Allstate 2012 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2012 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

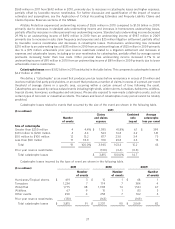

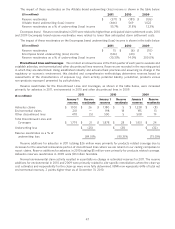

The following tables reflect the accident years to which the reestimates shown above are applicable by line of

business. Favorable reserve reestimates are shown in parentheses.

2011 Prior year reserve reestimates

2001 &($ in millions)

prior 2002 2003 2004 2005 2006 2007 2008 2009 2010 Total

Allstate brand $ 123 $ 16 $ 26 $ 8 $ 5 $ 7 $ — $ (28) $ (150) $ (378) $ (371)

Encompass brand 2 — (1) — 1 1 (1) 2 2 9 15

Total Allstate

Protection 125 16 25 8 6 8 (1) (26) (148) (369) (356)

Discontinued Lines

and Coverages 21 —————————21

Total Property-

Liability $ 146 $ 16 $ 25 $ 8 $ 6 $ 8 $ (1) $ (26) $ (148) $ (369) $ (335)

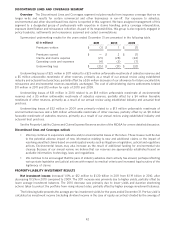

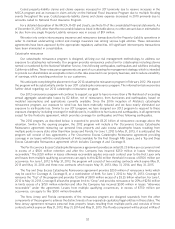

2010 Prior year reserve reestimates

2000 &($ in millions)

prior 2001 2002 2003 2004 2005 2006 2007 2008 2009 Total

Allstate brand $ 262 $ (1) $ (7) $ (18) $ (15) $ (51) $ (106) $ (86) $ (45) $ (114) $ (181)

Encompass brand 1 — 1 1 2 6 — (6) (1) (10) (6)

Total Allstate

Protection 263 (1) (6) (17) (13) (45) (106) (92) (46) (124) (187)

Discontinued Lines

and Coverages 28 —————————28

Total Property-

Liability $ 291 $ (1) $ (6) $ (17) $ (13) $ (45) $ (106) $ (92) $ (46) $ (124) $ (159)

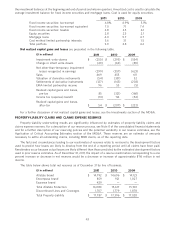

2009 Prior year reserve reestimates

1999 &($ in millions)

prior 2000 2001 2002 2003 2004 2005 2006 2007 2008 Total

Allstate brand $ 247 $ 46 $ 58 $ 44 $ 37 $ 85 $ 74 $ (149) $ (151) $ (417) $ (126)

Encompass brand — 3 1 3 6 5 10 8 (7) (39) (10)

Total Allstate

Protection 247 49 59 47 43 90 84 (141) (158) (456) (136)

Discontinued Lines

and Coverages 24 ———————— —24

Total Property-

Liability $ 271 $ 49 $ 59 $ 47 $ 43 $ 90 $ 84 $ (141) $ (158) $ (456) $ (112)

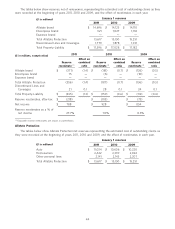

Allstate brand prior year reserve reestimates were $371 million favorable in 2011, $181 million favorable in 2010 and

$126 million favorable in 2009. In 2011, this was primarily due to severity development that was better than expected

and favorable catastrophe reserve reestimates. The increased reserves in accident years 2001 & prior is due to a

reclassification of injury reserves to older years and reserve strengthening. In 2010, this was primarily due to favorable

catastrophe reserve reestimates and severity development that was better than expected, partially offset by litigation

settlements. The increased reserves in accident years 2000 & prior is due to the litigation settlements of $100 million, a

reclassification of injury reserves to older years and reserve strengthening. In 2009, this was primarily due to favorable

reserve reestimates from Hurricanes Ike and Gustav and a catastrophe related subrogation recovery. The shift of

reserves to older accident years is attributable to a reallocation of reserves related to employee postretirement benefits

to more accident years, and a reclassification of injury and 2008 non-injury reserves to older years.

These trends are primarily responsible for revisions to loss development factors, as previously described, used to

predict how losses are likely to develop from the end of a reporting period until all claims have been paid. Because these

trends cause actual losses to differ from those predicted by the estimated development factors used in prior reserve

estimates, reserves are revised as actuarial studies validate new trends based on the indications of updated

development factor calculations.

46