently-insured home with an acceptable property. The Encompass companies... -

Page 157

... risk on certain policies that do not specifically exclude coverage for earthquake losses, including our auto policies, and to fires following earthquakes. Allstate policyholders in the state of California are offered coverage through the CEA, a privately-financed, publicly-managed state agency... -

Page 158

... of the year and interim quarters. Investment balances, for purposes of the pre-tax yield calculation, exclude unrealized capital gains and losses. Limited partnerships accounted for under the equity method of accounting (''EMA'') are included in the 2012 yields since their income is reported in net... -

Page 159

... 31 by line of business. ($ in millions) 2012 $ 14,364 807 470 15,641 1,637 $ 17,278 $ $ 2011 14,792 859 429 16,080 1,707 17,787 $ $ 2010 14,696 921 - 15,617 1,779 17,396 Allstate brand Encompass brand Esurance brand Total Allstate Protection Discontinued Lines and Coverages Total Property... -

Page 160

... 15,150 1,878 17,028 2010 Effect on combined ratio (2) Reserve reestimate (1) Effect on combined ratio (2) Allstate brand Encompass brand Esurance brand Total Allstate Protection Discontinued Lines and Coverages Total Property-Liability ($ in millions, except ratios) $ 14,792 859 429 16,080 1,707... -

Page 161

...The increase in pending claims as of December 31, 2012 compared to December 31, 2011 relates to catastrophes, primarily Sandy, for all lines as well as the inclusion of Esurance claims for auto. Number of claims Auto Pending, beginning of year New Total closed Pending, end of year Homeowners Pending... -

Page 162

...by line of business. Favorable reserve reestimates are shown in parentheses. 2012 Prior year reserve reestimates ($ in millions) 2002 & prior 2003 2004 2005 2006 2007 2008 2009 2010 2011 Total Allstate brand $ Encompass brand Esurance brand Total Allstate Protection Discontinued Lines and Coverages... -

Page 163

... on our ceding companies to report claims. Reserve additions for asbestos in 2010 were primarily for products related coverage. The reserve additions for environmental in 2012 were primarily related to site-specific remediations where the clean-up cost estimates and responsibility for the clean... -

Page 164

...asbestos claims and claims expense reserves, claim payments and the resultant ratio. As payments result in corresponding reserve reductions, survival ratios can be expected to vary over time. In both 2012 and 2011, the asbestos net 3-year survival ratio increased due to lower average annual payments... -

Page 165

...For Allstate Protection, we utilize reinsurance to reduce exposure to catastrophe risk and manage capital, and to support the required statutory surplus and the insurance financial strength ratings of certain subsidiaries such as Castle Key Insurance Company and Allstate New Jersey Insurance Company... -

Page 166

...674 Industry pools and facilities Michigan Catastrophic Claim Association (''MCCA'') National Flood Insurance Program North Carolina Reinsurance Facility New Jersey Unsatisfied Claim and Judgment Fund Other Subtotal Lloyd's of London (''Lloyd's'') Westport Insurance Corporation (formerly Employers... -

Page 167

... are part of our catastrophe management strategy, which is intended to provide our shareholders an acceptable return on the risks assumed in our property business, and to reduce variability of earnings, while providing protection to our customers. We anticipate completing the placement of our 2013... -

Page 168

... benefits, offering one of the broadest product portfolios in the voluntary benefits market. Our strategy for Allstate Benefits focuses on growth in the national accounts market by increasing the number of sales and account management personnel, expanding independent agent distribution in targeted... -

Page 169

...and Allstate Benefits channels. We continue to focus on improving returns and reducing our concentration in spread-based products resulting in net reductions in contractholder fund obligations. We plan to further grow premiums and contract charges on underwritten insurance products and offer a broad... -

Page 170

...Accident and health insurance premiums Interest-sensitive life insurance contract charges Subtotal Annuities Immediate annuities with life contingencies premiums Other fixed annuity contract charges Subtotal Life and annuity premiums and contract charges (1) (1) Contract charges related to the cost... -

Page 171

... products and fixed annuities. In September 2011, Allstate Bank stopped opening new customer accounts and all funds were returned to Allstate Bank account holders prior to December 31, 2011. Surrenders and partial withdrawals on deferred fixed annuities and interest-sensitive life insurance products... -

Page 172

... life insurance and the reduction in accident and health insurance reserves at Allstate Benefits in 2011, partially offset by lower sales of immediate annuities with life contingencies and the reduction in reserves for secondary guarantees on interest-sensitive life insurance. Our 2012 annual review... -

