Allstate 2011 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Reduced our commercial real estate exposure by 18.7% or $2.31 billion of amortized cost primarily through

targeted dispositions and principal repayments from borrowers.

• Maintained hedges to protect our portfolio, primarily against interest rate spikes and equity price declines,

which performed consistently with our positions in relation to the movement in the underlying market indices.

The resulting realized capital losses from our interest rate and equity hedges were offset by the increase in fair

value of our fixed income and equity securities, which is reflected in other comprehensive income (‘‘OCI’’).

Investments outlook

For 2011, we expect the U.S. and other developed economies to recover at a moderate pace, with greater growth in

developing and emerging countries. These increasing growth expectations should move equity prices higher. Expected

tightening of monetary policy will drive interest rates moderately higher. With expected growth in the economy, credit

markets should continue to improve, but challenges will remain in certain segments such as municipal bonds. As a

result, we plan to focus on the following priorities:

• Optimizing our allocation of assets to align with changes in Allstate Financial’s liabilities.

• Continuing to explore global investments in areas of emerging opportunity with higher prospects for growth.

• Managing the impact of gradually rising rates on our fixed income portfolio.

• Continuing to favor credit risk, while managing our municipal exposure.

As a result of these actions and market conditions:

• Invested assets and income are expected to decline in line with reductions in contractholder obligations for the

Allstate Financial segment.

• Our risk and return optimization actions will allow us to maintain portfolio yields comparable to 2010.

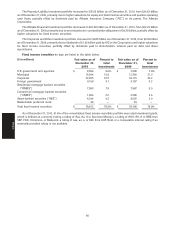

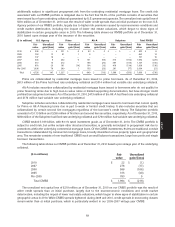

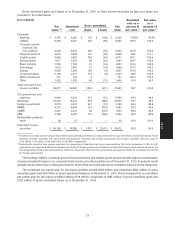

Portfolio composition The composition of the investment portfolios as of December 31, 2010 is presented in the

table below. Also see Notes 2 and 4 of the consolidated financial statements for investment accounting policies and

additional information.

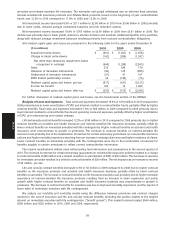

Property- Allstate Corporate and($ in millions)

Liability (5) Financial (5) Other (5) Total

Percent Percent Percent Percent

to total to total to total to total

Fixed income securities (1) $ 27,413 78.2% $ 49,934 81.1% $ 2,265 58.8% $ 79,612 79.2%

Equity securities (2) 4,578 13.1 233 0.4 — — 4,811 4.8

Mortgage loans 18 0.1 6,661 10.8 — — 6,679 6.6

Limited partnership interests (3) 2,506 7.1 1,274 2.1 36 0.9 3,816 3.8

Short-term (4) 430 1.2 1,297 2.1 1,552 40.3 3,279 3.3

Other 103 0.3 2,183 3.5 — — 2,286 2.3

Total $ 35,048 100.0% $ 61,582 100.0% $ 3,853 100.0% $ 100,483 100.0%

(1) Fixed income securities are carried at fair value. Amortized cost basis for these securities was $27.38 billion, $49.19 billion and $2.22 billion for

Property-Liability, Allstate Financial and Corporate and Other, respectively.

(2) Equity securities are carried at fair value. Cost basis for these securities was $4.04 billion and $185 million for Property-Liability and Allstate

Financial, respectively.

(3) We have commitments to invest in additional limited partnership interests totaling $740 million and $731 million for Property-Liability and Allstate

Financial, respectively.

(4) Short-term investments are carried at fair value. Amortized cost basis for these investments was $430 million, $1.30 billion and $1.55 billion for

Property-Liability, Allstate Financial and Corporate and Other, respectively.

(5) Balances reflect the elimination of related party investments between segments.

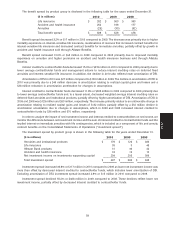

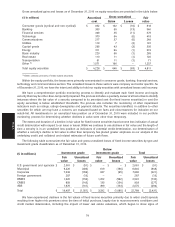

Total investments increased to $100.48 billion as of December 31, 2010, from $99.83 billion as of December 31, 2009,

primarily due to higher valuations for fixed income securities, partially offset by net reductions in contractholder

obligations. Valuations of fixed income securities are typically driven by a combination of changes in relevant risk-free

interest rates and credit spreads over the period. Risk-free interest rates are typically defined as the yield on U.S.

Treasury securities, whereas credit spread is the additional yield on fixed income securities above the risk-free rate that

market participants require to compensate them for assuming credit, liquidity and/or prepayment risks. The increase in

valuation of fixed income securities during 2010 was mainly due to declining risk-free interest rates and tightening of

credit spreads in certain sectors.

65

MD&A