Allstate 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Committee determined Mr. Wilson’s annual incentive award for 2010 based on the 2010 plan mechanics and

performance results and made an annual cash award of $1,091,096. This award is below the target of $1,640,466

for Mr. Wilson.

●Mr. Wilson. Under Mr. Wilson’s leadership Allstate continued to make progress on its strategic initiatives in

2010 designed to position the company for long-term growth.

●Allstate Protection’s profitability was within its annual outlook range but was negatively impacted by high

catastrophes and increased auto claim frequency. In spite of momentum gained in new auto business,

auto market share declined due the offsetting effects of profitability improvement efforts in several large

states.

●Allstate Financial made great progress in repositioning the business and lowering costs resulting in

significantly increased operating profit.

●Allstate Investments strategies in 2010 were well executed and timed resulting in good total return but a

decline in investment income.

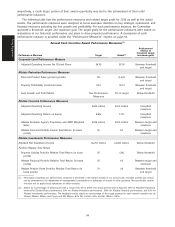

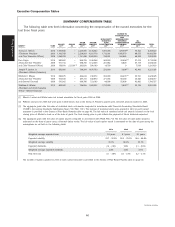

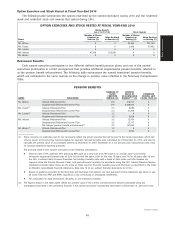

Long-Term Incentive Awards—Cash and Equity

As part of total core compensation, we historically have provided three forms of long-term incentive awards:

stock options, restricted stock units, and long-term cash incentive awards. In 2009, we discontinued future cycles

of the long-term cash incentive plan. The relative mix of various forms of these awards is driven by our objectives

in providing the specific form of award, as described below.

Long-Term Incentive Awards—Equity

We grant larger equity awards to executives with the broadest scope of responsibility, consistent with our

philosophy that a significant amount of executive compensation should be in the form of equity and that a greater

percentage of compensation should be at risk for executives who bear higher levels of responsibility for Allstate’s

performance. However, from time to time, larger equity awards are granted to attract new executives. The

Committee annually reviews the mix of equity incentives provided to the named executives. Since 2009, the mix

has consisted of 65% stock options and 35% restricted stock units. The majority of equity incentives are granted

in stock options, which are performance-based, requiring growth in the stock price to deliver any value to an

executive. The restricted stock units provide alignment with stockholder interests along with providing an effective

retention tool.

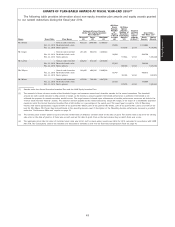

Stock options

Stock options represent the opportunity to buy shares of our stock at a fixed exercise price at a future date.

We use them to align the interests of our executives with long-term stockholder value as the stock price must

appreciate from the date of grant for any value to be delivered to executives.

Key elements:

●Under our stockholder-approved equity incentive plan, the exercise price cannot be less than the fair

market value of a share on the date of grant.

●Stock option repricing is not permitted. In other words, absent an event such as a stock split, if the

Committee cancels an award and substitutes a new award, the exercise price of the new award cannot be

less than the exercise price of the cancelled award.

●All stock option awards have been made in the form of nonqualified stock options.

●The options granted to the named executives in 2010 become exercisable in three installments, 50% on the

second anniversary of the grant date and 25% on each of the third and fourth anniversary dates, and

expire in ten years, except in certain change-in-control situations or under other special circumstances

approved by the Committee.

Restricted stock units

Each restricted stock unit represents our promise to transfer one fully vested share of stock in the future if

and when the restrictions expire (when the unit ‘‘vests’’). Because restricted stock units are based on and payable

in stock, they serve to reinforce the alignment of interests of our executives and our stockholders. In addition,

because restricted stock units have a real, current value that is forfeited, except in some circumstances, if an

executive terminates employment before the restricted stock units vest, they provide a retention incentive. Under

36

Proxy Statement