Page 173

...-sensitive life insurance and immediate fixed annuities. Additionally, valuation changes on derivatives embedded in equity-indexed annuity contracts that are not hedged increased interest credited to contractholder funds by $18 million in 2011. Amortization of deferred sales inducement costs was... -

Page 174

... life contracts where management has the ability to change the crediting rate, subject to a contractual minimum. Other products, including equity-indexed, variable and immediate annuities, equity-indexed and variable life, and institutional products totaling $10.72 billion of contractholder funds... -

Page 175

... $5 million related to equity-indexed annuities and was primarily due to an increase in projected investment margins. In 2010, the review resulted in a deceleration of DAC amortization (credit to income) of $16 million. Amortization deceleration of $37 million related to variable life insurance and... -

Page 176

... service costs, reduced insurance department assessments for 2011 and lower net Allstate agencies distribution channel expenses reflecting increased fees from sales of third party financial products, partially offset by a charge related to the liquidation plan for Executive Life Insurance Company... -

Page 177

...Paul Revere Life Insurance Company Mutual of Omaha Insurance Security Life of Denver Manulife Insurance Company Lincoln National Life Insurance Triton Insurance Company American Health & Life Insurance Co. Other (3) Total (1) $ $ The Company has extensive reinsurance contracts directly with Swiss... -

Page 178

... which has produced competitive returns over the long term, is designed to ensure financial strength and stability for paying claims, while maximizing economic value and surplus growth. The Allstate Financial portfolio's investment strategy focuses on the total return of assets needed to support the... -

Page 179

... increased to $38.22 billion as of December 31, 2012, from $36.00 billion as of December 31, 2011, primarily due to higher valuations of fixed income securities and positive operating cash flows, partially offset by dividends paid by Allstate Insurance Company (''AIC'') to its parent, The Allstate... -

Page 180

...for fixed income securities by credit rating as of December 31, 2012. ($ in millions) Fair value U.S. government and agencies Municipal Tax exempt Taxable ARS Corporate Public Privately placed Foreign government ABS Collateralized debt obligations (''CDO'') Consumer and other asset-backed securities... -

Page 181

... up of 518 issuers. Privately placed corporate obligations contain structural security features such as financial covenants and call protections that provide investors greater protection against credit deterioration, reinvestment risk or fluctuations in interest rates than those typically found in... -

Page 182

... small balance transactions, large loan pools and single borrower transactions. Equity securities Equity securities primarily include common stocks, exchange traded and mutual funds, non-redeemable preferred stocks and real estate investment trust equity investments. The equity securities portfolio... -

Page 183

... of the related financial statements. The recognition of income on hedge funds is primarily on a one-month delay and the income recognition on private equity/debt funds, real estate funds and tax credit funds are generally on a three-month delay. Income on cost method limited partnerships is... -

Page 184

risk-free interest rates. The increase for equity securities was primarily due to positive returns in the equity markets. The following table presents unrealized net capital gains and losses as of December 31. ($ in millions) 2012 $ 326 $ 930 3,594 227 1 32 (12) 4 5,102 460 7 (22) $ 5,547 $ 2011 ... -

Page 185

... Consumer goods (cyclical and non-cyclical) Technology Basic industry Financial services Capital goods Utilities Index-based funds Banking Communications Real estate Transportation Emerging market fixed income funds Emerging market equity funds Total equity securities $ $ $ Within the equity... -

Page 186

... consumer goods and communications sectors. We also have additional indirect and diversified exposures through investments in multinational equity funds and limited partnership interests that invest in Europe. We estimate these indirect exposures do not exceed 1% of total investments. Net investment... -

Page 187

...and long-term capital growth. Accordingly, our investment decisions and objectives are a function of the underlying risks and product profiles of each business. Investment policies define the overall framework for managing market and other investment risks, including accountability and controls over... -

Page 188

...respective boards of directors. These ALM policies specify limits, ranges and/or targets for investments that best meet Allstate Financial's business objectives in light of its product liabilities. We use quantitative and qualitative market-based approaches to measure, monitor and manage market risk... -

Page 189

... is designed to ensure our financial strength and stability for paying claims, while maximizing economic value and surplus growth. For the Allstate Financial business, we seek to invest premiums, contract charges and deposits to generate future cash flows that will fund future claims, benefits and... -

Page 190

... assets related to variable annuity and variable life contracts with account values totaling $6.61 billion and $6.98 billion, respectively. Equity risk exists for contract charges based on separate account balances and guarantees for death and/or income benefits provided by our variable products... -

