Allstate 2011 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

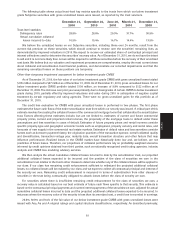

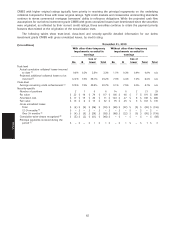

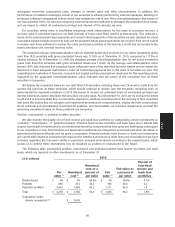

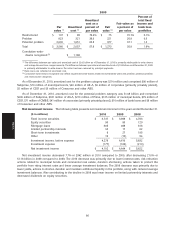

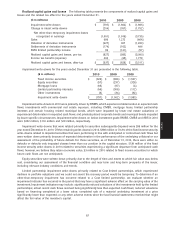

2010 2009 2008 2010 Explanations

($ in millions)

Valuation Settlements Total Total Total

Allstate Financial

Duration gap (111) (43) (154) 288 (503) Interest rate caps, floors, swaptions and swaps are used by Allstate Financial to

management balance interest-rate sensitivities of its assets and liabilities. The contracts settle

based on differences between current market rates and a contractually specified

fixed rate through expiration. The contracts can be terminated and settled at any

time with minimal additional cost. The maximum loss on caps, floors and swaptions

is limited to the amount of premiums paid. The change in valuation reflects the

changing value of expected future settlements from changing interest rates, which

may vary over the period of the contracts. The 2010 losses, resulting from

decreasing interest rates, are offset in unrealized capital gains and losses of our

fixed income securities in OCI to the extent it relates to changes in risk-free rates.

Anticipatory hedging 24 8 32 (18) 153 Futures and interest rate swaps are used to protect investment spread from

interest rate changes during mismatches in the timing of cash flows between

product sales and the related investment activity. The futures contracts are

exchange traded, daily cash settled and can be exited at any time for minimal

additional cost. If the cash flow mismatches are such that a positive net investment

position is being hedged, there is an offset for the related investment’s unrealized

loss in OCI. The 2010 gains resulted from a decrease in risk-free interest rates over

the life of the net short position as liability issuances exceeded asset acquisitions.

Hedging of interest (16) — (16) 10 (29) Value of expected future settlements on interest rate caps and the associated value

rate exposure in of future credited interest, which is reportable in future periods when incurred,

annuity contracts decreased due to a decrease in interest rates.

Hedging unrealized — — — — 7

gains on equity

indexed notes

Hedge ineffectiveness 7 — 7 (1) (4) The hedge ineffectiveness of $7 million includes $74 million in realized capital

losses on swaps that were offset by $81 million in realized capital gains on the

hedged risk.

Foreign currency (2) 6 4 3 (1) Currency forwards are used to protect our foreign bond portfolio from changes in

contracts currency rates.

Credit risk reduction (1) 6 (13) (7) (50) 17 Valuation gain is the result of widening credit spreads on referenced credit entities.

Other — — — — 1

Total Risk $ (417) $ (195) $ (612) $ (58) $ (54)

management

Income generation

The 2010 changes in valuation on the Property-Liability segment are due to theAsset replication —

tightening of credit spreads on referenced credit entities. The gains are primarily oncredit exposure

single name credit default swaps (‘‘CDS’’). The 2010 changes in valuation on theProperty-Liability $ 5 $ 10 $ 15 $ 13 $ (41)

Allstate Financial segment are due to the widening credit spreads on referencedAllstate Financial (10) 11 1 64 (62)

credit entities. The losses are primarily on first-to-default CDS and credit derivative

Total (5) 21 16 77 (103) index CDS. The changes in valuation would only be converted to cash upon

disposition, which can be done at any time, or if the credit event specified in the

contract occurs. For further discussion on CDS, see Note 6 of the consolidated

financial statements.

Asset replication —

equity exposure

Property–Liability — — — 66 (84)

Commodity derivatives —

Property–Liability — — — — (44)

Total Income

generation $ (5) $ 21 $ 16 $ 143 $ (231)

90

MD&A