Allstate 2011 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

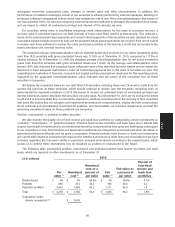

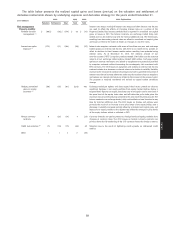

As of December 31, 2010, our below investment grade CMBS with gross unrealized losses and with

other-than-temporary impairments recorded in earnings had incurred actual cumulative collateral losses of 2.3%. The

projected additional collateral loss rate for these securities as of December 31, 2010 was 29.2%. As the average

remaining credit enhancement for these securities of 20.7% is insufficient to withstand the projected additional

collateral losses, we have recognized cumulative write-downs in earnings on these securities as reflected in the table

above using our calculated recovery value at the time of impairment. The current average recovery value of these

securities as a percentage of par was 61.3% and exceeded these securities’ current average amortized cost as a

percentage of par of 61.2%, which demonstrates our conclusion that the nature of the remaining unrealized loss on

these securities is temporary and will reverse over time. The comparison indicates that recovery value is in line with

amortized cost as impairment write-downs were recorded in the reporting period based on a comprehensive evaluation

of financial, economic and capital markets assumptions developed for this reporting period.

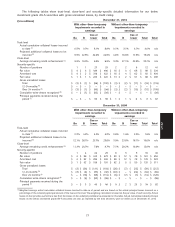

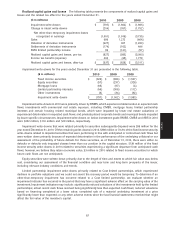

The following table shows actual trust-level key metrics specific to the trusts from which our below investment

grade CMBS with gross unrealized losses were issued, as reported by the trust servicers.

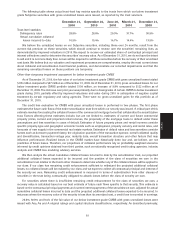

December 31, September 30, June 30, March 31, December 31,

2010 2010 2010 2010 2009

Trust-level statistics

Delinquency rates 7.2% 8.3% 8.5% 8.6% 5.2%

Actual cumulative collateral

losses incurred to date 1.4% 2.9% 1.6% 0.8% 0.3%

We believe the unrealized losses on our CMBS, including those over 24 months, result from the current risk

premium on these securities, which should continue to reverse over the securities’ remaining lives, as demonstrated by

improved valuations during 2010. We expect to receive our estimated share of contractual principal and interest

collections used to determine the securities’ recovery value. As of December 31, 2010, we do not have the intent to sell

and it is not more likely than not we will be required to sell these securities before the recovery of their amortized cost

basis. We believe that our valuation and impairment processes are comprehensive, employ the most current views about

collateral and securitization trust financial positions, and demonstrate our recorded impairments and that the remaining

unrealized losses on these positions are temporary.

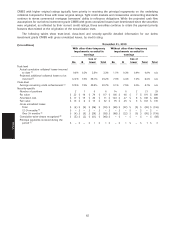

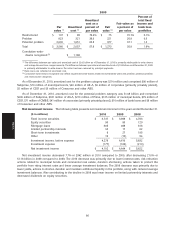

Other-than-temporary impairment assessment for below investment grade cash flow CLO ABS

As of December 31, 2010, the fair value for our below investment grade cash flow CLO portfolio with gross

unrealized losses totaled $169 million compared to $188 million as of December 31, 2009. The gross unrealized losses

for these securities totaled $48 million as of December 31, 2010, a decrease of 51.5%, compared to $99 million as of

December 31, 2009, primarily due to higher valuations resulting from lower risk premiums and upgrades of certain cash

flow CLO to investment grade during 2010. Gross unrealized gains for these securities were $53 million as of

December 31, 2010. For below investment grade cash flow CLO with gross unrealized gains, we have recognized

cumulative write-downs in earnings totaling $85 million.

As of December 31, 2010, none of our below investment grade cash flow CLO portfolio with gross unrealized losses

have other-than-temporary impairments recorded in earnings and all of the gross unrealized losses are aged over

24 months.

Cash flow CLO are collateralized primarily by below investment grade senior secured corporate loans and are

structured with overcollateralization which serves as credit enhancement for the class of securities we own.

Overcollateralization ratios are based on the par value of the collateral in the underlying portfolio as a percentage of the

notes issued as cash flow CLO securities. The performance of these securities is impacted primarily by defaults and

recoveries of the underlying collateral within the structures, which reduce overcollateralization ratios over time. A

violation of the senior overcollateralization test could result in an event of default of the structure which would give the

controlling class, generally defined as the majority of the senior lenders, certain rights, including the ability to divert

cash flows or liquidate the underlying portfolio to pay off the senior liabilities.

The credit loss evaluation for cash flow CLO is performed in two phases. The first phase evaluates the

overcollateralization that exists for the class of securities we own. A critical part of this estimate involves projections of

future losses formulated through our assessment of the corporate loan markets, and considers opinions from third

parties, such as industry analysts and strategists, credit rating agencies, our own participation in these markets, as well

as our overall economic outlook for indicators such as unemployment and GDP. The expected performance of each

security considers anticipated collateral losses and credit enhancement levels, as well as factors including default rates,

84

MD&A