Allstate 2011 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We expect to retain approximately 30,000 PIF with earthquake coverage due to regulatory and other reasons. We

also will continue to have exposure to earthquake risk on certain policies that do not specifically exclude coverage for

earthquake losses, including our auto policies, and to fires following earthquakes. Allstate policyholders in the state of

California are offered coverage through the CEA, a privately-financed, publicly-managed state agency created to

provide insurance coverage for earthquake damage. Allstate is subject to assessments from the CEA under certain

circumstances as explained in Note 13 of the consolidated financial statements.

Fires Following Earthquakes

Actions taken related to our risk of loss from fires following earthquakes include changing homeowners

underwriting requirements in California and purchasing reinsurance for Kentucky and purchasing nationwide

occurrence reinsurance excluding Florida and New Jersey.

Wildfires

Actions we are taking to reduce our risk of loss from wildfires include changing homeowners underwriting

requirements in certain states and purchasing nationwide occurrence reinsurance. Catastrophe losses related to the

Southern California wildfires occurred during 2009 and 2008 and totaled $76 million and $166 million, respectively.

Reinsurance

A description of our current catastrophe reinsurance program appears in Note 9 of the consolidated financial

statements and a description of program changes as of June 1, 2011 appears in the Property-Liability Claims and Claims

Expense Reserves section of the MD&A.

DISCONTINUED LINES AND COVERAGES SEGMENT

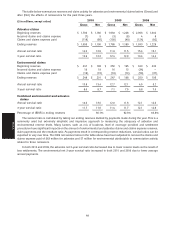

Overview The Discontinued Lines and Coverages segment includes results from insurance coverage that we no

longer write and results for certain commercial and other businesses in run-off. Our exposure to asbestos,

environmental and other discontinued lines claims is reported in this segment. We have assigned management of this

segment to a designated group of professionals with expertise in claims handling, policy coverage interpretation,

exposure identification and reinsurance collection. As part of its responsibilities, this group is also regularly engaged in

policy buybacks, settlements and reinsurance assumed and ceded commutations.

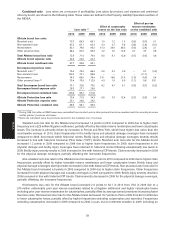

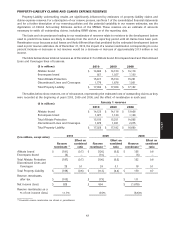

Summarized underwriting results for the years ended December 31 are presented in the following table.

($ in millions) 2010 2009 2008

Premiums written $ 1 $ (1) $ —

Premiums earned $ 2 $ (1) $ —

Claims and claims expense (28) (24) (18)

Operating costs and expenses (5) (7) (7)

Underwriting loss $ (31) $ (32) $ (25)

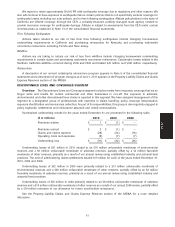

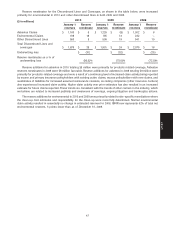

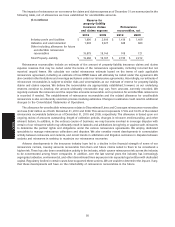

Underwriting losses of $31 million in 2010 related to an $18 million unfavorable reestimate of environmental

reserves and a $5 million unfavorable reestimate of asbestos reserves, partially offset by a $4 million favorable

reestimate of other reserves, primarily as a result of our annual review using established industry and actuarial best

practices. The cost of administering claims settlements totaled $13 million for each of the years ended December 31,

2010, 2009 and 2008.

Underwriting losses of $32 million in 2009 were primarily related to a $13 million unfavorable reestimate of

environmental reserves and a $28 million unfavorable reestimate of other reserves, partially offset by an $8 million

favorable reestimate of asbestos reserves, primarily as a result of our annual review using established industry and

actuarial best practices.

Underwriting losses of $25 million in 2008 primarily related to an $8 million unfavorable reestimate of asbestos

reserves and a $13 million unfavorable reestimate of other reserves as a result of our annual 2008 review, partially offset

by a $16 million reduction of our allowance for future uncollectible reinsurance.

See the Property-Liability Claims and Claims Expense Reserves section of the MD&A for a more detailed

discussion.

41

MD&A