Allstate 2012 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2012 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

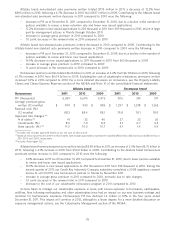

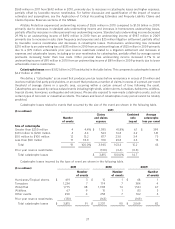

Allstate brand standard auto premiums written totaled $15.70 billion in 2011, a decrease of 0.9% from $15.84 billion

in 2010, following a 0.5% increase in 2010 from $15.76 billion in 2009. Contributing to the Allstate brand standard auto

premiums written decrease in 2011 compared to 2010 were the following:

– decrease in PIF of 1.5% as of December 31, 2011 compared to December 31, 2010, due to fewer new issued

applications and fewer policies available to renew. Excluding Florida and New York, PIF as of December 31, 2011

were comparable to December 31, 2010.

– 5.8% decrease in new issued applications on a countrywide basis to 1,908 thousand in 2011 from

2,025 thousand in 2010. Excluding Florida and New York (impacted by actions to improve profitability), new

issued applications on a countrywide basis decreased 0.1% to 1,697 thousand in 2011 from 1,699 thousand in

2010. New issued applications increased in 17 states in 2011 compared to 2010.

– increase in average gross premium in 2011 compared to 2010.

– 0.3 point increase in the renewal ratio in 2011 compared to 2010. In 2011, 39 states are showing favorable

comparisons to prior year.

Allstate brand standard auto premiums written increased in 2010 compared to 2009. Contributing to the Allstate

brand standard auto premiums written increase in 2010 compared to 2009 were the following:

– decrease in PIF as of December 31, 2010 compared to December 31, 2009, due to fewer policies available to

renew and a 0.7% decrease in net items added to existing policies to 1,498 thousand from 1,509 thousand,

reflecting industry economic trends for declines in the number of cars per household

– 0.2% decrease in new issued applications on a countrywide basis to 2,025 thousand in 2010 from

2,029 thousand in 2009 impacted by decreases in Florida and California, due in part to rate actions that were

approved in 2009 in these markets and other actions to improve profitability. Excluding Florida and California,

new issued applications on a countrywide basis increased 12.9% to 1,606 thousand in 2010 from

1,423 thousand in 2009. New issued application increased in 40 states in 2010 compared to 2009, most of

which offer an auto discount (the Preferred Package Discount) for our target customer.

– increased average gross premium in 2010 compared to 2009, primarily due to rate changes, partially offset by

customers electing to lower coverage levels of their policy

– 0.2 point decrease in the renewal ratio in 2010 compared to 2009, reflects profit management actions in

California, New York and Georgia as well as the effects of the direct channel which has a lower renewal ratio.

Excluding these items the renewal ratio had a 0.3 point increase.

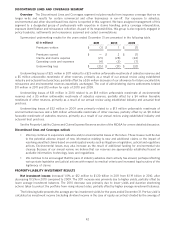

The level of Encompass premiums written continues to be impacted by comprehensive actions designed to

reposition Encompass as the package policy carrier of choice for above middle market customers through independent

agencies in order to drive stable, consistent earnings growth over time. Some of the actions contributing to the

Encompass brand standard auto premiums written decrease in 2011 compared to 2010 were the following:

– Aligned pricing and underwriting with strategic direction

– Terminated relationships with certain independent agencies

– Non-renewal of underperforming business

– Discontinued writing the Special Value product (middle market auto product focused on segment auto) and

Deerbrook (non-standard auto) in certain states

– Non-renewal of property in Florida

Non-standard auto premiums written totaled $776 million in 2011, a decrease of 12.7% from $889 million in 2010,

following a 6.3% decrease in 2009 from $949 million in 2009.

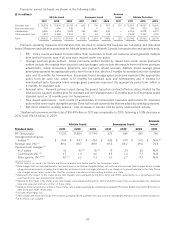

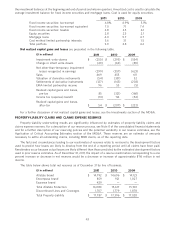

Allstate brand

Non-Standard Auto 2011 2010 2009

PIF (thousands) 571 640 719

Average premium-gross written

(6 months) $ 606 $ 624 $ 616

Renewal ratio (%) (6 months) 70.4 71.4 72.5

Approved rate changes:

# of states 13 (2) 11 (2) 11

Countrywide (%) 6.0 4.6 2.6

State specific (%) (1) 12.8 9.6 6.5

(1) Based on historical premiums written in those states, rate changes approved for non-standard auto

totaled $49 million, $41 million and $25 million in 2011, 2010 and 2009, respectively.

(2) Includes Washington D.C.

34