ADT 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.require taxes to be paid at grant, rather than at vesting. The shares will be issued at vesting. Under

the terms of the 2004 Stock and Incentive Plan, adopted in March 2004, no additional options,

equity or equity-based grants will be made under the LTIP. The shares granted under the LTIP will

be issued at vesting under the 2004 Stock and Incentive Plan.

(3) LTIP II allows for the grant of stock options and other equity or equity-based grants to employees

who are not officers of Tyco. Under this plan, non-officer employees or former employees of Tyco

or a subsidiary could receive: (i) options to purchase Tyco common shares; (ii) stock appreciation

rights; (iii) awards payable in cash, common shares, other securities or other property, based on

the achievement of performance goals; (iv) dividend equivalents, consisting of a right to receive

payments equivalent to dividends declared on Tyco common shares; and (v) other stock-based

awards as determined by the Compensation and Human Resources Committee. The exercise price

of options and stock appreciation rights would generally be fair market value on the date of grant,

but could be lower in certain circumstances. No individual could receive awards for more than

12,000,000 shares in any calendar year. Terms and conditions of awards were determined by the

Committee. Awards could be deferred, and could be payable in any form the Committee

determined, including cash, Tyco common shares, other securities or other property. The

Committee may modify awards in recognition of unusual or nonrecurring events, including a

change of control. Under the terms of the 2004 Stock and Incentive Plan, adopted in March 2004,

no additional options, equity or equity-based grants will be made under the LTIP II. The shares

granted under the LTIP II will be issued at vesting under the 2004 Stock and Incentive Plan.

(4) The 1994 Restricted Stock Ownership Plan for Key Employees (‘‘1994 Restricted Stock Plan’’)

provides for the issuance of restricted stock grants to officers and non-officer employees. The 1994

Restricted Stock Plan expired in November 2004, thus no additional grants of restricted stock will

be made under this plan as of November 2004.

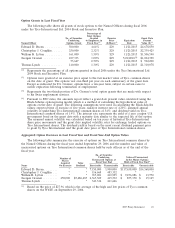

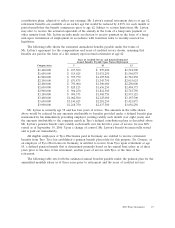

(5) This table includes an aggregate of 10,598,310 shares available for future issuance under the Tyco

Employee Stock Purchase Plan (‘‘ESPP’’) and the Tyco International (Ireland) Employee Share

Scheme (‘‘Irish Bonus Plan’’), which represents the number of remaining shares registered for

issuance under these two plans. All of the shares delivered to participants under the ESPP and

Irish Bonus Plan are purchased in the open market. The Irish Bonus Plan is a profit sharing plan

for employees of Irish subsidiaries of the Company. Upon the achievement of pre-established

budget targets, eligible participants receive a bonus payment in the form of common shares of the

Company, or, if the participant elects, in cash. In addition, eligible participants can elect to have a

portion of their salary withheld to purchase additional shares, up to a maximum of the lesser of

the 7.5% of annual salary or the amount of annual bonus paid in shares. In addition, the value of

the shares received as bonus and purchased with withheld salary cannot exceed A12,700. Bonuses

paid in shares and the portion of salary used to purchase additional shares are not subject to

income tax, provided the shares are held for the periods described below. All shares received by

the employee are held by a trustee on behalf of the employee, and cannot be sold or transferred

for at least two years. Shares sold or transferred after two years but before three years from

receipt are subject to income tax. The shares received or purchased under the plan receive

dividends, which are distributed by the trustee on an annual basis.

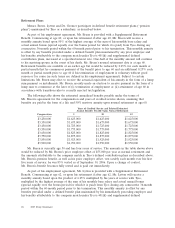

(6) The Tyco International Ltd. UK Savings Related Share Option Plan (‘‘SAYE’’) is a UK Inland

Revenue approved plan for UK employees pursuant to which employees may be granted options to

purchase shares at the end of three years of service at a 15% discount off the market price at time

of grant. Employees make monthly contributions that are, at the election of the employee, used for

the purchase price or returned to the employee. The total amount of shares that may be purchased

at the end of the three years of service is equal to the total of the monthly contributions, plus a

tax-free bonus amount equal to a multiple of the aggregate amount of monthly contributions,

divided by the option price. An option will generally be exercisable only during the period of six

months following the three-year period. The plan is administered by the Company’s International

Benefits Oversight Committee, appointed by the Compensation and Human Resources Committee.

The International Benefits Oversight Committee, among other things, determines when to grant

options and sets the option price.

2007 Proxy Statement 33