Allstate 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

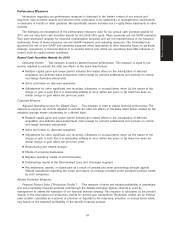

Total Property Profitability: A financial measure used by management to assess profitability. The Allstate

Protection combined ratio adjusted to exclude the total auto combined ratio and the effect of restructuring and

related charges. For disclosure of Allstate Protection combined ratio, see discussion of the Allstate Protection

segment in Management’s Discussion and Analysis of Financial Condition and Results of Operations in this

booklet.

Total Auto Growth and Profit Matrix: A matrix used by management that combines financial measures in

order to emphasize a balanced approach to premium growth and profit. The matrix utilizes (a) the percent

increase in items-in-force for Allstate brand standard and non-standard auto and Encompass brand auto

(excluding Deerbrook business and certain business sold by a national agency that has been discontinued) and

(b) the combined ratio for Allstate brand standard and non-standard auto, Encompass brand auto (including

Deerbrook and certain business sold by a national agency that has been discontinued), business insurance auto,

involuntary auto, and Allstate Canada auto, and excluding the effect of restructuring and related charges. For

disclosure of Allstate Protection auto combined ratio and items-in-force, see the discussion of the Allstate

Protection segment in Management’s Discussion and Analysis of Financial Condition and Results of Operations in

this booklet.

Allstate Financial Measures

Adjusted Operating Income: This is a measure management uses to assess the profitability of the business.

The Allstate Financial segment measure, operating income, is adjusted to exclude the after tax effects of

restructuring and related charges and the potential amount by which 2010 guaranty fund assessments related to

insured solvencies exceed $6 million. For disclosure of the Allstate Financial segment measure see footnote 18 to

our audited financial statements.

Adjusted Operating Return on Equity: This is a measure management uses to assess profitability and capital

efficiency. This measure is calculated using adjusted operating income, as defined above, as the numerator, and

Allstate Financial’s adjusted average subsidiary shareholder’s equity as the denominator. Adjusted subsidiary

shareholder’s equity is the sum of subsidiaries’ shareholder’s equity for Allstate Life Insurance Company, Allstate

Bank, a proportionate share of American Heritage Life Investment Corporation and certain other minor entities

and excludes the effect of unrealized net capital gains and losses, net of tax and deferred acquisition costs. The

average adjusted shareholder’s equity is calculated by dividing the sum of Allstate Financial’s adjusted

shareholder’s equity at year-end 2009 and at the end of each quarter of 2010 by five.

Allstate Exclusive Agency Proprietary and AWD Weighted Sales: This operating measure is used to quantify

the current year sales of financial products through Allstate’s Exclusive Agency proprietary distribution channel,

including agencies and direct, and the Allstate Workplace Division. The measure is calculated by applying a

percentage or factor against the premium or deposits of life insurance, annuities and Allstate Workplace Division

products that vary based on the relative expected profitability of the specific product. For non-Allstate Workplace

Division proprietary products sold through Allstate Financial Services channel, the percentage or factors are

consistent with those used for production credits by Allstate Protection.

Allstate Financial Portfolio Relative Total Return: See definition under ‘‘Allstate Investments Measures’’ below.

Allstate Investments Measures

Adjusted Net Investment Income: Management uses this measure to assess the financial operating

performance provided from investments relative to internal goals. Net investment income consists of certain

amounts reported in the consolidated financial statements as net investment income. It excludes the difference

between actual and planned expenses for certain employee benefit and incentive expenses.

Portfolio Relative Total Return: Management uses the three following measures to assess the value of active

portfolio management relative to the total return of a market based benchmark. The measure is calculated as the

difference, in basis points, of the specific portfolio total return from a designated benchmark. Total return is

principally determined using industry standards and the same sources used in preparing the financial statements

to determine fair value. (See footnotes to our audited financial statements for our methodologies for estimating

the fair value of our investments.) In general, total return represents the annualized increase or decrease,

expressed as a percentage, in the value of the portfolio. Time weighted returns are utilized. The designated

benchmark is a composite of pre-determined, customized indices which reflect the investment risk parameters

established in investment policies by the boards of the relevant subsidiaries, weighted in proportion to our

54

Proxy Statement