Allstate 2011 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

These actions have allowed Encompass to position itself with aligned agencies as the package policy carrier of

choice for customers with broad personal lines coverage needs in order to drive stable, consistent earnings growth over

time.

Rate changes that are indicated based on loss trend analysis to achieve a targeted return will continue to be

pursued. The following table shows the rate changes that were approved for standard auto and does not include rating

plan enhancements, including the introduction of discounts and surcharges, that result in no change in the overall rate

level in the state. These rate changes do not reflect initial rates filed for insurance subsidiaries initially writing business

in a state.

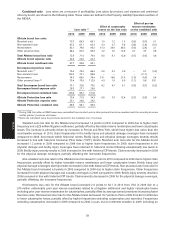

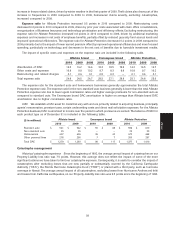

# of States Countrywide (%) (1) State Specific (%) (2)(3)

2010 2009 2010 2009 2010 2009

Allstate brand (4) 45 (5) 36 1.4 4.6 2.2 7.2

Encompass brand 24 36 1.4 7.3 2.7 9.3

(1) Represents the impact in the states where rate changes were approved during 2010 and 2009, respectively, as a percentage of total

countrywide prior year-end premiums written.

(2) Represents the impact in the states where rate changes were approved during 2010 and 2009, respectively, as a percentage of its

respective total prior year-end premiums written in those states.

(3) Based on historical premiums written in those states, rate changes approved for standard auto totaled $218 million in 2010

compared to $784 million in 2009.

(4) Includes Washington D.C.

(5) Includes targeted rate decreases in certain markets to improve our competitive position for target customers.

Non-standard auto premiums written totaled $889 million in 2010, a decrease of 6.3% from $949 million in 2009,

following a 10.3% decrease in 2009 from $1.06 billion in 2008.

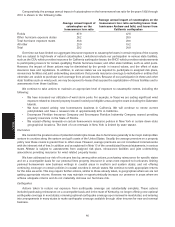

Allstate brand Encompass brand

Non-Standard Auto 2010 2009 2008 2010 2009 2008

PIF (thousands) 640 719 745 5 20 39

Average premium-gross written

(6 months) $ 624 $ 616 $ 624 $ 426 $ 476 $ 479

Renewal ratio (%) (6 months) 71.4 72.5 73.7 46.9 67.1 68.3

Allstate brand non-standard auto premiums written totaled $883 million in 2010, a decrease of 4.7% from

$927 million in 2009, following a 8.9% decrease in 2009 from $1.02 billion in 2008. Contributing to the Allstate brand

non-standard auto premiums written decrease in 2010 compared to 2009 were the following:

– decrease in PIF as of December 31, 2010 compared to December 31, 2009, due to a decline in the number of

policies available to renew and fewer new issued applications

– 14.9% decrease in new issued applications to 309 thousand in 2010 from 363 thousand in 2009

– increase in average gross premium in 2010 compared to 2009

– 1.1 point decrease in the renewal ratio in 2010 compared to 2009

Allstate brand non-standard auto premiums written decreased in 2009 compared to 2008. Contributing to the

Allstate brand non-standard auto premiums written decrease in 2009 compared to 2008 were the following:

– decrease in PIF as of December 31, 2009 compared to December 31, 2008, due to new business production that

was insufficient to offset declines in the renewal ratio and polices available to renew

– 10.7% increase in new issued applications to 363 thousand in 2009 from 328 thousand in 2008

– decrease in average gross premium in 2009 compared to 2008

– decrease in the renewal ratio in 2009 compared to 2008

Rate changes that are indicated based on loss trend analysis to achieve a targeted return will continue to be

pursued. The following table shows the rate changes that were approved for non-standard auto and does not include

rating plan enhancements, including the introduction of discounts and surcharges, that result in no change in the

34

MD&A