Allstate 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

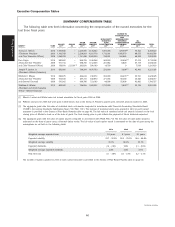

Our philosophy and practices have provided us with the tools to create an effective executive compensation

program as detailed below.

Named Executives

This CD&A describes the executive compensation program at Allstate and specifically describes total 2010

compensation for the following named executives:

●Thomas J. Wilson—Chairman, President and Chief Executive Officer

●Don Civgin—Executive Vice President and Chief Financial Officer

●Joseph P. Lacher, Jr.—President, Allstate Protection

●Michele C. Mayes—Executive Vice President and General Counsel

●Matthew E. Winter—President and Chief Executive Officer, Allstate Financial

CEO Compensation

As stated in its charter, one of the Committee’s most important responsibilities is making recommendations to

the Board regarding the CEO’s compensation. The Committee establishes the goals against which the CEO’s

performance for the year will be evaluated and, in conjunction with the Nominating and Governance Committee,

evaluates the CEO’s performance relative to these goals. When reviewing performance relative to these goals, the

Board discusses the Committee’s recommendations in executive session, without the CEO present. The Committee

fulfills its oversight responsibilities and provides meaningful recommendations to the Board for its consideration

by analyzing competitive compensation data provided by its independent executive compensation consultant and

company performance data provided by senior management. The Committee reviews the various elements of the

CEO’s compensation in the context of a total compensation package, including salary, annual cash incentive

awards, long-term incentive awards, and accrued pension benefits, as well as the value of Allstate stock holdings

and prior long-term incentive awards, and then presents its recommendations to the Board within this total

compensation framework.

Mr. Wilson’s total compensation and the amount of each compensation element are driven by the design of

our compensation plans, his years of experience, the scope of his duties, including his responsibilities for

Allstate’s overall strategic direction, performance, and operations, and the Committee’s analysis of competitive

compensation for CEOs of peer insurance companies and general industry CEO compensation practices. Because

of his leadership responsibilities, his leadership experience, and his ultimate accountability for performance of the

company, the Committee set a higher level of target total compensation as compared to the executive officers

who report to him.

Compensation Practices

The Committee reviews the design of our executive compensation program and executive pay levels on an

annual basis and performance and goal attainment within this design throughout the year. As part of that review,

the Committee engages Towers Watson, an independent compensation consultant, to conduct a marketplace

review of our executive compensation program. Towers Watson provided the Committee with relevant market data

and alternatives to consider when making compensation decisions for the named executives. In benchmarking our

executive compensation program the Committee utilizes a group of peer insurance companies as the primary data

source. The Committee selected these insurance companies based on the fact that they are publicly-traded and

their comparability to Allstate in product offerings, market segment, annual revenues, assets, and market value.

The Committee believes that these are companies against which Allstate competes for executive talent and

stockholder investment. Towers Watson recommended modifications to the peer insurance companies that the

Committee uses in benchmarking executive compensation for 2010, including program design, executive pay, and

performance comparisons. The Committee approved removing from the peer insurance companies Cincinnati

Financial Corporation due to its relative size and CNA Financial Corporation because it is closely held. ACE Ltd,

AFLAC Inc., and Manulife Financial Corporation were added to augment the peer insurance companies with

similarly sized insurers.

31

Proxy Statement