Allstate 2011 Annual Report Download - page 243

Download and view the complete annual report

Please find page 243 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Allstate Financial

The Company’s Allstate Financial segment reinsures certain of its risks to other insurers primarily under yearly

renewable term, coinsurance, modified coinsurance and coinsurance with funds withheld agreements. These

agreements result in a passing of the agreed-upon percentage of risk to the reinsurer in exchange for negotiated

reinsurance premium payments. Modified coinsurance and coinsurance with funds withheld are similar to coinsurance,

except that the cash and investments that support the liability for contract benefits are not transferred to the assuming

company and settlements are made on a net basis between the companies. Allstate Financial cedes 100% of the

morbidity risk on substantially all of its long-term care contracts.

For certain term life insurance policies issued prior to October 2009, Allstate Financial ceded up to 90% of the

mortality risk depending on the year of policy issuance under coinsurance agreements to a pool of fourteen unaffiliated

reinsurers. Effective October 2009, mortality risk on term business is ceded under yearly renewable term agreements

under which Allstate Financial cedes mortality in excess of its retention, which is consistent with how Allstate Financial

generally reinsures its permanent life insurance business. The following table summarizes those retention limits by

period of policy issuance.

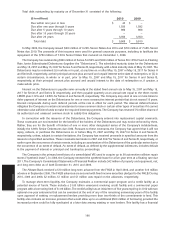

Period Retention limits

July 2007 through current $5 million per life, $3 million age 70 and over, and

$10 million for contracts that meet specific criteria

September 1998 through June 2007 $2 million per life, in 2006 the limit was increased to

$5 million for instances when specific criteria were met

August 1998 and prior Up to $1 million per life

In addition, Allstate Financial has used reinsurance to effect the acquisition or disposition of certain blocks of

business. Allstate Financial had reinsurance recoverables of $1.63 billion and $1.51 billion as of December 31, 2010 and

2009, respectively, due from Prudential related to the disposal of substantially all of its variable annuity business that

was effected through reinsurance agreements. In 2010, life and annuity premiums and contract charges of $171 million,

contract benefits of $152 million, interest credited to contractholder funds of $29 million, and operating costs and

expenses of $31 million were ceded to Prudential. In 2009, life and annuity premiums and contract charges of

$170 million, contract benefits of $44 million, interest credited to contractholder funds of $27 million, and operating

costs and expenses of $28 million were ceded to Prudential. In 2008, life and annuity premiums and contract charges of

$238 million, contract benefits of $467 million, interest credited to contractholder funds of $36 million, and operating

costs and expenses of $47 million were ceded to Prudential. In addition, as of December 31, 2010 and 2009 Allstate

Financial had reinsurance recoverables of $170 million and $175 million, respectively, due from subsidiaries of Citigroup

(Triton Insurance and American Health and Life Insurance), and Scottish Re (U.S.) Inc. in connection with the disposition

of substantially all of the direct response distribution business in 2003.

As of December 31, 2010, the gross life insurance in force was $532.89 billion of which $238.75 billion was ceded to

the unaffiliated reinsurers.

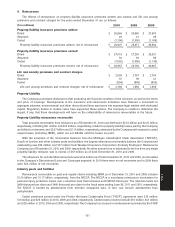

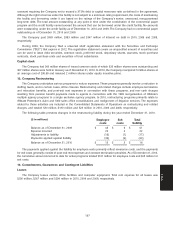

Allstate Financial’s reinsurance recoverables on paid and unpaid benefits as of December 31 are summarized in the

following table.

2010 2009

($ in millions)

Annuities $ 1,785 $ 1,667

Life insurance 1,569 1,535

Long-term care insurance 957 851

Other 89 90

Total Allstate Financial $ 4,400 $ 4,143

As of December 31, 2010 and 2009, approximately 94% and 93%, respectively, of Allstate Financial’s reinsurance

recoverables are due from companies rated A- or better by S&P.

163

Notes