Allstate 2012 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2012 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

coverage we issued. We also consider relevant judicial interpretations of policy language and applicable coverage

defenses or determinations, if any.

Evaluation of both the insureds’ estimated liabilities and our exposure to the insureds depends heavily on an

analysis of the relevant legal issues and litigation environment. This analysis is conducted by our specialized claims

adjusting staff and legal counsel. Based on these evaluations, case reserves are established by claims adjusting staff and

actuarial analysis is employed to develop an IBNR reserve, which includes estimated potential reserve development and

claims that have occurred but have not been reported. As of December 31, 2011 and 2010, IBNR was 59.0% and 60.1%,

respectively, of combined asbestos and environmental reserves.

For both asbestos and environmental reserves, we also evaluate our historical direct net loss and expense paid and

incurred experience to assess any emerging trends, fluctuations or characteristics suggested by the aggregate paid and

incurred activity.

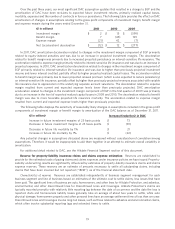

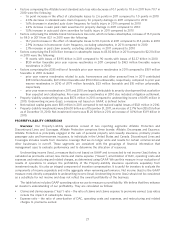

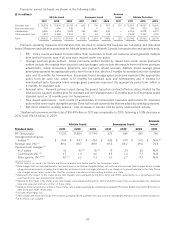

Other Discontinued Lines and Coverages The following table shows reserves for other discontinued lines which

provide for remaining loss and loss expense liabilities related to business no longer written by us, other than asbestos

and environmental, as of December 31.

($ in millions) 2011 2010 2009

Other mass torts $ 169 $ 188 $ 201

Workers’ compensation 117 116 122

Commercial and other 158 174 177

Other discontinued lines $ 444 $ 478 $ 500

Other mass torts describes direct excess and reinsurance general liability coverage provided for cumulative injury

losses other than asbestos and environmental. Workers’ compensation and commercial and other include run-off from

discontinued direct primary, direct excess and reinsurance commercial insurance operations of various coverage

exposures other than asbestos and environmental. Reserves are based on considerations similar to those previously

described, as they relate to the characteristics of specific individual coverage exposures.

Potential reserve estimate variability Establishing Discontinued Lines and Coverages net loss reserves for asbestos,

environmental and other discontinued lines claims is subject to uncertainties that are much greater than those

presented by other types of claims. Among the complications are lack of historical data, long reporting delays,

uncertainty as to the number and identity of insureds with potential exposure and unresolved legal issues regarding

policy coverage; unresolved legal issues regarding the determination, availability and timing of exhaustion of policy

limits; plaintiffs’ evolving and expanding theories of liability; availability and collectability of recoveries from reinsurance;

retrospectively determined premiums and other contractual agreements; estimates of the extent and timing of any

contractual liability; the impact of bankruptcy protection sought by various asbestos producers and other asbestos

defendants; and other uncertainties. There are also complex legal issues concerning the interpretation of various

insurance policy provisions and whether those losses are covered, or were ever intended to be covered, and could be

recoverable through retrospectively determined premium, reinsurance or other contractual agreements. Courts have

reached different and sometimes inconsistent conclusions as to when losses are deemed to have occurred and which

policies provide coverage; what types of losses are covered; whether there is an insurer obligation to defend; how policy

limits are determined; how policy exclusions and conditions are applied and interpreted; and whether clean-up costs

represent insured property damage. Our reserves for asbestos and environmental exposures could be affected by tort

reform, class action litigation, and other potential legislation and judicial decisions. Environmental exposures could also

be affected by a change in the existing federal Superfund law and similar state statutes. There can be no assurance that

any reform legislation will be enacted or that any such legislation will provide for a fair, effective and cost-efficient

system for settlement of asbestos or environmental claims. We believe these issues are not likely to be resolved in the

near future, and the ultimate costs may vary materially from the amounts currently recorded resulting in material

changes in loss reserves. Historical variability of reserve estimates is demonstrated in the Property-Liability Claims and

Claims Expense Reserves section of this document.

Adequacy of reserve estimates Management believes its net loss reserves for environmental, asbestos and other

discontinued lines exposures are appropriately established based on available facts, technology, laws, regulations, and

assessments of other pertinent factors and characteristics of exposure (i.e. claim activity, potential liability, jurisdiction,

products versus non-products exposure) presented by individual policyholders, assuming no change in the legal,

legislative or economic environment. Due to the uncertainties and factors described above, management believes it is

not practicable to develop a meaningful range for any such additional net loss reserves that may be required.

25