Allstate 2012 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2012 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

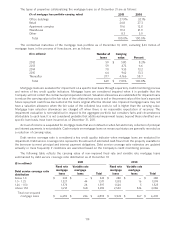

The types of properties collateralizing the mortgage loans as of December 31 are as follows:

(% of mortgage loan portfolio carrying value) 2011 2010

Office buildings 27.9% 32.1%

Retail 24.8 27.3

Apartment complex 19.6 12.8

Warehouse 19.4 21.9

Other 8.3 5.9

Total 100.0% 100.0%

The contractual maturities of the mortgage loan portfolio as of December 31, 2011, excluding $43 million of

mortgage loans in the process of foreclosure, are as follows:

($ in millions) Number of Carrying

loans value Percent

2012 59 $ 580 8.2%

2013 59 473 6.6

2014 70 935 13.2

2015 64 942 13.3

Thereafter 377 4,166 58.7

Total 629 $ 7,096 100.0%

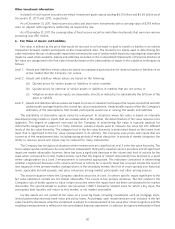

Mortgage loans are evaluated for impairment on a specific loan basis through a quarterly credit monitoring process

and review of key credit quality indicators. Mortgage loans are considered impaired when it is probable that the

Company will not collect the contractual principal and interest. Valuation allowances are established for impaired loans

to reduce the carrying value to the fair value of the collateral less costs to sell or the present value of the loan’s expected

future repayment cash flows discounted at the loan’s original effective interest rate. Impaired mortgage loans may not

have a valuation allowance when the fair value of the collateral less costs to sell is higher than the carrying value.

Mortgage loan valuation allowances are charged off when there is no reasonable expectation of recovery. The

impairment evaluation is non-statistical in respect to the aggregate portfolio but considers facts and circumstances

attributable to each loan. It is not considered probable that additional impairment losses, beyond those identified on a

specific loan basis, have been incurred as of December 31, 2011.

Accrual of income is suspended for mortgage loans that are in default or when full and timely collection of principal

and interest payments is not probable. Cash receipts on mortgage loans on nonaccrual status are generally recorded as

a reduction of carrying value.

Debt service coverage ratio is considered a key credit quality indicator when mortgage loans are evaluated for

impairment. Debt service coverage ratio represents the amount of estimated cash flows from the property available to

the borrower to meet principal and interest payment obligations. Debt service coverage ratio estimates are updated

annually or more frequently if conditions are warranted based on the Company’s credit monitoring process.

The following table reflects the carrying value of non-impaired fixed rate and variable rate mortgage loans

summarized by debt service coverage ratio distribution as of December 31:

2011 2010

($ in millions)

Fixed rate Variable rate Fixed rate Variable rate

mortgage mortgage mortgage mortgage

Debt service coverage ratio loans loans Total loans loans Total

distribution

Below 1.0 $ 345 $ — $ 345 $ 280 $ — $ 280

1.0 - 1.25 1,527 44 1,571 1,583 16 1,599

1.26 - 1.50 1,573 24 1,597 1,520 5 1,525

Above 1.50 3,214 168 3,382 2,540 546 3,086

Total non-impaired

mortgage loans $ 6,659 $ 236 $ 6,895 $ 5,923 $ 567 $ 6,490

119