Allstate 2011 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

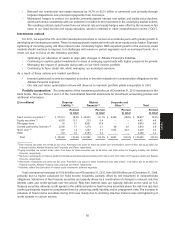

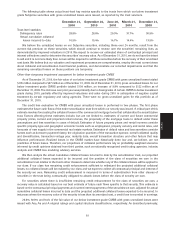

stabilization in certain geographic areas in 2010. Consistent with their ratings, our portfolio monitoring process

indicates that investment grade securities have a low risk of default. Securities rated below investment grade,

comprising securities with a rating of Ba, B and Caa or lower, have a higher risk of default.

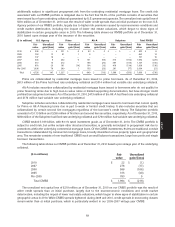

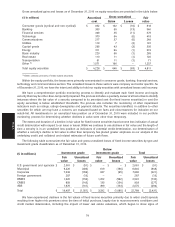

As of December 31, 2010, 68% of our below investment grade gross unrealized losses were concentrated in RMBS,

specifically Alt-A and Subprime, CMBS and ABS, specifically cash flow CLO. The fair value of these securities totaled

$1.39 billion, an increase of 7.8%, compared to $1.29 billion as of December 31, 2009, due to improved valuations

resulting from tighter credit spreads driven by lower risk premiums. Gross unrealized losses on these securities totaled

$736 million as of December 31, 2010, a decrease of 42.6%, compared to $1.28 billion as of December 31, 2009, due to

improved valuations, impairment write-downs, sales and principal collections, partially offset by the downgrade of

certain securities to below investment grade during 2010.

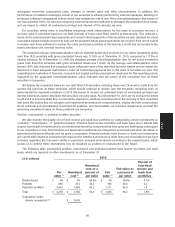

Fair values for our structured securities are obtained from third-party valuation service providers and are subject to

review as disclosed in our Application of Critical Accounting Estimates. In accordance with GAAP, when fair value is less

than the amortized cost of a security and we have not made the decision to sell the security and it is not more likely than

not we will be required to sell the security before recovery of its amortized cost basis, we evaluate if we expect to receive

cash flows sufficient to recover the entire amortized cost basis of the security. We calculate the estimated recovery value

by discounting our best estimate of future cash flows at the security’s original or current effective rate, as appropriate,

and compare this to the amortized cost of the security. If we do not expect to receive cash flows sufficient to recover the

entire amortized cost basis of the security, the credit loss component of the impairment is recorded in earnings, with the

remaining amount of the unrealized loss related to other factors (‘‘non-credit-related’’) recognized in OCI.

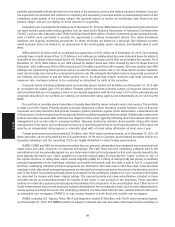

The non-credit-related unrealized losses for our structured securities, including our below investment grade Alt-A,

Subprime, CMBS and cash flow CLO, are heavily influenced by risk factors other than those related to our best estimate

of future cash flows. The difference between these securities’ original or current effective rates and the yields implied by

their fair value indicates that a higher risk premium is included in the valuation of these securities than existed at initial

issue or purchase. This risk premium represents the return that a market participant requires as compensation to

assume the risk associated with the uncertainties regarding the future performance of the underlying collateral. The risk

premium is comprised of: default risk, which reflects the probability of default and the uncertainty related to collection

of contractual principal and interest; liquidity risk, which reflects the risk associated with exiting the investment in an

illiquid market, both in terms of timeliness and cost; and volatility risk, which reflects the potential valuation volatility

during an investor’s holding period. Other factors reflected in the risk premium include the costs associated with

underwriting, monitoring and holding these types of complex securities. Certain aspects of the default risk are included

in the development of our best estimate of future cash flows, as appropriate. Other aspects of the risk premium are

considered to be temporary in nature and are expected to reverse over the remaining lives of the securities as future

cash flows are received.

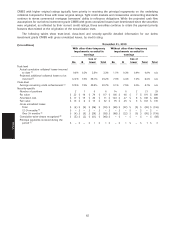

Other-than-temporary impairment assessment for below investment grade Alt-A and Subprime RMBS

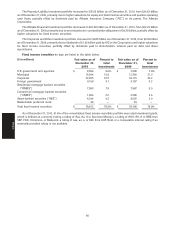

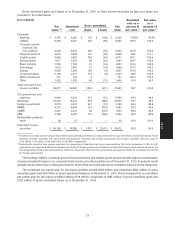

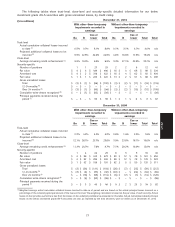

As of December 31, 2010, the fair value of our below investment grade Alt-A securities with gross unrealized losses

totaled $288 million, a decrease of 7.4% compared to $311 million as of December 31, 2009. As of December 31, 2010,

gross unrealized losses for our below investment grade Alt-A portfolio totaled $116 million, a decrease of 45.3%

compared to $212 million as of December 31, 2009. The improvement over prior year was primarily due to improved

valuations resulting from lower risk premiums, impairment write-downs and principal collections. For our below

investment grade Alt-A securities with gross unrealized gains of $20 million, we have recognized cumulative write-

downs in earnings totaling $45 million as of December 31, 2010.

As of December 31, 2010, the fair value of our below investment grade Subprime securities with gross unrealized

losses totaled $796 million, an increase of 10.2% compared to $722 million as of December 31, 2009. As of December 31,

2010, gross unrealized losses for our below investment grade Subprime portfolio totaled $438 million, a decrease of

48.4% compared to $849 million as of December 31, 2009. The improvement over prior year was primarily due to

improved valuations resulting from lower risk premiums, impairment write-downs, sales and principal collections,

partially offset by downgrades of certain Subprime securities to below investment grade during 2010. For our below

investment grade Subprime with gross unrealized gains totaling $4 million, we have recognized cumulative write-downs

in earnings totaling $95 million as of December 31, 2010.

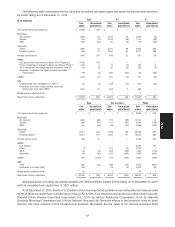

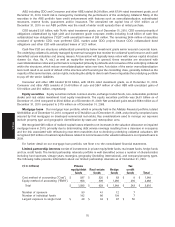

The credit loss evaluation for Alt-A and Subprime securities with gross unrealized losses is performed in two

phases. The first phase estimates the future cash flows of the entire securitization trust from which our security was

issued. A critical part of this estimate involves forecasting default rates and loss severities of the residential mortgage

loans that collateralize the securitization trust. The factors that affect the default rates and loss severities include, but are

75

MD&A