ADT 2006 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

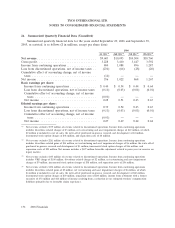

21. Share Plans (Continued)

three years. The Company has granted 2 million DSUs, of which all but 0.1 million were outstanding at

September 29, 2006.

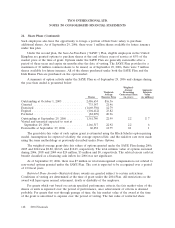

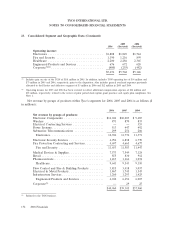

A summary of the status of the Company’s DSUs as of September 29, 2006 and changes during

the year then ended is presented below: Weighted-Average

Grant-Date Fair

Non-vested Deferred Stock Units Shares Value

Non-vested at October 1, 2005 ........................... 400,000 $ 8.47

Granted ........................................... 46,651 28.30

Dividend reinvestment ................................ 27,690 26.11

Vested ............................................ (274,341) 13.62

Non-vested at September 29, 2006 ........................ 200,000 8.47

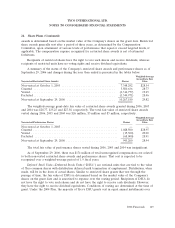

The weighted-average grant-date fair value of DSUs granted during 2006, 2005 and 2004 was

$28.30, $31.08 and $20.44, respectively. The total fair value of DSUs vested during 2006, 2005 and 2004

was $4 million, $6 million and $6 million, respectively. As of September 29, 2006, there was $1.7 million

of total unrecognized compensation cost related to non-vested DSUs. That cost is expected to be

recognized over a weighted-average period of 0.8 fiscal years.

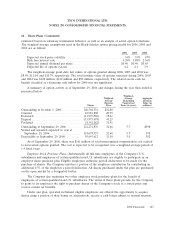

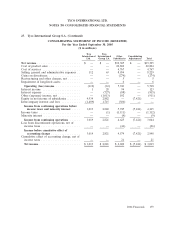

22. Comprehensive Income

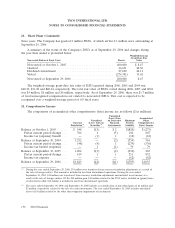

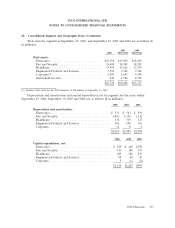

The components of accumulated other comprehensive (loss) income are as follows ($ in millions):

Unrealized

(Loss) Gain Accumulated

Unrealized on Derivative Minimum Other

Currency (Loss) Gain on Financial Pension Comprehensive

Translation(1) Securities(2) Instruments Liability (Loss) Income

Balance at October 1, 2003 ...... $ 548 $(3) $2 $(820) $ (273)

Pretax current period change . . . 704 4 (5) 104 807

Income tax (expense) benefit . . . — (1) 1 (18) (18)

Balance at September 30, 2004 . . . 1,252 — (2) (734) 516

Pretax current period change . . . (48) (4) 1 (279) (330)

Income tax benefit (expense) . . . — 1 (1) 79 79

Balance at September 30, 2005 . . . 1,204 $(3) (2) (934) 265

Pretax current period change . . . 619 1 1 211 832

Income tax expense .......... — — — (62) (62)

Balance at September 29, 2006 . . . $1,823 $(2) $(1) $(785) $1,035

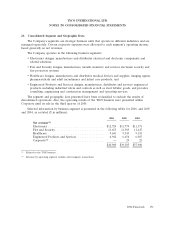

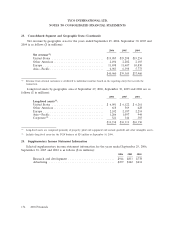

(1) During the year ended September 29, 2006, $34 million was transferred from currency translation adjustments as a result of

the sale of foreign entities. This amount is included in loss from discontinued operations. During the year ended

September 30, 2005, $48 million was transferred from currency translation adjustments and included in net income as a

result of the sale of foreign entities. Of the $48 million gain, $30 million related to the TGN and is included in (gains) losses

on divestitures while $18 million is included in loss from discontinued operations.

(2) The years ended September 29, 2006 and September 30, 2005 include a reclassification of unrealized gains of $1 million and

$2 million, respectively, related to the sale of certain investments. The year ended September 30, 2004 includes unrealized

losses of $4 million related to the other than temporary impairment of investments.

150 2006 Financials