Allstate 2011 Annual Report Download - page 224

Download and view the complete annual report

Please find page 224 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

collateral. The fair value of limited partnership interests accounted for on the cost basis is determined using reported

net asset values of the underlying funds. The fair value of bank loans, which are reported in other investments on the

Consolidated Statements of Financial Position, are based on broker quotes from brokers familiar with the loans and

current market conditions.

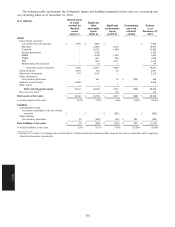

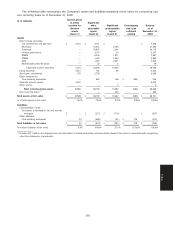

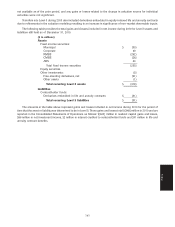

Financial liabilities

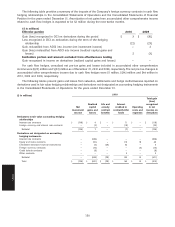

December 31, 2010 December 31, 2009

($ in millions)

Carrying Fair Carrying Fair

value value value value

Contractholder funds on investment contracts $ 36,163 $ 35,194 $ 40,943 $ 39,328

Long-term debt 5,908 6,325 5,910 6,016

Liability for collateral 484 484 658 658

The fair value of contractholder funds on investment contracts is based on the terms of the underlying contracts

utilizing prevailing market rates for similar contracts adjusted for the Company’s own credit risk. Deferred annuities

included in contractholder funds are valued using discounted cash flow models which incorporate market value

margins, which are based on the cost of holding economic capital, and the Company’s own credit risk. Immediate

annuities without life contingencies and fixed rate funding agreements are valued at the present value of future benefits

using market implied interest rates which include the Company’s own credit risk.

The fair value of long-term debt is based on market observable data (such as the fair value of the debt when traded

as an asset) or, in certain cases, is determined using discounted cash flow calculations based on current interest rates

for instruments with comparable terms and considers the Company’s own credit risk. The liability for collateral is valued

at carrying value due to its short-term nature.

6. Derivative Financial Instruments and Off-balance-sheet Financial Instruments

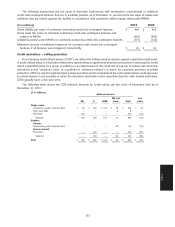

The Company primarily uses derivatives for risk management, to partially mitigate potential adverse impacts from

changes in risk-free interest rates, negative equity market valuations and increases in credit spreads, and asset

replication. In addition, the Company has derivatives embedded in non-derivative host contracts that are required to be

separated from the host contracts and accounted for at fair value. With the exception of non-hedge derivatives used for

asset replication and non-hedge embedded derivatives, all of the Company’s derivatives are evaluated for their ongoing

effectiveness as either accounting hedge or non-hedge derivative financial instruments on at least a quarterly basis. The

Company does not use derivatives for trading purposes. Non-hedge accounting is generally used for ‘‘portfolio’’ level

hedging strategies where the terms of the individual hedged items do not meet the strict homogeneity requirements to

permit the application of hedge accounting.

Property-Liability uses interest rate swaption contracts and exchange traded options on interest rate futures to

offset potential declining fixed income market values resulting from potential rising interest rates. Property-Liability also

uses interest rate swaps to mitigate municipal bond interest rate risk within the municipal bond portfolio. Exchange

traded equity put options are utilized by Property-Liability for overall equity portfolio protection from significant declines

in equity market values below a targeted level. Equity index futures are used by Property-Liability to offset valuation

losses in the equity portfolio during periods of declining equity market values. Credit default swaps are typically used to

mitigate the credit risk within the Property-Liability fixed income portfolio.

Portfolio duration management is a risk management strategy that is principally employed by Property-Liability

wherein, depending on the current portfolio duration relative to a designated target and the expectations of future

interest rate movements, financial futures and interest rate swaps are utilized to change the duration of the portfolio in

order to offset the economic effect that interest rates would otherwise have on the fair value of its fixed income

securities.

Property-Liability uses futures to hedge the market risk related to deferred compensation liability contracts and

forward contracts to hedge foreign currency risk associated with holding foreign currency denominated investments

and foreign operations.

Allstate Financial uses foreign currency swaps primarily to reduce the foreign currency risk associated with issuing

foreign currency denominated funding agreements and holding foreign currency denominated investments. Credit

default swaps are also typically used to mitigate the credit risk within the Allstate Financial fixed income portfolio.

144

Notes