Allstate 2012 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2012 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

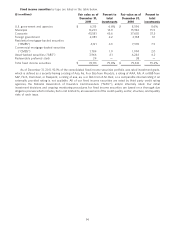

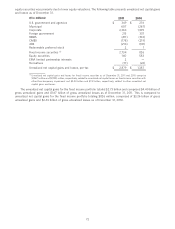

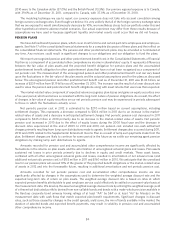

Gross unrealized gains and losses as of December 31, 2011 on equity securities by sector are provided in the table

below.

Gross unrealized

($ in millions) Amortized Fair

cost Gains Losses value

Financial services $ 295 $ 37 $ (39) $ 293

Emerging market equity funds 458 — (35) 423

Index-based funds 419 25 (24) 420

Consumer goods (cyclical and non-cyclical) 715 101 (21) 795

Emerging market fixed income funds 610 — (18) 592

Technology 345 49 (12) 382

Basic industry 182 20 (12) 190

Banking 214 19 (11) 222

Energy 272 44 (10) 306

Capital goods 234 22 (9) 247

Real estate 145 8 (7) 146

Communications 165 22 (7) 180

Utilities 92 12 (2) 102

Transportation 57 10 (2) 65

Total equity securities $ 4,203 $ 369 $ (209) $ 4,363

Within the equity portfolio, the losses were primarily concentrated in financial services, emerging market equity

funds and index-based funds. The unrealized losses were company and sector specific. As of December 31, 2011, we

have the intent and ability to hold our equity securities with unrealized losses until recovery.

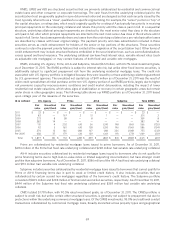

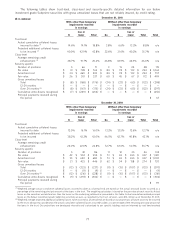

As of December 31, 2011, the total fair value of our investments in the European Union (‘‘EU’’) is $4.03 billion, with

net unrealized capital gains of $79 million, comprised of $224 million of gross unrealized gains and $145 million of gross

unrealized losses. The following table summarizes our total direct exposure related to Greece, Ireland, Italy, Portugal and

Spain (collectively ‘‘GIIPS’’) and the EU.

Banking Sovereign Other corporate Total($ in millions)

Gross Gross Gross Gross

Fair unrealized Fair unrealized Fair unrealized Fair unrealized

value losses value losses value losses value losses

GIIPS

Fixed income securities $ 23 $ (11) $ 2 $ — $ 496 $ (37) $ 521 $ (48)

Equity securities — — — — 6 — 6 —

Total 23 (11) 2 — 502 (37) 527 (48)

EU non-GIIPS

Fixed income securities 373 (49) 70 (1) 2,785 (34) 3,228 (84)

Equity securities 7 (2) — — 270 (11) 277 (13)

Total 380 (51) 70 (1) 3,055 (45) 3,505 (97)

Total EU $ 403 $ (62) $ 72 $ (1) $ 3,557 $ (82) $ 4,032 $ (145)

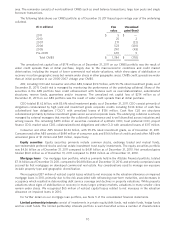

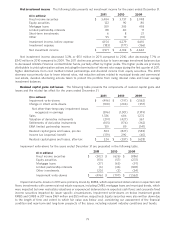

We have a comprehensive portfolio monitoring process to identify and evaluate each fixed income and equity

security that may be other-than-temporarily impaired. The process includes a quarterly review of all securities to

identify instances where the fair value of a security compared to its amortized cost (for fixed income securities) or cost

(for equity securities) is below established thresholds. The process also includes the monitoring of other impairment

indicators such as ratings, ratings downgrades and payment defaults. The securities identified, in addition to other

securities for which we may have a concern, are evaluated based on facts and circumstances for inclusion on our

watch-list. All investments in an unrealized loss position as of December 31, 2011 were included in our portfolio

monitoring process for determining whether declines in value were other than temporary.

The extent and duration of a decline in fair value for fixed income securities have become less indicative of actual

credit deterioration with respect to an issue or issuer. While we continue to use declines in fair value and the length of

time a security is in an unrealized loss position as indicators of potential credit deterioration, our determination of

74