Allstate 2012 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2012 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

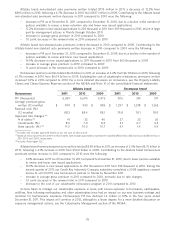

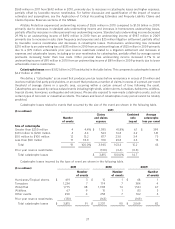

Allstate brand non-standard auto premiums written totaled $775 million in 2011, a decrease of 12.2% from

$883 million in 2010, following a 4.7% decrease in 2010 from $927 million in 2009. Contributing to the Allstate brand

non-standard auto premiums written decrease in 2011 compared to 2010 were the following:

– decrease in PIF as of December 31, 2011 compared to December 31, 2010, due to a decline in the number of

policies available to renew, a lower retention rate and fewer new issued applications

– 17.2% decrease in new issued applications to 256 thousand in 2011 from 309 thousand in 2010, driven in large

part by management actions in Florida through October 2011

– decrease in average gross premium in 2011 compared to 2010

– 1.0 point decrease in the renewal ratio in 2011 compared to 2010

Allstate brand non-standard auto premiums written decreased in 2010 compared to 2009. Contributing to the

Allstate brand non-standard auto premiums written decrease in 2010 compared to 2009 were the following:

– decrease in PIF as of December 31, 2010 compared to December 31, 2009, due to a decline in the number of

policies available to renew and fewer new issued applications

– 14.9% decrease in new issued applications to 309 thousand in 2010 from 363 thousand in 2009

– increase in average gross premium in 2010 compared to 2009

– 1.1 point decrease in the renewal ratio in 2010 compared to 2009

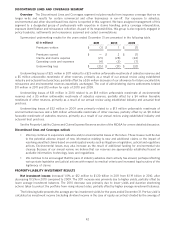

Homeowners premiums written totaled $6.26 billion in 2011, an increase of 2.4% from $6.11 billion in 2010, following

a 1.1% increase in 2010 from $6.04 billion in 2009. Excluding the cost of catastrophe reinsurance, premiums written

increased 1.6% in 2011 compared to 2010. For a more detailed discussion on reinsurance, see the Property-Liability

Claims and Claims Expense Reserves section of the MD&A and Note 10 of the consolidated financial statements.

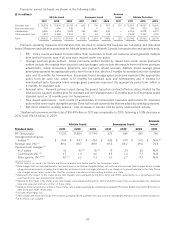

Allstate brand Encompass brand

Homeowners 2011 2010 2009 2011 2010 2009

PIF (thousands) 6,369 6,690 6,973 306 314 371

Average premium-gross

written (12 months) $ 999 $ 943 $ 883 $ 1,297 $ 1,298 $ 1,265

Renewal ratio (%)

(12 months) 88.3 88.4 88.1 79.8 78.1 78.9

Approved rate changes (1):

# of states (3) 41 32 40 27 23 36

Countrywide (%) 8.6 7.0 8.4 3.1 0.7 4.4

State specific (%) (2) 11.0 10.0 10.7 4.1 1.4 5.9

(1) Includes rate changes approved based on our net cost of reinsurance.

(2) Based on historical premiums written in those states, rate changes approved for homeowners totaled $533 million, $424 million and $534 million in

2011, 2010 and 2009, respectively.

(3) Includes Washington D.C.

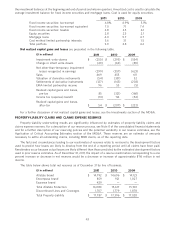

Allstate brand homeowners premiums written totaled $5.89 billion in 2011, an increase of 2.4% from $5.75 billion in

2010, following a 2.1% increase in 2010 from $5.64 billion in 2009. Contributing to the Allstate brand homeowners

premiums written increase in 2011 compared to 2010 were the following:

– 4.8% decrease in PIF as of December 31, 2011 compared to December 31, 2010, due to fewer policies available

to renew and fewer new issued applications

– 14.9% decrease in new issued applications to 456 thousand in 2011 from 536 thousand in 2010. During the

second quarter of 2011, our Castle Key Indemnity Company subsidiary completed a 2008 regulatory consent

decree to sell 50,000 new homeowners policies in Florida by November 2011.

– increase in average gross premium in 2011 compared to 2010, primarily due to rate changes

– 0.1 point decrease in the renewal ratio in 2011 compared to 2010

– decrease in the cost of our catastrophe reinsurance program in 2011 compared to 2010

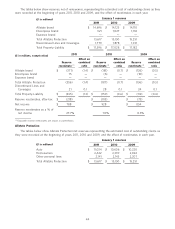

Actions taken to manage our catastrophe exposure in areas with known exposure to hurricanes, earthquakes,

wildfires, fires following earthquakes and other catastrophes have had an impact on our new business writings and

retention for homeowners insurance. Homeowners PIF has declined 1.2 million or 16% in the four years ended

December 31, 2011. This impact will continue in 2012, although to a lesser degree. For a more detailed discussion on

exposure management actions, see the Catastrophe Management section of the MD&A.

35