Allstate 2012 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2012 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

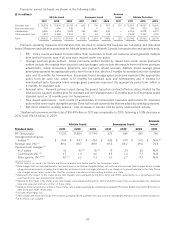

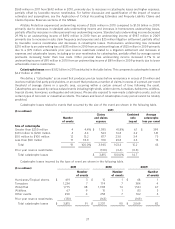

Premiums earned by brand are shown in the following table.

Esurance

($ in millions)

Allstate brand Encompass brand brand Allstate Protection

2011 2010 2009 2011 2010 2009 2011 2011 2010 2009

Standard auto $ 15,679 $ 15,814 $ 15,735 $ 620 $ 716 $ 907 $ 201 $ 16,500 $ 16,530 $ 16,642

Non-standard auto 797 896 939 2 9 27 — 799 905 966

Homeowners 5,835 5,693 5,633 365 385 444 — 6,200 6,078 6,077

Other personal lines 2,352 2,348 2,402 91 94 108 — 2,443 2,442 2,510

Total $ 24,663 $ 24,751 $ 24,709 $ 1,078 $ 1,204 $ 1,486 $ 201 $ 25,942 $ 25,955 $ 26,195

Premium operating measures and statistics that are used to analyze the business are calculated and described

below. Measures and statistics presented for Allstate brand exclude Allstate Canada, loan protection and specialty auto.

• PIF: Policy counts are based on items rather than customers. A multi-car customer would generate multiple

item (policy) counts, even if all cars were insured under one policy.

• Average premium-gross written: Gross premiums written divided by issued item count. Gross premiums

written include the impacts from discounts and surcharges, and exclude the impacts from mid-term premium

adjustments, ceded reinsurance premiums, and premium refund accruals. Allstate brand average gross

premiums represent the appropriate policy term for each line, which is 6 months for standard and non-standard

auto and 12 months for homeowners. Encompass brand average gross premiums represent the appropriate

policy term for each line, which is 12 months for standard auto and homeowners and 6 months for

non-standard auto. Esurance brand average gross premiums represent the appropriate policy term, which is

6 months for standard auto.

• Renewal ratio: Renewal policies issued during the period, based on contract effective dates, divided by the

total policies issued 6 months prior for standard and non-standard auto (12 months prior for Encompass brand

standard auto) or 12 months prior for homeowners.

• New issued applications: Item counts of automobiles or homeowners insurance applications for insurance

policies that were issued during the period. Does not include automobiles that are added by existing customers.

• Net items added to existing policies: Net increases in insured cars by policy endorsement activity.

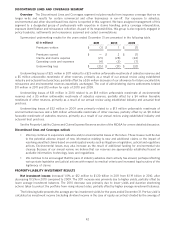

Standard auto premiums written total of $16.49 billion in 2011 was comparable to 2010, following a 0.5% decrease in

2010 from $16.56 billion in 2009.

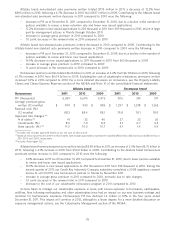

Esurance

Allstate brand Encompass brand brand

Standard Auto 2011 2010 2009 2011 2010 2009 2011

PIF (thousands) 17,213 17,484 17,744 673 689 859 786

Average premium-gross

written (1) $ 444 $ 443 $ 434 $ 935 $ 979 $ 972 $ N/A (8)

Renewal ratio (%) (1) 89.0 88.7 88.9 69.5 69.2 69.6 76.3

Approved rate changes (2):

# of states 33 45 (6) 36 (6) 19 24 36 N/A

Countrywide (%) (3) 4.7 1.4 4.6 3.5 1.4 7.3 N/A

State specific (%) (4)(5) 8.1 (7) 2.2 7.2 6.1 2.7 9.3 N/A

(1) Policy term is six months for Allstate and Esurance brands and twelve months for Encompass brand.

(2) Rate changes that are indicated based on loss trend analysis to achieve a targeted return will continue to be pursued. Rate changes do not include

rating plan enhancements, including the introduction of discounts and surcharges, that result in no change in the overall rate level in the state. These

rate changes do not reflect initial rates filed for insurance subsidiaries initially writing business in a state.

(3) Represents the impact in the states where rate changes were approved during 2011, 2010 and 2009, respectively, as a percentage of total

countrywide prior year-end premiums written.

(4) Represents the impact in the states where rate changes were approved during 2011, 2010 and 2009, respectively, as a percentage of its respective

total prior year-end premiums written in those states.

(5) Based on historical premiums written in those states, rate changes approved for standard auto totaled $731 million, $218 million and $784 million in

2011, 2010 and 2009, respectively.

(6) Includes Washington D.C.

(7) 2011 includes the impact of Florida rate increases averaging 18.5%, and New York rate increases averaging 11.2% taken across multiple companies.

(8) N/A reflects not available.

33