Allstate 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

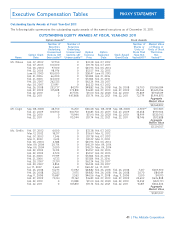

Pre 409A SRIP Benefits may be payable at age 50 or later • Mr. Civgin’s Post 409A Benefit would be paid on

if disabled, following early retirement at age 55 or older January 1, 2017, or following death. Mr. Civgin will turn

with 20 years of service, or following death in accordance 65 on May 17, 2026.

with the terms of the SRIP. SRIP benefits earned after • Ms. Greffin’s Pre 409A SRIP benefit would become

December 31, 2004 (Post 409A SRIP Benefits) are paid payable at age 65 or following death or disability.

on the January 1 following termination of employment Ms. Greffin’s Post 409A Benefit would be paid on

after reaching age 55 (a minimum six month deferral January 1, 2016, or following death. Ms. Greffin will turn

period applies), or following death in accordance with the 65 on August 16, 2025.

terms of the SRIP.

• Mr. Gupta’s SRIP benefit is not currently vested but

Eligible employees are vested in the normal ARP and SRIP would become payable following death. Mr. Gupta will

retirement benefit on the earlier of the completion of five turn 65 on March 4, 2026.

years of service or upon reaching age 65 (for participants

with final average pay benefits) or the completion of three • Mr. Winter’s SRIP benefit is not currently vested but

years of service or upon reaching age 65 (for participants would become payable following death. Mr. Winter will

whose benefits are calculated under the cash balance turn 65 on January 22, 2022.

formula). • Mr. Lacher’s SRIP benefit was not vested prior to

• Mr. Wilson’s Pre 409A SRIP benefit would become termination of employment and is not payable.

payable at age 65 or following death or disability.

Mr. Wilson’s Post 409A Benefit would be paid on

January 1, 2013, or following death. Mr. Wilson will turn

65 on October 15, 2022.

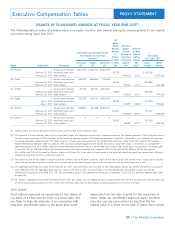

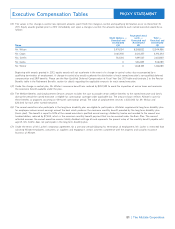

Non-Qualified Deferred Compensation

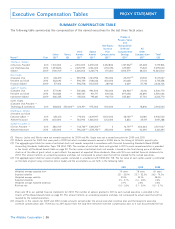

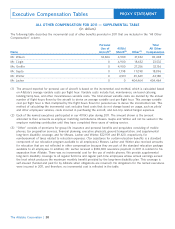

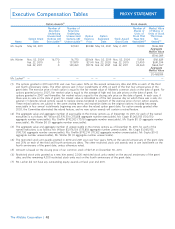

The following table summarizes the non-qualified deferred compensation contributions, earnings, and account balances of

our named executives in 2011. All amounts relate to The Allstate Corporation Deferred Compensation Plan.

NON-QUALIFIED DEFERRED COMPENSATION AT FISCAL YEAR-END 2011

Mr. Wilson 0 0 (8,596) 0 453,863

Mr. Civgin 0 0 0 0 0

Ms. Greffin 0 0 (40,171) 0 1,451,808

Mr. Gupta 0 0 0 0 0

Mr. Winter 0 0 0 0 0

Mr. Lacher 0 0 0 0 0

(1) Aggregate earnings were not included in the named executive’s compensation in the last completed fiscal year in the

Summary Compensation Table.

(2) There are no amounts reported in the Aggregate Balance at Last FYE column that previously were reported as

compensation in the Summary Compensation Table.

In order to remain competitive with other employers, we 80% of their salary and/or up to 100% of their annual

allow the named executives and other employees whose cash incentive award that exceeds that amount under the

annual compensation exceeds the amount specified in the Deferred Compensation Plan. Allstate does not match

Internal Revenue Code ($245,000 in 2011), to defer up to

46

Executive Registrant Aggregate Aggregate Aggregate

Contributions Contributions Earnings Withdrawals/ Balance

in Last FY in Last FY in Last FY Distributions at Last FYE

Name ($) ($) ($)(1) ($) ($)(2)

Executive Compensation Tables

The Allstate Corporation |

PROXY STATEMENT