Allstate 2012 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2012 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The surrender and partial withdrawal rate on deferred fixed annuities, interest-sensitive life insurance products and

Allstate Bank products, based on the beginning of year contractholder funds, was 15.9% in 2011 compared to 12.2% in

2010 and 11.8% in 2009. Excluding Allstate Bank products, the surrender and partial withdrawal rate on deferred fixed

annuities and interest-sensitive life insurance products, based on the beginning of year contractholder funds, was 12.6%

in 2011 compared to 10.1% in 2010 and 9.6% in 2009.

Net investment income decreased 4.8% or $137 million to $2.72 billion in 2011 from $2.85 billion in 2010 primarily

due to lower average investment balances which were partially offset by higher yields. The higher yields are primarily

attributable to yield optimization actions including the termination of interest rate swaps during the first quarter of 2011.

Net investment income decreased 6.9% or $211 million to $2.85 billion in 2010 from $3.06 billion in 2009 primarily due

to lower yields, reduced average investment balances and risk reduction actions.

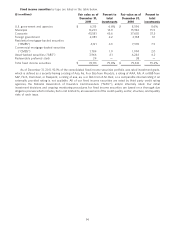

Net realized capital gains and losses are presented in the following table for the years ended December 31.

($ in millions) 2011 2010 2009

Impairment write-downs $ (246) $ (501) $ (1,021)

Change in intent write-downs (51) (142) (268)

Net other-than-temporary impairment losses

recognized in earnings (297) (643) (1,289)

Sales 838 219 638

Valuation of derivative instruments (237) (94) 315

Settlements of derivative instruments 22 (31) 41

EMA limited partnership income 62 32 (136)

Realized capital gains and losses, pre-tax 388 (517) (431)

Income tax (expense) benefit (138) 180 14

Realized capital gains and losses, after-tax $ 250 $ (337) $ (417)

For further discussion of realized capital gains and losses, see the Investments section of the MD&A.

Analysis of costs and expenses Total costs and expenses increased 0.2% or $11 million in 2011 compared to 2010

primarily due to higher amortization of DAC, partially offset by lower interest credited to contractholder funds and life

and annuity contract benefits. Total costs and expenses decreased 13.9% or $719 million in 2010 compared to 2009

primarily due to lower amortization of DAC and interest credited to contractholder funds, partially offset by higher life

and annuity contract benefits.

Life and annuity contract benefits decreased 3.0% or $54 million in 2011 compared to 2010 primarily due to reserve

reestimations recorded in second quarter 2010 that did not recur in 2011 and a $38 million reduction in accident and

health insurance reserves at Allstate Benefits as of December 31, 2011 related to a contract modification, partially offset

by unfavorable mortality experience on life insurance.

The reserve reestimations in the second quarter of 2010 utilized more refined policy level information and

assumptions. The increase in reserves for certain secondary guarantees on universal life insurance policies resulted in a

charge to contract benefits of $68 million and a related reduction in amortization of DAC of $50 million. The decrease in

reserves for immediate annuities resulted in a credit to contract benefits of $26 million. The net impact was an increase

to income of $8 million, pre-tax.

Life and annuity contract benefits increased 12.2% or $198 million in 2010 compared to 2009 primarily due to

higher contract benefits on accident and health insurance and interest-sensitive life insurance products, partially offset

by lower contract benefits on immediate annuities with life contingencies. Higher contract benefits on accident and

health insurance were proportionate to growth in premiums. The increase in contract benefits on interest-sensitive life

insurance was primarily due to the reestimation of reserves for certain secondary guarantees on universal life insurance

policies and higher mortality experience resulting from an increase in average claim size and higher incidence of claims.

Lower contract benefits on immediate annuities with life contingencies were due to the reestimation of reserves for

benefits payable to certain annuitants to reflect current contractholder information.

We analyze our mortality and morbidity results using the difference between premiums and contract charges

earned for the cost of insurance and life and annuity contract benefits excluding the portion related to the implied

interest on immediate annuities with life contingencies (‘‘benefit spread’’). This implied interest totaled $541 million in

2011, $549 million in 2010 and $558 million in 2009.

58