Page 191

... value of plan assets is adjusted annually so that differences between changes in the fair value of equity securities and hedge fund limited partnerships and the expected long-term rate of return on these securities are recognized into the market-related value of plan assets over a five year period... -

Page 192

...-related value of assets in 2013 and into the foreseeable future, resulting in additional amortization and net periodic pension cost. The net actuarial loss will be amortized over the remaining service life of active employees (approximately 9 years) or will reverse with increases in the discount... -

Page 193

... the 2013 fiscal year to maintain the plans' funded status. This estimate could change significantly following either an improvement or decline in investment markets. GOODWILL Goodwill represents the excess of amounts paid for acquiring businesses over the fair value of the net assets acquired. The... -

Page 194

... from the Allstate Protection business have benefitted by the general presence of stable to higher premium rates and stable loss costs. Goodwill impairment evaluations indicated no impairment as of December 31, 2012 and no reporting unit was at risk of having its carrying value including goodwill... -

Page 195

...to our business model or strategies. We have distinct and separately capitalized groups of subsidiaries licensed to sell property and casualty insurance in New Jersey and Florida that maintain separate group ratings. The ratings of these groups are influenced by the risks that relate specifically to... -

Page 196

...-liability companies takes into account asset and credit risks but places more emphasis on underwriting factors for reserving and pricing. The formula for calculating RBC for life insurance companies takes into account factors relating to insurance, business, asset and interest rate risks. As... -

Page 197

... service expenses and repayment Payments related to employee and agent benefit plans X X X X X X X X X X X X X X X X X X X X X Allstate Financial Corporate and Other X X X X X X X X X We actively manage our financial position and liquidity levels in light of changing market, economic, and business... -

Page 198

... for cash or a change in life insurance coverage needs. Other key factors that may impact the likelihood of customer surrender include the level of the contract surrender charge, the length of time the contract has been in force, distribution channel, market interest rates, equity market conditions... -

Page 199

... by higher net purchases of fixed income and equity securities. Allstate Financial Lower cash provided by operating cash flows in 2012 compared to 2011 was primarily due to higher contract benefits paid. Lower cash provided by operating cash flows in 2011 was primarily due to income tax payments in... -

Page 200

... and institutional products. The reserve for life-contingent contract benefits relates primarily to traditional life insurance, immediate annuities with life contingencies and voluntary accident and health insurance. These amounts reflect the present value of estimated cash payments to be... -

Page 201

... and analytics. This framework provides an enterprise view of risks and opportunities and is used by senior leaders and business managers to drive strategic and business decisions. Allstate's risk management strategies adapt to changes in business and market environments and seek to optimize... -

Page 202

..., Allstate designs business and enterprise strategies that seek to optimize returns on risk-adjusted capital. Examples include shifting Allstate Financial away from spread-based products toward underwritten products, implementing a comprehensive program of margin improvement actions in homeowners... -

Page 203

... ALLSTATE CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS ($ in millions, except per share data) Year Ended December 31, 2012 2011 2010 Revenues Property-liability insurance premiums (net of reinsurance ceded of $1,090, $1,098 and $1,092) Life and annuity premiums and contract... -

Page 204

THE ALLSTATE CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME ($ in millions) Year Ended December 31, 2012 2011 $ 787 $ 2010 911 $ 2,306 Net income Other comprehensive income, after-tax Changes in: Unrealized net capital gains and losses Unrealized foreign currency ... -

Page 205

... assets Separate Accounts Total assets Liabilities Reserve for property-liability insurance claims and claims expense Reserve for life-contingent contract benefits Contractholder funds Unearned premiums Claim payments outstanding Deferred income taxes Other liabilities and accrued expenses Long-term... -

Page 206

...benefit cost Cumulative effect of change in accounting principle Balance, end of year Total shareholders' equity Noncontrolling interest Balance, beginning of year Change in noncontrolling interest ownership Noncontrolling gain Cumulative effect of change in accounting principle Balance, end of year... -

Page 207

... Fixed income securities Equity securities Limited partnership interests Mortgage loans Other investments Change in short-term investments, net Change in other investments, net Purchases of property and equipment, net Disposition (acquisition) of operations, net of cash acquired Net cash provided... -

Page 208

..., life insurance, voluntary accident and health insurance, annuities and funding agreements. Allstate primarily distributes its products through exclusive agencies, financial specialists, independent agencies, call centers and the internet. The Allstate Protection segment principally sells private... -

Page 209

... exclusive agencies and exclusive financial specialists, workplace enrolling independent agents and independent master brokerage agencies, specialized structured settlement brokers, and directly through call centers and the internet. Allstate has exposure to market risk as a result of its investment... -

