Allstate 2012 Annual Report Download - page 171

Download and view the complete annual report

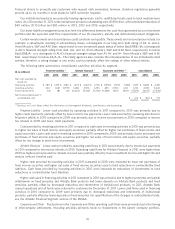

Please find page 171 of the 2012 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Holding other assumptions constant, a hypothetical decrease of 100 basis points in the weighted average discount

rate would result in an increase of $52 million in net periodic pension cost and a $427 million increase in the

unrecognized pension and other postretirement benefit cost liability of our pension plans recorded as accumulated

other comprehensive income as of December 31, 2011, compared to an increase of $43 million in net periodic pension

cost and a $392 million increase in the unrecognized pension and other postretirement benefit cost liability as of

December 31, 2010. A hypothetical increase of 100 basis points in the weighted average discount rate would decrease

net periodic pension cost by $46 million and would decrease the unrecognized pension and other postretirement benefit

cost liability of our pension plans recorded as accumulated other comprehensive income by $360 million as of

December 31, 2011, compared to a decrease in net periodic pension cost of $38 million and a $331 million decrease in

the unrecognized pension and other postretirement benefit cost liability of our pension plans recorded as accumulated

other comprehensive income as of December 31, 2010. This non-symmetrical range results from the non-linear

relationship between discount rates and pension obligations, and changes in the amortization of unrealized net actuarial

gains and losses.

The expected long-term rate of return on plan assets reflects the average rate of earnings expected on plan assets.

While this rate reflects long-term assumptions and is consistent with long-term historical returns, sustained changes in

the market or changes in the mix of plan assets may lead to revisions in the assumed long-term rate of return on plan

assets that may result in variability of pension cost. Differences between the actual return on plan assets and the

expected long-term rate of return on plan assets are a component of unrecognized gains or losses, which may be

amortized as a component of net actuarial gains and losses and recorded in accumulated other comprehensive income.

As a result, the effect of changes in fair value on our pension cost may be experienced in results of operations in periods

subsequent to those in which the fluctuations actually occur.

Holding other assumptions constant, a hypothetical decrease of 100 basis points in the expected long-term rate of

return on plan assets would result in an increase of $47 million in pension cost as of December 31, 2011, compared to

$44 million as of December 31, 2010. A hypothetical increase of 100 basis points in the expected long-term rate of

return on plan assets would result in a decrease in net periodic pension cost of $47 million as of December 31, 2011,

compared to $44 million as of December 31, 2010.

We target funding levels that do not restrict the payment of plan benefits in our domestic plans and were within our

targeted range as of December 31, 2011. In 2011, we contributed $264 million to our pension plans. We expect to

contribute $417 million for the 2012 fiscal year to maintain the plans’ funded status. This estimate could change

significantly following either a dramatic improvement or decline in investment markets.

Other post employment benefits

In 2010, the Patient Protection and Affordable Care Act was signed into law. One aspect of this legislation is the

introduction of an excise tax, effective in 2018, on ‘‘high cost’’ plans. The liabilities as of December 31, 2011 for the

postretirement medical plans include an estimate of this additional liability, which amounts to $3 million.

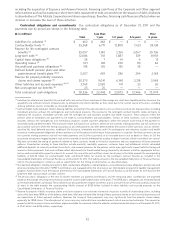

GOODWILL

Goodwill represents the excess of amounts paid for acquiring businesses over the fair value of the net assets

acquired. The goodwill balances were $824 million and $418 million as of December 31, 2011 and $456 million and

$418 million as of December 31, 2010 for the Allstate Protection segment and the Allstate Financial segment,

respectively. The increase in 2011 relates to the acquisition of Esurance and Answer Financial. Our reporting units are

equivalent to our reporting segments, Allstate Protection and Allstate Financial. Goodwill is allocated to reporting units

based on which unit is expected to benefit from the synergies of the business combination.

Goodwill is not amortized but is tested for impairment at least annually. We perform our annual goodwill

impairment testing during the fourth quarter of each year based upon data as of the close of the third quarter. We also

review goodwill for impairment whenever events or changes in circumstances, such as deteriorating or adverse market

conditions, indicate that it is more likely than not that the carrying amount of goodwill may exceed its implied fair value.

Impairment testing requires the use of estimates and judgments. For purposes of goodwill impairment testing, if the

carrying value of a reporting unit exceeds its estimated fair value, the second step of the goodwill test is required. In such

instances, the implied fair value of the goodwill is determined in the same manner as the amount of goodwill that would

be determined in a business acquisition. The excess of the carrying value of goodwill over the implied fair value of

goodwill would be recognized as an impairment and recorded as a charge against net income.

To estimate the fair value of our reporting units for our annual impairment test as of September 30, 2011, we utilized

a combination of widely accepted valuation techniques including a stock price and market capitalization analysis,

85