Allstate 2011 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

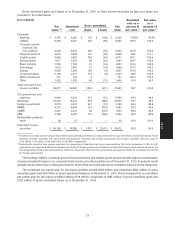

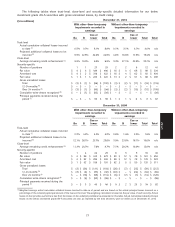

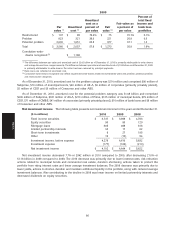

December 31, 2009

Without

With other-than-temporary other-than-temporary

impairments recorded in impairments recorded in

earnings earnings

Caa or Caa or

Ba B lower Total Ba B lower Total Total

Trust-level

Actual cumulative collateral losses incurred to

date (1) 1.4% 0.6% —% 0.8% —% —% —% —% n/a

Projected additional collateral losses to be

incurred (2) 20.1% 13.5% —% 15.0% 6.1% 7.7% —% 6.7% n/a

Class-level

Average remaining credit enhancement (3) 17.4% 9.8% —% 11.5% 9.1% 8.5% —% 8.9% n/a

Security-specific

Number of positions 1 5 — 6 6 6 — 12 18

Par value $ 20 $ 69 $ — $ 89 $ 87 $ 49 $ — $ 136 $ 225

Amortized cost $ 14 $ 41 $ — $ 55 $ 84 $ 50 $ — $ 134 $ 189

Fair value $ 9 $ 16 $ — $ 25 $ 29 $ 13 $ — $ 42 $ 67

Gross unrealized losses

Total $ (5) $ (25) $ — $ (30) $ (55) $ (37) $ — $ (92) $ (122)

12-24 months (4) $ — $ — $ — $ — $ (13) $ — $ — $ (13) $ (13)

Over 24 months (5) $ (5) $ (25) $ — $ (30) $ (42) $ (37) $ — $ (79) $ (109)

Cumulative write-downs recognized (6) $ (7) $ (34) $ — $ (41) $ — $ — $ — $ — $ (41)

Principal payments received during the

period (7) $1$—$—$1$1$—$—$ 1$ 2

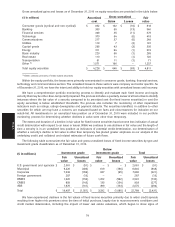

(1) Weighted average actual cumulative collateral losses incurred to date as of period end are based on the actual principal losses incurred as a

percentage of the remaining principal amount of the loans in the trust. The weighting calculation is based on the par value of each security. Actual

losses on the securities we hold are less than the losses on the underlying collateral as presented in this table. There were no actual cumulative

realized principal losses on the below investment grade CMBS we own, as reported by the trust servicers, as of December 31, 2010.

(2) Weighted average projected additional collateral losses to be incurred as of period end are based on our projections of future losses to be incurred

by the trust, taking into consideration the actual cumulative collateral losses incurred to date, as a percentage of the remaining principal amount of

the loans in the trust. Our projections are developed internally and customized to our specific holdings and are informed by and benchmarked

against credit opinions obtained from third parties, such as industry analysts, nationally recognized credit rating agencies and CMBS loss modeling

advisory services. Projected additional collateral losses to be incurred are compared to average remaining credit enhancement for each security. For

securities where the projected additional collateral losses exceed remaining credit enhancement, a recovery value is calculated to determine

whether impairment losses should be recorded in earnings. The weighting calculation is based on the par value of each security.

(3) Weighted average remaining credit enhancement as of period end is based on structural subordination and reflects our projection of future

principal losses that can occur as a percentage of the remaining principal amount of the loans in the trust before the class of the security we own

will incur its first dollar of principal loss. The weighting calculation is based on the par value of each security.

(4) Includes total gross unrealized losses on securities in an unrealized loss position for a period of 12 to 24 consecutive months.

(5) Includes total gross unrealized losses on securities in an unrealized loss position for a period more than 24 consecutive months. As of December 31,

2010, $39 million of unrealized losses on securities with other-than-temporary impairments recognized in earnings and $93 million of unrealized

losses on securities without other-than-temporary impairments recognized in earnings have been greater than or equal to 20% of those securities’

amortized cost for a period of more than 24 consecutive months. As of December 31, 2009, there were no CMBS with gross unrealized losses

greater than or equal to 20% for a period of more than 24 consecutive months.

(6) Includes cumulative write-downs recorded in accordance with GAAP.

(7) Reflects principal payments for the years ended December 31, 2010 and 2009, respectively.

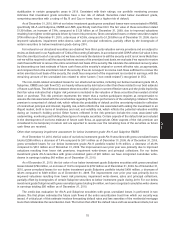

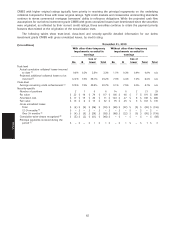

The above tables include information about below investment grade CMBS with gross unrealized losses as of each

period presented. The par value and composition of securities included can vary significantly from period to period due

to changes in variables such as credit ratings, principal payments, sales and purchases.

Our impairment evaluation for CMBS forecasts more severe assumptions than the trusts are actually experiencing.

We assume that all loans delinquent 60 days or more default and project default rates on otherwise performing loans.

Projected loss severities are then applied against the resulting default rates, arriving at our projected additional

collateral loss rates. The projected additional collateral loss rates by vintage year of our CMBS portfolio range from a low

of 1.5% for holdings with a vintage year of 2001 to a high of 11.1% for holdings with a vintage year of 2005.

As of December 31, 2010, our below investment grade CMBS with gross unrealized losses and without

other-than-temporary impairments recorded in earnings had incurred actual cumulative collateral losses of 0.9%, and

the projected additional collateral loss rate for these securities as of December 31, 2010 was 6.4%. As the average

remaining credit enhancement for these securities of 8.7% exceeds the projected additional collateral losses of 6.4%,

these securities have not been impaired.

83

MD&A