Page 210

...'') are embedded in certain fixed income securities, equity-indexed life and annuity contracts, reinsured variable annuity contracts and certain funding agreements. All derivatives are accounted for on a fair value basis and reported as other investments, other assets, other liabilities and accrued... -

Page 211

... item together with the results of the associated asset or liability for which risks are being managed. Securities loaned The Company's business activities include securities lending transactions, which are used primarily to generate net investment income. The proceeds received in conjunction with... -

Page 212

... contracts. Fixed annuities, including market value adjusted annuities, equity-indexed annuities and immediate annuities without life contingencies, and funding agreements (primarily backing medium-term notes) are considered investment contracts. Consideration received for such contracts is reported... -

Page 213

...policy acquisition and sales inducement costs Costs that are related directly to the successful acquisition of new or renewal property-liability insurance, life insurance and investment contracts are deferred and recorded as DAC. These costs are principally agents' and brokers' remuneration, premium... -

Page 214

... that fair value to individual reporting units. The discounted cash flow analysis utilizes long term assumptions for revenue growth, capital growth, earnings projections including those used in the Company's strategic plan, and an appropriate discount rate. The peer company price to earnings... -

Page 215

... for life-contingent contract benefits payable under insurance policies, including traditional life insurance, life-contingent immediate annuities and voluntary accident and health insurance products, is computed on the basis of long-term actuarial assumptions of future investment yields, mortality... -

Page 216

... any contract provision wherein the Company provides a guarantee, variable annuity and variable life insurance contractholders bear the investment risk that the separate accounts' funds may not meet their stated investment objectives. Substantially all of the Company's variable annuity business was... -

Page 217

...no impact on the Company's results of operations or financial position. Intangibles - Goodwill and Other In September 2011, the FASB issued guidance providing the option to first assess qualitative factors, such as macroeconomic conditions and industry and market considerations, to determine whether... -

Page 218

...(''Esurance''). Esurance sells private passenger auto and renters insurance direct to consumers online, through call centers and through select agents, including Answer Financial. Answer Financial is an independent personal lines insurance agency that offers comparison quotes for auto and homeowners... -

Page 219

... Net change in short-term investments Operating cash flow (used) provided Net change in cash Net change in proceeds managed Net change in liabilities Liabilities for collateral, beginning of year Liabilities for collateral, end of year Operating cash flow provided (used) 5. Investments Fair values... -

Page 220

...4,279 (177) 4,102 Fixed income securities Equity securities Mortgage loans Limited partnership interests (1) Short-term investments Other Investment income, before expense Investment expense Net investment income (1) Income from EMA limited partnerships is reported in net investment income in 2012... -

Page 221

...-than-temporary impairment losses by asset type for the years ended December 31 are as follows: ($ in millions) Gross Fixed income securities: Municipal Corporate Foreign government ABS RMBS CMBS Total fixed income securities Equity securities Mortgage loans Limited partnership interests Other Other... -

Page 222

... to sell Change in credit loss due to accretion of increase in cash flows Ending balance $ The Company uses its best estimate of future cash flows expected to be collected from the fixed income security, discounted at the security's original or current effective rate, as appropriate, to calculate... -

Page 223

... would increase if the net unrealized gains in the applicable product portfolios were realized and reinvested at current lower interest rates, resulting in a premium deficiency. Although the Company evaluates premium deficiencies on the combined performance of life insurance and immediate annuities... -

Page 224

... temporary are: 1) the financial condition, near-term and long-term prospects of the issue or issuer, including relevant industry specific market conditions and trends, geographic location and implications of rating agency actions and offering prices; 2) the specific reasons that a security is in an... -

Page 225

..., a or bbb from A.M. Best, or a comparable internal rating if an externally provided rating is not available. Unrealized losses on investment grade securities are principally related to widening credit spreads or rising interest rates since the time of initial purchase. As of December 31, 2012, the... -

Page 226

... estimated to be equivalent to the reported net asset value of the underlying funds. In 2012, 2011 and 2010, the Company had write-downs related to cost method limited partnerships of $8 million, $4 million and $45 million, respectively. Mortgage loans The Company's mortgage loans are commercial... -

Page 227

...when full and timely collection of principal and interest payments is not probable. Cash receipts on mortgage loans on nonaccrual status are generally recorded as a reduction of carrying value. Debt service coverage ratio is considered a key credit quality indicator when mortgage loans are evaluated... -

