Allstate 2012 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2012 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our institutional product line consists of funding agreements sold to unaffiliated trusts that use them to back

medium-term notes issued to institutional and individual investors. Banking products and services were previously

offered to customers through the Allstate Bank. In 2011, after receiving regulatory approval to voluntarily dissolve,

Allstate Bank ceased operations. In the first half of 2012, we expect to cancel the bank’s charter and deregister The

Allstate Corporation as a savings and loan holding company.

Allstate Financial outlook

• We plan to continue to increase premiums and contract charges on underwritten insurance products and develop

products our customers need for retirement income.

• Our growth initiatives will be primarily focused on increasing the number of customers served through our

proprietary and Allstate Benefits (workplace distribution) channels.

• We will continue to focus on improving returns and reducing our concentration in spread based products resulting

in net reductions in contractholder funds obligations.

• We expect increases in Allstate Financial’s attributed GAAP equity as there may be limitations on the amount of

dividends Allstate Financial companies can pay without prior approval by their insurance departments.

• We expect lower investment spread due to reduced contractholder funds, the continuing low interest rate

environment and changes in asset allocations. The amount by which the low interest rate environment will reduce

our investment spread is contingent on our ability to maintain the portfolio yield and lower interest crediting rates

on spread based products, which could be limited by market conditions, regulatory minimum rates or contractual

minimum rate guarantees, and may not match the timing or magnitude of changes in asset yields. We also

anticipate changing our asset allocation for long-term immediate annuities by reducing fixed income securities and

increasing investments in limited partnerships, equities and other alternative investments. This shift could result in

lower and more volatile investment income; however, we anticipate that this strategy will lead to higher total returns

and attributed equity.

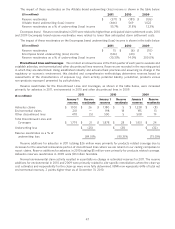

Summary analysis Summarized financial data for the years ended December 31 is presented in the following

table.

($ in millions) 2011 2010 2009

Revenues

Life and annuity premiums and contract charges $ 2,238 $ 2,168 $ 1,958

Net investment income 2,716 2,853 3,064

Realized capital gains and losses 388 (517) (431)

Total revenues 5,342 4,504 4,591

Costs and expenses

Life and annuity contract benefits (1,761) (1,815) (1,617)

Interest credited to contractholder funds (1,645) (1,807) (2,126)

Amortization of DAC (593) (356) (965)

Operating costs and expenses (455) (469) (430)

Restructuring and related charges (1) 3 (25)

Total costs and expenses (4,455) (4,444) (5,163)

(Loss) gain on disposition of operations (15) 6 7

Income tax (expense) benefit (286) (8) 82

Net income (loss) $ 586 $ 58 $ (483)

Investments as of December 31 $ 57,373 $ 61,582 $ 62,216

Net income

Life insurance $ 289

Accident and health insurance 104

Annuities and institutional and bank products 193

Net income $ 586

Net income in 2011 was $586 million compared to $58 million in 2010. The $528 million increase was primarily due

to net realized capital gains in the current year compared to net realized capital losses in the prior year, decreased

55