Allstate 2011 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

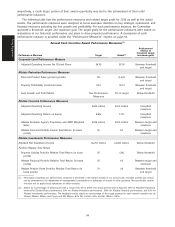

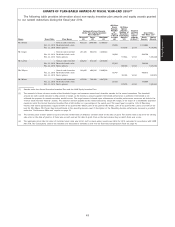

Target award opportunities approved by the Committee are stated as a percentage of annual base salary.

Annual cash incentive awards are calculated using base salary, as adjusted by any merit and promotional

increases granted during the year on a prorated basis. In setting target incentive levels for named executives, the

Committee gives the most consideration to market data primarily focusing on pay levels at peer group companies

with which we directly compete for executive talent and stockholder investment. As a result of leveraging external

market data, Mr. Wilson has the highest target award opportunity of 150%, followed by Messrs. Lacher and

Winter, heads of Allstate Protection and Allstate Financial, respectively, with a target award opportunity of 125%,

followed by Mr. Civgin, our chief financial officer, with a target award opportunity of 100%, followed by

Ms. Mayes, our general counsel, with a target award opportunity of 85%.

In calculating the annual cash incentive awards, our achievement with respect to each performance measure

is expressed as a percentage of the target goal, with interpolation applied between the threshold and target goals

and between the target and maximum goals. Unless otherwise adjusted by the Committee, the amount of each

named executive’s annual cash incentive award is the sum of the amounts calculated using the calculation below

for all of the performance measures.

Actual performance interpolated X Weighting X Target award opportunity as a X Salary**

relative to threshold and percentage of salary**

target on a range of 50%

to 100% and relative to

target and maximum on

a range of 100% to 250%*

* Actual performance below threshold results in 0%

** Base salary, as adjusted by any merit and promotional increases granted during the year on a prorated basis.

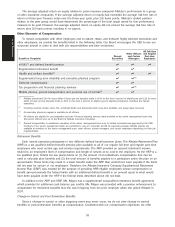

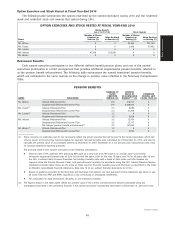

Following the end of the performance year, Mr. Wilson conducted an evaluation of the performance of each

member of his senior management team, including each other named executive. Based on his subjective

evaluation of each executive’s contributions and performance, Mr. Wilson made recommendations to the

Committee regarding individual adjustments to the formula driven annual incentive amounts. The

recommendations were considered and approved by the Committee. The annual cash award for each named

executive for 2010 is based on the plan mechanics, performance results, and individual performance assessments

by the CEO, which reflect progress made against established goals.

●Mr. Civgin. Under Mr. Civgin’s leadership Allstate continued to demonstrate excellent capital management

results, improved its enterprise risk and return practices, and provided strong overall governance. Mr. Civgin

demonstrated strong leadership in winding down Allstate Bank and continued to develop stronger

relationships with Allstate’s shareholders. Mr. Civgin’s annual cash award of $400,000 reflects plan results

and his performance during 2010.

●Mr. Lacher. Allstate Protection’s profitability was within the annual outlook range but was negatively

impacted by high catastrophes and increased auto claim frequency. Momentum gained in new auto

business through a new advertising program was offset by effects of profitability improvement efforts in

several large states. Progress was made in implementing a new organization structure, recruiting new

leadership to the business and improving agency loyalty. Mr. Lacher’s annual cash bonus award of $250,000

is reflective of the plan results and his performance in leading the Allstate Protection business.

●Ms. Mayes. Ms. Mayes continued to drive process improvements and expense management in her

leadership of Allstate’s Law & Regulation department. Ms. Mayes continued to provide expert leadership in

addressing significant regulatory reforms and government relations. Reflective of plan results and her

performance during 2010, Ms. Mayes earned an annual cash award of $350,000.

●Mr. Winter. Allstate Financial’s adjusted operating income and adjusted operating return on equity exceeded

maximum. Allstate Financial continued executing on its strategy to serve its customers by focusing on

Allstate agencies and Allstate Benefits (formerly the Allstate Workplace Division), including the launch of

the new GoodforLifeSM product. Mr. Winter’s leadership re-energized the organization through his strategic

vision and driving performance and accountability. Reflecting plan results and his performance, Mr. Winter’s

annual cash bonus award is $1,212,300.

35

Proxy Statement