Allstate 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

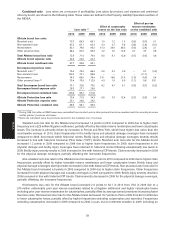

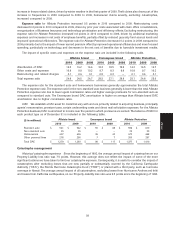

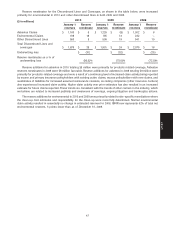

Combined ratio Loss ratios are a measure of profitability. Loss ratios by product, and expense and combined

ratios by brand, are shown in the following table. These ratios are defined in the Property-Liability Operations section of

the MD&A.

Effect of pre-tax

Effect of catastrophe reserve reestimates

Loss ratio (2) losses on the loss ratio on the combined ratio

2010 2009 2008 2010 2009 2008 2010 2009 2008

Allstate brand loss ratio:

Standard auto 70.7 69.3 68.1 1.0 1.2 1.5 (0.9) (0.3) 0.1

Non-standard auto 67.2 67.1 62.3 0.3 0.7 0.9 (3.6) (1.6) (0.1)

Homeowners 82.1 79.6 96.3 31.3 29.0 46.5 (0.3) (2.6) 2.1

Other personal lines 66.4 67.3 69.3 7.2 7.0 10.6 0.7 3.5 0.6

Total Allstate brand loss ratio 72.8 71.4 74.4 8.5 8.1 12.6 (0.7) (0.5) 0.6

Allstate brand expense ratio 24.9 24.5 24.7

Allstate brand combined ratio 97.7 95.9 99.1

Encompass brand loss ratio:

Standard auto (1) 75.4 75.4 66.3 0.8 0.3 0.9 — 0.7 (4.2)

Non-standard auto 100.0 74.1 88.9 — — — — (11.1) —

Homeowners 74.3 66.0 76.4 23.1 14.6 27.8 (1.3) (4.3) 0.4

Other personal lines (1) 73.4 75.9 112.9 4.3 1.9 8.9 (1.1) 5.6 33.1

Total Encompass brand loss ratio 75.1 72.6 73.0 8.2 4.7 9.1 (0.5) (0.7) (0.2)

Encompass brand expense ratio 28.5 27.1 28.8

Encompass brand combined ratio 103.6 99.7 101.8

Allstate Protection loss ratio 72.9 71.5 74.3 8.5 7.9 12.4 (0.7) (0.5) 0.6

Allstate Protection expense ratio 25.1 24.6 25.0

Allstate Protection combined ratio 98.0 96.1 99.3

(1) During 2008, $45 million of IBNR losses were reclassified from standard auto to other personal lines to be consistent with the recording of excess

liability policies’ premiums and losses.

(2) Ratios are calculated using the premiums earned for the respective line of business.

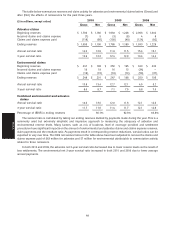

Standard auto loss ratio for the Allstate brand increased 1.4 points in 2010 compared to 2009 due to higher claim

frequency and a $25 million litigation settlement, partially offset by favorable reserve reestimates and lower catastrophe

losses. The increase is primarily driven by increases in Florida and New York, which have higher loss ratios than the

countrywide average. In 2010, claim frequencies in the bodily injury and physical damage coverages have increased

compared to 2009, but remain within historical norms. Bodily injury and physical damage coverages severity results

increased in line with historical Consumer Price Index (‘‘CPI’’) trends. Standard auto loss ratio for the Allstate brand

increased 1.2 points in 2009 compared to 2008 due to higher claim frequencies. In 2009, claim frequencies in the

physical damage and bodily injury coverages have returned to historical norms following exceptionally low levels in

2008. Bodily injury severity results in 2009 increased in line with historical CPI trends. Claims severity decreased in 2009

for the physical damage coverages, partially offsetting the increased frequencies.

Non-standard auto loss ratio for the Allstate brand increased 0.1 point in 2010 compared to 2009 due to higher claim

frequencies, partially offset by higher favorable reserve reestimates and lower catastrophe losses. Bodily injury and

physical damage coverages severity results increased in line with historical CPI trends. Non-standard auto loss ratio for

the Allstate brand increased 4.8 points in 2009 compared to 2008 due to higher claim frequencies. Claim frequencies

increased for both physical damage and casualty coverages in 2009 compared to 2008. Bodily injury severity results in

2009 increased in line with historical CPI trends. Claims severity decreased in 2009 for the physical damage coverages,

partially offsetting the increased frequencies.

Homeowners loss ratio for the Allstate brand increased 2.5 points to 82.1 in 2010 from 79.6 in 2009 due to a

$75 million unfavorable prior year reserve reestimate related to a litigation settlement and higher catastrophe losses

including prior year reserve reestimates for catastrophes, partially offset by average earned premiums increasing faster

than loss costs. Homeowners loss ratio for the Allstate brand decreased 16.7 points to 79.6 in 2009 from 96.3 in 2008 due

to lower catastrophe losses, partially offset by higher frequencies excluding catastrophes and severities. Frequencies

excluding catastrophes increased in 2009 compared to 2008, in part, due to inclement weather in 2009, including an

38

MD&A