Allstate 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

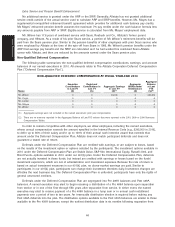

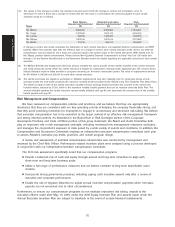

(2) See the Non-Qualified Deferred Compensation section for additional information on the Deferred Compensation Plan and distribution options

available.

(3) Examples of ‘‘Involuntary Termination’’ independent of a change-in-control include performance-related terminations; terminations for employee

dishonesty and violation of Allstate rules, regulations, or policies; and terminations resulting from lack of work, rearrangement of work, and

reduction in force.

(4) Retirement for purposes of the annual cash incentive plan is defined as voluntary termination on or after the date the named executive attains

age 55 with at least twenty 20 years of service. The ‘‘normal retirement date’’ under the equity awards is the date on or after the date the

named executive attains age 60 with at least one year of service. The ‘‘health retirement date’’ is the date on which the named executive

terminates for health reasons after attaining age 50, but before attaining age 60, with at least ten years of continuous service. The ‘‘early

retirement date’’ is the date the named executive attains age 55 with 20 years of service.

(5) In general, a change-in-control is one or more of the following events: (1) any person acquires 30% or more of the combined voting power of

Allstate common stock within a 12-month period; (2) any person acquires more than 50% of the combined voting power of Allstate common

stock; (3) certain changes are made to the composition of the Board; or (4) the consummation of a merger, reorganization, or similar

transaction. These triggers were selected because, in a widely held company the size of Allstate, they could each result in a substantial change

in management. Effective upon a change-in-control, the named executives become subject to covenants prohibiting competition and solicitation

of employees, customers, and suppliers at any time until one year after termination of employment. During the two-year period following a

change-in-control, the change-in-control agreements provide for a minimum salary, annual cash incentive awards, and other benefits. In

addition, they provide that the named executives’ positions, authority, duties, and responsibilities will be at least commensurate in all material

respects with those held prior to the change-in-control. If a named executive incurs legal fees or other expenses in an effort to enforce the

change-in-control agreement, Allstate will reimburse the named executive for these expenses unless it is established by a court that the named

executive had no reasonable basis for the claim or acted in bad faith.

(6) Under the change-in-control agreements, severance benefits would be payable if a named executive’s employment is terminated either by

Allstate without ‘‘cause’’ or by the executive for ‘‘good reason’’ as defined in the agreements during the two-year period following the

change-in-control. Cause means the named executive has been convicted of a felony or other crime involving fraud or dishonesty, has willfully

or intentionally breached the change-in-control agreement, has habitually neglected his or her duties, or has engaged in willful or reckless

material misconduct in the performance of his or her duties. Good reason includes a material diminution in a named executive’s base

compensation, authority, duties, or responsibilities, a material change in the geographic location where the named executive performs services,

or a material breach of the change-in-control agreement by Allstate.

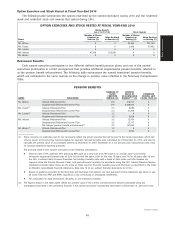

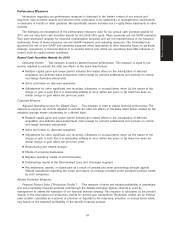

The pension enhancement is a lump sum payment equal to the positive difference, if any, between: (a) the sum of the lump-sum values of each

maximum annuity that would be payable to the named executive under any defined benefit plan (whether or not qualified under Section 401(a)

of the Internal Revenue Code) if the named executive had: (i) become fully vested in all such benefits, (ii) attained as of the named executive’s

termination date an age that is three years greater than named executive’s actual age, (iii) accrued a number of years of service that is three

years greater than the number of years of service actually accrued by the named executive as of the named executive’s termination date, and

(iv) received a lump-sum severance benefit consisting of three times base salary, three times annual incentive cash compensation calculated at

target, plus the 2010 annual incentive cash award as covered compensation in equal monthly installments during the three-year period

following the named executive’s termination date; and (b) the lump-sum values of the maximum annuity benefits vested and payable to named

executive under each defined benefit plan that is qualified under Section 401(a) of the Internal Revenue Code plus the aggregate amounts

simultaneously or previously paid to the named executive under the defined benefit plans (whether or not qualified under Section 401(a)). The

calculation of the lump sum amounts payable under this formula does not impact the benefits payable under the ARP, or the SRIP.

(7) If a named executive’s employment is terminated by reason of death during the two-year period commencing on the date of a

change-in-control, the named executive’s estate or beneficiary will be entitled to survivor and other benefits, including retiree medical coverage,

if eligible, that are not less favorable than the most favorable benefits available to the estates or surviving families of peer executives of

Allstate. In the event of termination by reason of disability, Allstate will pay disability and other benefits, including supplemental long-term

disability benefits and retiree medical coverage, if eligible, that are not less favorable than the most favorable benefits available to disabled peer

executives. In addition, such survivor or disability benefits shall not be materially less favorable, in the aggregate, than the most favorable

benefits in effect during the 90-day period preceding the change-in-control.

50

Proxy Statement