Allstate 2011 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

During 2008, indicators emerged that suggested a study of mortality experience for our immediate annuities with

life contingences was warranted. At the same time, the underlying profitability of the traditional life insurance business

deteriorated due to lower investment returns and growth. For traditional life insurance and immediate annuities with life

contingencies, an aggregate premium deficiency of $336 million resulted primarily from the experience study indicating

that the annuitants on certain life contingent contracts are projected to live longer than we anticipated when the

contracts were issued and, to a lesser degree, a reduction in the related investment portfolio yield. The deficiency was

recorded through a reduction in DAC. There was no similar charge to income recorded in 2010 or 2009.

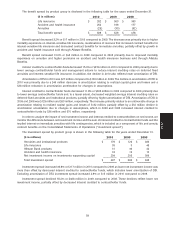

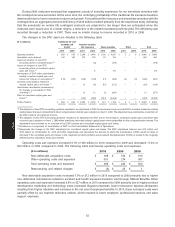

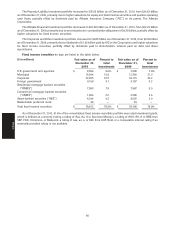

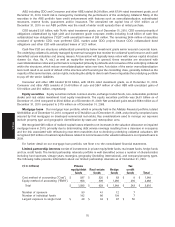

The changes in the DAC asset are detailed in the following table.

Traditional life and($ in millions)

accident and Interest-sensitive

health life insurance Fixed annuities Other Total

2010 2009 2010 2009 2010 2009 2010 2009 2010 2009

Beginning balance $ 650 $ 595 $ 2,246 $ 2,449 $ 1,159 $ 4,037 $ 5 $ 8 $ 4,060 $ 7,089

Acquisition costs deferred 156 162 275 230 52 103 — — 483 495

Impact of adoption of new OTTI

accounting before unrealized impact (1) — — — (6) — (170) — — — (176)

Impact of adoption of new OTTI

accounting effect of unrealized capital

gains and losses (2) ——— 6—170———176

Amortization of DAC before amortization

relating to realized capital gains and

losses and changes in assumptions (3) (113) (107) (140) (176) (71) (186) (2) (3) (326) (472)

Accretion (amortization) relating to

realized capital gains and losses (3) — — 15 (4) (57) (212) — — (42) (216)

Amortization deceleration (acceleration)

for changes in assumptions (‘‘DAC

unlocking’’) (3) — — 13 12 (1) (289) — — 12 (277)

Effect of unrealized capital gains and

losses (4) — — (144) (265) (651) (2,294) — — (795) (2,559)

Ending balance $ 693 $ 650 $ 2,265 $ 2,246 $ 431 $ 1,159 $ 3 $ 5 $ 3,392 $ 4,060

(1) The adoption of new OTTI accounting guidance resulted in an adjustment to DAC to reverse previously recorded DAC accretion related to realized

capital losses that were reclassified to other comprehensive income upon adoption on April 1, 2009. The adjustment was recorded as a reduction of

the DAC balance and retained income.

(2) The adoption of new OTTI accounting guidance resulted in an adjustment to DAC due to the change in unrealized capital gains and losses that

occurred upon adoption on April 1, 2009 when previously recorded realized capital losses were reclassified to other comprehensive income. The

adjustment was recorded as an increase of the DAC balance and unrealized capital gains and losses.

(3) Included as a component of amortization of DAC on the Consolidated Statements of Operations.

(4) Represents the change in the DAC adjustment for unrealized capital gains and losses. The DAC adjustment balance was $75 million and

$870 million as of December 31, 2010 and 2009, respectively, and represents the amount by which the amortization of DAC would increase or

decrease if the unrealized gains and losses in the respective product portfolios were realized. Recapitalization of DAC is limited to the originally

deferred policy acquisition costs plus interest.

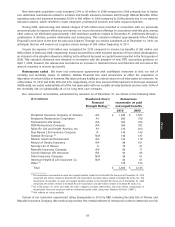

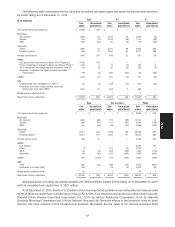

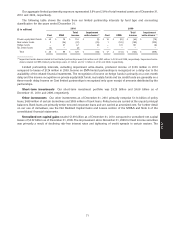

Operating costs and expenses increased 9.1% or $39 million in 2010 compared to 2009 and decreased 17.3% or

$90 million in 2009 compared to 2008. The following table summarizes operating costs and expenses.

($ in millions) 2010 2009 2008

Non-deferrable acquisition costs $ 168 $ 156 $ 153

Other operating costs and expenses 301 274 367

Total operating costs and expenses $ 469 $ 430 $ 520

Restructuring and related charges $ (3) $ 25 $ 1

Non-deferrable acquisition costs increased 7.7% or $12 million in 2010 compared to 2009 primarily due to higher

non-deferrable commissions related to accident and health insurance business sold through Allstate Benefits. Other

operating costs and expenses increased 9.9% or $27 million in 2010 compared to 2009 primarily due to higher product

development, marketing and technology costs, increased litigation expenses, lower reinsurance expense allowances

resulting from higher retention and increases in the net cost of employee benefits. In 2010, these increased costs were

partially offset by our expense reduction actions, which resulted in lower employee, professional services and sales

support expenses.

62

MD&A