Allstate 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Regulation limiting rate increases and requiring us to underwrite business and participate in loss sharing

arrangements may adversely affect our operating results and financial condition

From time to time, political events and positions affect the insurance market, including efforts to suppress rates to a

level that may not allow us to reach targeted levels of profitability. For example, if Allstate Protection’s loss ratio

compares favorably to that of the industry, state regulatory authorities may impose rate rollbacks, require us to pay

premium refunds to policyholders, or resist or delay our efforts to raise rates even if the property and casualty industry

generally is not experiencing regulatory resistance to rate increases. Such resistance affects our ability, in all product

lines, to obtain approval for rate changes that may be required to achieve targeted levels of profitability and returns on

equity. Our ability to afford reinsurance required to reduce our catastrophe risk in designated areas may be dependent

upon the ability to adjust rates for its cost.

In addition to regulating rates, certain states have enacted laws that require a property-liability insurer conducting

business in that state to participate in assigned risk plans, reinsurance facilities and joint underwriting associations or

require the insurer to offer coverage to all consumers, often restricting an insurer’s ability to charge the price it might

otherwise charge. In these markets, we may be compelled to underwrite significant amounts of business at lower than

desired rates, possibly leading to an unacceptable return on equity, or as the facilities recognize a financial deficit, they

may in turn have the ability to assess participating insurers, adversely affecting our results of operations and financial

condition. Laws and regulations of many states also limit an insurer’s ability to withdraw from one or more lines of

insurance in the state, except pursuant to a plan that is approved by the state insurance department. Additionally,

certain states require insurers to participate in guaranty funds for impaired or insolvent insurance companies. These

funds periodically assess losses against all insurance companies doing business in the state. Our operating results and

financial condition could be adversely affected by any of these factors.

The potential benefits of our sophisticated risk segmentation process may not be fully realized

We believe that pricing sophistication and underwriting (including Strategic Risk Management which, in some

situations, considers information that is obtained from credit reports among other factors) has allowed us to be more

competitive and operate more profitably. However, because many of our competitors have adopted underwriting criteria

and sophisticated pricing models similar to those we use and because other competitors may follow suit, our

competitive advantage could decline or be lost. Further, the use of insurance scoring from information that is obtained

from credit reports as a factor in underwriting and pricing has at times been challenged by regulators, legislators,

litigants and special interest groups in various states. Competitive pressures could also force us to modify our pricing

sophistication model. Furthermore, we cannot be assured that these pricing sophistication models will accurately reflect

the level of losses that we will ultimately incur.

Allstate Protection’s operating results and financial condition may be adversely affected by the cyclical

nature of the property and casualty business

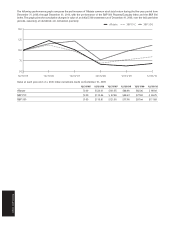

The property and casualty market is cyclical and has experienced periods characterized by relatively high levels of

price competition, less restrictive underwriting standards and relatively low premium rates, followed by periods of

relatively lower levels of competition, more selective underwriting standards and relatively high premium rates. A

downturn in the profitability cycle of the property and casualty business could have a material adverse effect on our

operating results and financial condition.

Risks Relating to the Allstate Financial Segment

Changes in underwriting and actual experience could materially affect profitability and financial condition

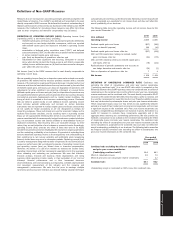

Our product pricing includes long-term assumptions regarding investment returns, mortality, morbidity, persistency

and operating costs and expenses of the business. We establish target returns for each product based upon these

factors and the average amount of capital that we must hold to support in-force contracts taking into account rating

agencies and regulatory requirements. We monitor and manage our pricing and overall sales mix to achieve target new

business returns on a portfolio basis, which could result in the discontinuation or de-emphasis of products or

distribution relationships and a decline in sales. Profitability from new business emerges over a period of years

depending on the nature and life of the product and is subject to variability as actual results may differ from pricing

assumptions. Additionally, many of our products have fixed or guaranteed terms that limit our ability to increase

revenues or reduce benefits, including credited interest, once the product has been issued.

Our profitability in this segment depends on the adequacy of investment spreads, the management of market and

credit risks associated with investments, the sufficiency of premiums and contract charges to cover mortality and

morbidity benefits, the persistency of policies to ensure recovery of acquisition expenses, and the management of

3

Risk Factors