Allstate 2012 Annual Report Download - page 108

Download and view the complete annual report

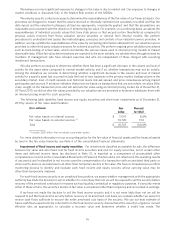

Please find page 108 of the 2012 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.estimation techniques previously described. In the normal course of business, we may also supplement our claims

processes by utilizing third party adjusters, appraisers, engineers, inspectors, and other professionals and information

sources to assess and settle catastrophe and non-catastrophe related claims.

Historically, the case reserves set by the field adjusting staff have not proven to be an entirely accurate estimate of

the ultimate cost of claims. To provide for this, a development reserve is estimated using previously described

processes, and allocated to pending claims as a supplement to case reserves. Typically, the case and supplemental

development reserves comprise about 90% of total reserves.

Another major component of reserves is IBNR. Typically, IBNR comprises about 10% of total reserves.

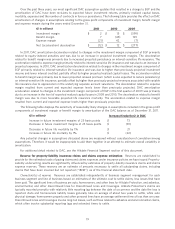

Generally, the initial reserves for a new accident year are established based on severity assumptions for different

business segments, lines and coverages based on historical relationships to relevant inflation indicators, and reserves for

prior accident years are statistically determined using processes previously described. Changes in auto current year

claim severity are generally influenced by inflation in the medical and auto repair sectors of the economy. We mitigate

these effects through various loss management programs. Injury claims are affected largely by medical cost inflation

while physical damage claims are affected largely by auto repair cost inflation and used car prices. For auto physical

damage coverages, we monitor our rate of increase in average cost per claim against a weighted average of the

Maintenance and Repair price index and the Parts and Equipment price index. We believe our claim settlement

initiatives, such as improvements to the claim review and settlement process, the use of special investigative units to

detect fraud and handle suspect claims, litigation management and defense strategies, as well as various other loss

management initiatives underway, contribute to the mitigation of injury and physical damage severity trends.

Changes in homeowners current year claim severity are generally influenced by inflation in the cost of building

materials, the cost of construction and property repair services, the cost of replacing home furnishings and other

contents, the types of claims that qualify for coverage, deductibles and other economic and environmental factors. We

employ various loss management programs to mitigate the effect of these factors.

As loss experience for the current year develops for each type of loss, it is monitored relative to initial assumptions

until it is judged to have sufficient statistical credibility. From that point in time and forward, reserves are reestimated

using statistical actuarial processes to reflect the impact actual loss trends have on development factors incorporated

into the actuarial estimation processes. Statistical credibility is usually achieved by the end of the first calendar year;

however, when trends for the current accident year exceed initial assumptions sooner, they are usually determined to be

credible, and reserves are increased accordingly.

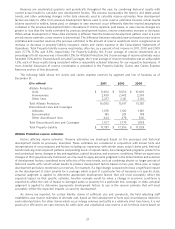

The very detailed processes for developing reserve estimates, and the lack of a need and existence of a common set

of assumptions or development factors, limits aggregate reserve level testing for variability of data elements. However,

by applying standard actuarial methods to consolidated historic accident year loss data for major loss types, comprising

auto injury losses, auto physical damage losses and homeowner losses, we develop variability analyses consistent with

the way we develop reserves by measuring the potential variability of development factors, as described in the section

titled ‘‘Potential Reserve Estimate Variability’’ below.

Causes of reserve estimate uncertainty Since reserves are estimates of unpaid portions of claims and claims

expenses that have occurred, including IBNR losses, the establishment of appropriate reserves, including reserves for

catastrophes, requires regular reevaluation and refinement of estimates to determine our ultimate loss estimate.

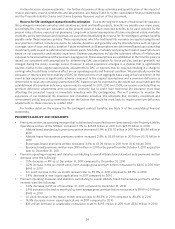

At each reporting date, the highest degree of uncertainty in estimates of losses arises from claims remaining to be

settled for the current accident year and the most recent preceding accident year. The greatest degree of uncertainty

exists in the current accident year because the current accident year contains the greatest proportion of losses that have

not been reported or settled but must be estimated as of the current reporting date. Most of these losses relate to

damaged property such as automobiles and homes, and medical care for injuries from accidents. During the first year

after the end of an accident year, a large portion of the total losses for that accident year are settled. When accident year

losses paid through the end of the first year following the initial accident year are incorporated into updated actuarial

estimates, the trends inherent in the settlement of claims emerge more clearly. Consequently, this is the point in time at

which we tend to make our largest reestimates of losses for an accident year. After the second year, the losses that we

pay for an accident year typically relate to claims that are more difficult to settle, such as those involving serious injuries

or litigation. Private passenger auto insurance provides a good illustration of the uncertainty of future loss estimates: our

typical annual percentage payout of reserves for an accident year is approximately 45% in the first year after the end of

the accident year, 20% in the second year, 15% in the third year, 10% in the fourth year, and the remaining 10%

thereafter.

22