Allstate 2011 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Discontinued Lines and Coverages outlook

• We may continue to experience asbestos and/or environmental losses in the future. These losses could be due

to the potential adverse impact of new information relating to new and additional claims or the impact of

resolving unsettled claims based on unanticipated events such as litigation or legislative, judicial and

regulatory actions. Environmental losses may also increase as the result of additional funding for

environmental site cleanup. Because of our annual grounds up review, we believe that our reserves are

appropriately established based on available information, technology, laws and regulations.

• We continue to be encouraged that the pace of industry asbestos claim activity has slowed, perhaps reflecting

various state legislative and judicial actions with respect to medical criteria and increased legal scrutiny of the

legitimacy of claims.

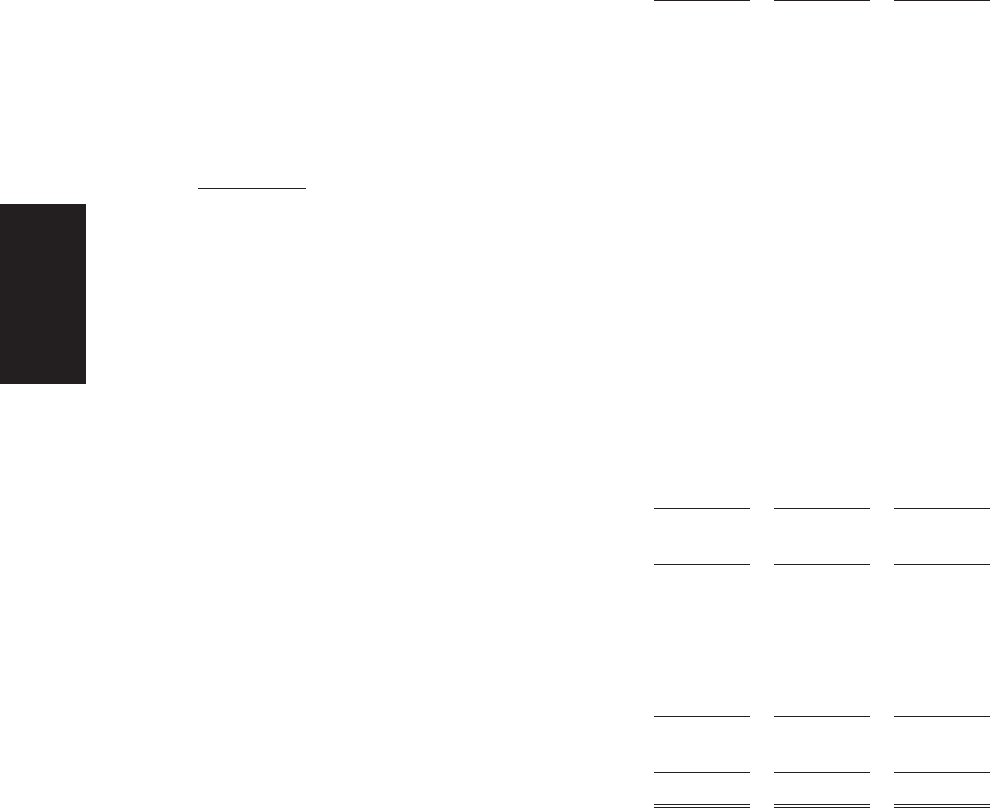

PROPERTY-LIABILITY INVESTMENT RESULTS

Net investment income decreased 10.5% or $139 million to $1.19 billion in 2010 from $1.33 billion in 2009, after

decreasing 20.7% in 2009 compared to 2008. The 2010 decrease was primarily due to lower yields and duration

shortening actions taken to protect the portfolio from rising interest rates, partially offset by higher average investment

balances. The 2009 decrease was primarily due to reduced portfolio yields, actions to shorten duration and maintain

additional liquidity in the portfolio, lower average investment balances and capital contributions to Allstate Life

Insurance Company (‘‘ALIC’’).

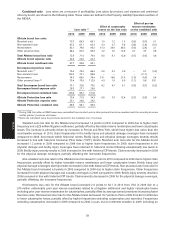

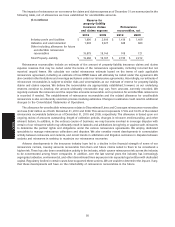

The following table presents the average pre-tax investment yields for the year ended December 31.

2010 (1)(2) 2009 (1)(2) 2008 (1)(2)

Fixed income securities: tax-exempt 4.9% 5.1% 5.1%

Fixed income securities: tax-exempt equivalent 7.1 7.4 7.4

Fixed income securities: taxable 3.5 4.1 5.6

Equity securities 2.3 2.1 3.0

Mortgage loans 5.7 4.7 6.1

Limited partnership interests (3)(4) 3.1 1.5 2.6

Total portfolio (4) 3.8 4.2 4.8

(1) Pre-tax yield is calculated as investment income (including dividend income in the case of equity securities) divided by

the average of the investment balances at the beginning and end of period and interim quarters.

(2) Amortized cost basis is used to calculate the average investment balance for fixed income securities and mortgage

loans. Cost is used for equity securities. Cost or the equity method of accounting basis is used for limited partnership

interests.

(3) Beginning in the fourth quarter of 2008, income from limited partnerships accounted for on the equity method of

accounting (‘‘EMA LP’’) is reported in realized capital gains and losses and is therefore excluded from the

determination of pre-tax investment yields on limited partnership interests. EMA LP income for periods prior to the

fourth quarter of 2008 is reported in net investment income and included in the determination of pre-tax investment

yields on limited partnership interests. For periods beginning with the fourth quarter of 2008, EMA LP’s have been

removed from the yield calculation.

(4) To conform to the current period presentation, prior periods have been reclassified.

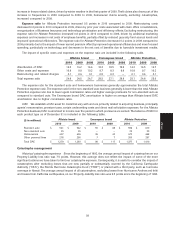

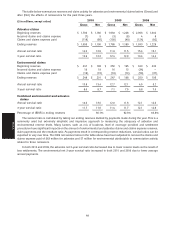

Net realized capital gains and losses are presented in the following table.

($ in millions) 2010 2009 2008

Impairment write-downs $ (295) $ (534) $ (638)

Change in intent write-downs (62) (89) (501)

Net other-than-temporary impairment losses

recognized in earnings (357) (623) (1,139)

Sales 455 611 (635)

Valuation of derivative instruments (331) 52 (296)

Settlements of derivative instruments (143) (203) 289

EMA limited partnership income 55 (5) (77)

Realized capital gains and losses, pre-tax (321) (168) (1,858)

Income tax benefit (expense) 114 (54) 649

Realized capital gains and losses, after-tax $ (207) $ (222) $ (1,209)

For a further discussion of net realized capital gains and losses, see the Investments section of the MD&A.

42

MD&A