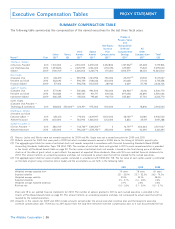

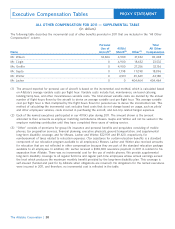

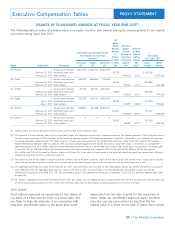

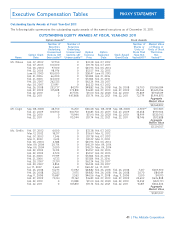

Allstate 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

change-in-control agreements agreed to become terminates the executive’s employment (other than for

participants in a new change-in-control severance plan cause, death, or disability) or the executive terminates his

(CIC Plan). Compared with the previous arrangements, the or her employment for good reason within two years after

CIC Plan eliminates all excise tax gross ups; eliminates the change-in-control (so-called ‘‘double-trigger’’ vesting).

the lump sum cash pension enhancement based on The change-in-control and post-termination arrangements

additional years of age, service, and compensation; and which are described in the Potential Payments as a Result

reduces for named executives other than the CEO the of Termination or Change-in-Control section are not

amount of cash severance payable from three to two provided exclusively to the named executives. A larger

times the sum of base salary and target annual incentive. group of management employees is eligible to receive

As a point of reference, Mr. Wilson’s change-in-control many of the post-termination benefits described in that

severance benefit on December 31, 2011, would have been section.

$7.09 million greater if the lump sum cash pension

enhancement had not been eliminated. Stock Ownership Guidelines

In order to receive the cash severance benefits under the Because we believe management’s interests must be

CIC Plan following a change-in-control, a participant must linked with those of our stockholders, we instituted stock

have been terminated (other than for cause, death, or ownership guidelines in 1996 that require each of the

disability) or the participant must have terminated named executives to own Allstate common stock worth a

employment for good reason (such as adverse changes in multiple of base salary. The Committee approved new

the terms or conditions of employment, including a guidelines effective February 20, 2012. The new guidelines

material reduction in base compensation, a material provide that an executive must hold 75% of net after-tax

change in authority, duties, or responsibilities, or a shares received as equity compensation until his or her

material change in job location) within two years following salary multiple guideline is met. The chart below shows

a change-in-control. In addition, long-term equity incentive the salary multiple guidelines and the equity holdings that

awards granted after 2011 will vest on an accelerated count towards the requirement.

basis due to a change-in-control only if either Allstate

Mr. Wilson 6x salary Meets guideline

Mr. Civgin 3x salary Meets guideline

Ms. Greffin 3x salary Meets guideline

Mr. Gupta 3x salary Must hold 75% of net after-tax shares

until guideline is met

Mr. Winter 3x salary Must hold 75% of net after-tax shares

until guideline is met

Mr. Lacher — —

• Allstate shares owned personally • Unexercised stock options

• Shares held in the Allstate 401(k) Savings Plan • Performance stock awards

• Restricted stock units

We also have a policy on insider trading that prohibits all Impact of Tax Considerations on Compensation

officers, directors, and employees from engaging in We may take a tax deduction of no more than $1 million

transactions in securities issued by Allstate or any of its per executive for compensation paid in any year to our

subsidiaries that might be considered speculative or CEO and the three other most highly compensated

hedging, such as selling short or buying or selling options. executives, excluding our CFO, as of the last day of the

fiscal year in which the compensation is paid, unless the

34

Executive Compensation

Name Guideline Status

What Counts Toward the Guideline What Does not Count Toward the Guideline

The Allstate Corporation |

PROXY STATEMENT