Page 228

... the financial capacity to fund the revenue shortfalls from the properties for the foreseeable term, the decrease in cash flows from the properties is considered temporary, or there are other risk mitigating circumstances such as additional collateral, escrow balances or borrower guarantees. The net... -

Page 229

... any credit concentration risk of a single issuer and its affiliates greater than 10% of the Company's shareholders' equity. Securities loaned The Company's business activities include securities lending programs with third parties, mostly large banks. As of December 31, 2012 and 2011, fixed income... -

Page 230

... equity securities. Valuation is based on unadjusted quoted prices for identical assets in active markets that the Company can access. Short-term: Comprise actively traded money market funds that have daily quoted net asset values for identical assets that the Company can access. Separate account... -

Page 231

...valuation include quoted prices for identical or similar assets in markets that are not active, contractual cash flows, benchmark yields and credit spreads. For certain short-term investments, amortized cost is used as the best estimate of fair value. Other investments: Free-standing exchange listed... -

Page 232

... inputs include interest rate yield curves and credit spreads. Contractholder funds: Derivatives embedded in certain life and annuity contracts are valued internally using models widely accepted in the financial services industry that determine a single best estimate of fair value for the embedded... -

Page 233

... value 394 Valuation technique Discounted cash flow model Stochastic cash flow model Unobservable input Anticipated date liquidity will return to the market Projected option cost Range 18 - 60 months Weighted average 31 - 43 months Derivatives embedded in life and annuity contracts - Equity-indexed... -

Page 234

... Equity securities Short-term investments Other investments: Free-standing derivatives Separate account assets Other assets Total recurring basis assets Non-recurring basis (1) Total assets at fair value % of total assets at fair value Liabilities Contractholder funds: Derivatives embedded in life... -

Page 235

...and agencies Municipal Corporate ABS RMBS CMBS Redeemable preferred stock Total fixed income securities Equity securities Other investments: Free-standing derivatives, net Other assets Total recurring Level 3 assets Liabilities Contractholder funds: Derivatives embedded in life and annuity contracts... -

Page 236

...and agencies Municipal Corporate ABS RMBS CMBS Redeemable preferred stock Total fixed income securities Equity securities Other investments: Free-standing derivatives, net Other assets Total recurring Level 3 assets Liabilities Contractholder funds: Derivatives embedded in life and annuity contracts... -

Page 237

... securities: Municipal Corporate ABS RMBS CMBS Redeemable preferred stock Total fixed income securities Equity securities Other investments: Free-standing derivatives, net Other assets Total recurring Level 3 assets Liabilities Contractholder funds: Derivatives embedded in life and annuity contracts... -

Page 238

... liquidity in the market and a sustained increase in market activity for these assets. When transferring these securities into Level 2, the Company did not change the source of fair value estimates or modify the estimates received from independent third-party valuation service providers or the... -

Page 239

... to sell. Risk adjusted discount rates are selected using current rates at which similar loans would be made to borrowers with similar characteristics, using similar types of properties as collateral. The fair value of cost method limited partnerships is determined using reported net asset values of... -

Page 240

... and options for hedging the equity exposure contained in its equity indexed life and annuity product contracts that offer equity returns to contractholders. In addition, Allstate Financial uses interest rate swaps to hedge interest rate risk inherent in funding agreements. Allstate Financial uses... -

Page 241

... value with changes in fair value of embedded derivatives reported in net income. The Company's primary embedded derivatives are equity options in life and annuity product contracts, which provide equity returns to contractholders; equity-indexed notes containing equity call options, which provide... -

Page 242

... location in the Consolidated Statement of Financial Position as of December 31, 2012. ($ in millions, except number of contracts) Asset derivatives Volume (1) Notional amount Number of contracts Fair value, net Gross asset Gross liability Balance sheet location Derivatives designated as accounting... -

Page 243

... accumulation benefits Guaranteed withdrawal benefits Equity-indexed and forward starting options in life and annuity product contracts Other embedded derivative financial instruments Credit default contracts Credit default swaps - buying protection Credit default swaps - selling protection Total... -

Page 244

... location in the Consolidated Statement of Financial Position as of December 31, 2011. ($ in millions, except number of contracts) Asset derivatives Volume (1) Notional amount Number of contracts Fair value, net Gross asset Gross liability Balance sheet location Derivatives designated as accounting... -

Page 245

... accumulation benefits Guaranteed withdrawal benefits Equity-indexed and forward starting options in life and annuity product contracts Other embedded derivative financial instruments Credit default contracts Credit default swaps - buying protection Credit default swaps - selling protection Total... -

Page 246