Allstate 2011 Annual Report Download - page 239

Download and view the complete annual report

Please find page 239 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

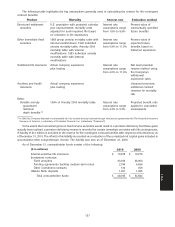

Absent any contract provision wherein the Company guarantees either a minimum return or account value upon

death, a specified contract anniversary date, partial withdrawal or annuitization, variable annuity and variable life

insurance contractholders bear the investment risk that the separate accounts’ funds may not meet their stated

investment objectives. The account balances of variable annuities contracts’ separate accounts with guarantees

included $6.94 billion and $7.93 billion of equity, fixed income and balanced mutual funds and $1.09 billion and

$568 million of money market mutual funds as of December 31, 2010 and 2009, respectively.

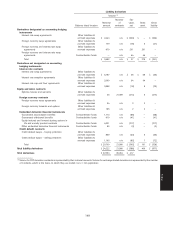

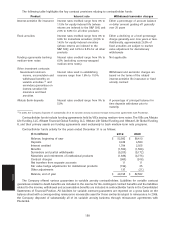

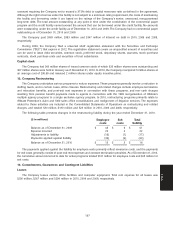

The table below presents information regarding the Company’s variable annuity contracts with guarantees. The

Company’s variable annuity contracts may offer more than one type of guarantee in each contract; therefore, the sum of

amounts listed exceeds the total account balances of variable annuity contracts’ separate accounts with guarantees.

December 31,

($ in millions)

2010 2009

In the event of death

Separate account value $ 8,029 $ 8,496

Net amount at risk (1) $ 1,402 $ 2,153

Average attained age of contractholders 66 years 65 years

At annuitization (includes income benefit guarantees)

Separate account value $ 1,945 $ 2,101

Net amount at risk (2) $ 580 $ 906

Weighted average waiting period until annuitization options available 2 years 3 years

For cumulative periodic withdrawals

Separate account value $ 735 $ 786

Net amount at risk (3) $21$42

Accumulation at specified dates

Separate account value $ 1,100 $ 1,113

Net amount at risk (4) $64$97

Weighted average waiting period until guarantee date 7 years 8 years

(1) Defined as the estimated current guaranteed minimum death benefit in excess of the current account balance as of the balance sheet date.

(2) Defined as the estimated present value of the guaranteed minimum annuity payments in excess of the current account balance.

(3) Defined as the estimated current guaranteed minimum withdrawal balance (initial deposit) in excess of the current account balance as of the

balance sheet date.

(4) Defined as the estimated present value of the guaranteed minimum accumulation balance in excess of the current account balance.

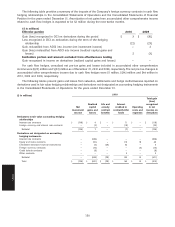

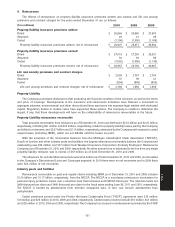

The liability for death and income benefit guarantees is equal to a benefit ratio multiplied by the cumulative contract

charges earned, plus accrued interest less contract benefit payments. The benefit ratio is calculated as the estimated

present value of all expected contract benefits divided by the present value of all expected contract charges. The

establishment of reserves for these guarantees requires the projection of future separate account fund performance,

mortality, persistency and customer benefit utilization rates. These assumptions are periodically reviewed and updated.

For guarantees related to death benefits, benefits represent the current guaranteed minimum death benefit payments in

excess of the current account balance. For guarantees related to income benefits, benefits represent the present value

of the minimum guaranteed annuitization benefits in excess of the current account balance.

Projected benefits and contract charges used in determining the liability for certain guarantees are developed

using models and stochastic scenarios that are also used in the development of estimated expected gross profits.

Underlying assumptions for the liability related to income benefits include assumed future annuitization elections based

on factors such as the extent of benefit to the potential annuitant, eligibility conditions and the annuitant’s attained age.

The liability for guarantees is re-evaluated periodically, and adjustments are made to the liability balance through a

charge or credit to life and annuity contract benefits.

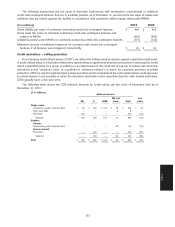

Guarantees related to withdrawal and accumulation benefits are considered to be derivative financial instruments;

therefore, the liability for these benefits is established based on its fair value.

159

Notes